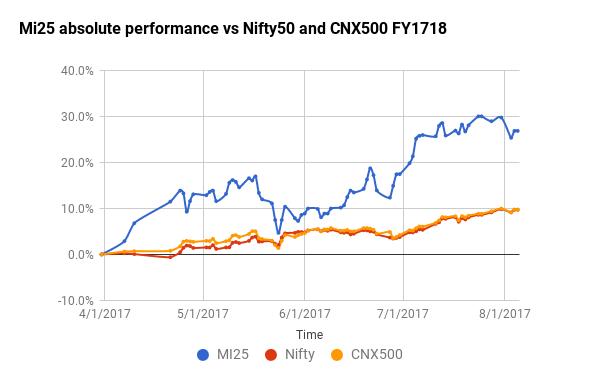

| 7/31/2017 | 29.81% | 10077 | 9.84% | 8793 | 9.98% |

At the close of July 2017, the strategy is up 29.81 pct for the FY vs 9.84% for the Nifty 50 and 9.98% for the broader CNX500. The strategy high point achieved this month was at 30.07% and low at 19.86%

The corresponding figures for June end were

| 6/30/2017 | 17.49% | 9521 | 3.78% | 8332 | 4.22% |

The new entrants this month have been:

| EXCEL |

| MBECL |

and the deletions have been :

| INDHOTEL |

| VIPIND |

The biggest gainer in the pack for the FY is GOACARBON at near 104% gain and the new entrant MBECL is the biggest loser at -18% as it has been put into the T2T segment after our purchase.

The strategy was able to recoup all the drawdown from previous months in July.

The distribution remains heavily skewed towards the positive as desired and intended

Currently the strategy sits with zero cash. This strategy is beating my other strategy Mi50 so far this year. A new strategy Mi40 is intended to be launched shortly in month of Aug 2017.

The Mi25 strategy remains open for new entrants. Do write in to alok@weekendinvesting.com or visit weekendinvesting.com for further queries.

0 thoughts on “Mi25 – Monthly Update July 2017”