Lets look at some back-tests done on some historical data. Back tests are not accurate to the extent that some stocks that would have be there have meanwhile gone extinct and are not there in the current trading data anymore (survival bias error). Also historical performance is no guarantee for future but I believe these insights give us confidence on the Edge that we are trading. We will study two such 3 year periods in the last 13 years which were unique. Here goes the first.

One very distinct period was the 2007-2009 period where we were in a massive bull rally till Jan 2008 , then a major crash to Oct 2008 and a subsequent rise in CY 2009. CNX500, a broad based index went from 3295 31st Dec2006 to a level of 5354 on 31Dec 2007 to 2295 31st Dec 2008 to 4329 on 31st Dec 2009. Overall gain in CNX500 for the 3 yr period was about 31% in a buy and hold situation. Quite a roller coaster with first a 62% rise, then a 57% drop and then a 89% rise again. The roller coaster move like this usually throws off all investing optimism a person has (did for me) and that does not come back till the next bull market. A bearish pessimism prevails while a baby bull surpasses you (2009) . Of course, ideally one should be buying the lows and selling highs. How many can do that? So what you say…in 2007-09 overall every body should have made at least the broader benchmark returns ?? The fact is most did not. Most did not make it even in the green.

Now, what would Mi25 be doing here…

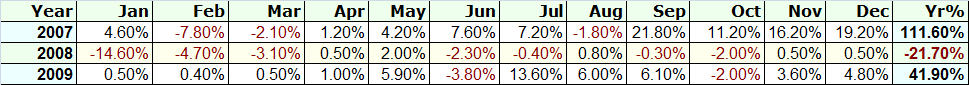

The 3 year returns for Mi25 in the hypothetical back test would have looked like this:

Some stats for these 3 years : Only 93 trades , 55% wins, 45% loses. Avg gain 53%, Avg loss 13%. Max draw down around 29% (from peak) by Oct 2008. 1% txn cost assumed.

So Mi25 vs CNX500 performance:

| Mi25 | CNX 500 | Analysis of Mi25 | |

| 2007 | 111% | 62% | Out-perform |

| 2008 | -22% | -57% | Out-perform |

| 2009 | 42% | 89% | Under-perform |

As you can see Mi25 outperformed in 2 years and massively under-performed in year 3. What was the over returns?

For CNX500 portfolio of INR10 lacs at beginning of 2007 compounded annually would be INR9.9 lacs at the end of 3 years for CNX500. No gain and inflation eats into your pocket. The mental damage : Non-calculatable!

Hypothetically, this is what Mi25 would have done: From INR 10 Lacs to INR 23.5 Lacs! You can discount this figure with whatever haircuts and with whatever additional costs you can think of, it will still tell you that a substantial out performance would have been achieved AND you would have a priceless mental state of a winner at the end of this period!

How is this possible? Please look at the 3 year data chart above. Note that after Mar 2008 the Mi25 results went flat. That is because the portfolio stocks were all sold out in Jan and Feb 2008 and by March2008 the entire fund was sitting in Liquid bees ( and not in a hope temple;) ) . In June and July there was again some (20%) buying but that was sold back again by Oct 2008. The fund remained in cash (Liquid bees) till Apr 2009. So almost one full year of NO activity. BORING! (would you pay your subscription if I did not give you a trade for a year?? 🙂 …think about it… ! In fact one may as well be cursing their advisor for getting only 42% vs 89% benchmark in year 3. All i can say is always look at the bigger picture and your wealth in totality. Peace-meal analysis is useless. If you are growing above the benchmark with a few minutes per week effort, there is nothing better than that! I hope this post will clarify what is the nature of this product.

Second phase of interesting data come from a “lifeless” market from 2010 to 2013. It will be covered in the next blog post soon.

Have a good day!

0 thoughts on “Mi25 – Backtest Analysis 2007-09”