To get this weekly report directly to your e-mail Click this

Boy, what a week it was !! Just a rocket up from day one and it went one way all through. If you were a trend follower there is no way you would not have made monies this week. All our strategies fared very well. Nifty was up nearly 600 points and BankNifty about 3000 pts. Clearly nobody was able to call this like always. As I always maintain, keep following the markets and stop predicting it. Let your thoughts follow the markets …freely.

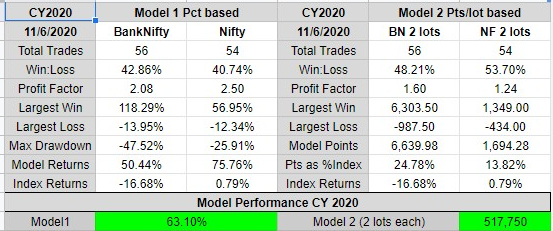

STAIRS our trading product was a super hit this week gaining a handsome near 7% on capital if trading on futures. On balance so far for CY 2020, STAIRS has accumulated 2775 points on NF and 11200+ points on BN.

There are two models to trade using futures. For Model 1, which trades at 3X leverage, capital of 10L at start of the year is now at 16L and for Model 2, where leverage is left to the user, NF has gained 1349 points and BN 6303 points per lot basis.

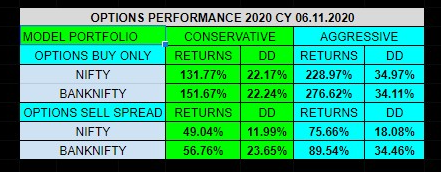

The Options4STAIRS module of STAIRS was also a good place to be. All strategies gained ground this week. The Options4STAIRS works off STAIRS signal so that you only spend a few mins a day at designated time to look into the markets. No staring at the screen all day!!

For CY 2020 to date the Options4STAIRS results

Both these models above track STAIRS signal and have defined risk per trade. The Options4STAIRS has now made the STAIRS product accessible to lower capital , is risk defined and has better performance dynamics. For volatile weeks like these options models are easier to handle and trade.

More details on the options models are here

To subscribe to STAIRS click here.

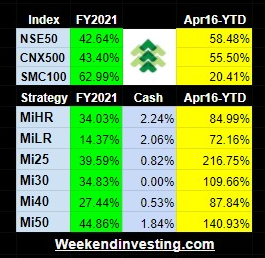

The Weekendinvesting Smallcases did well and were all up. There is a decisive shift happening in the retail mutual fund space. Investors are increasingly taking charge of their investments and getting better value for their money spent.

For Monday 9 Nov 2020, the proposed changes are:

Mi_LT_CNX200 : NO CHANGE

Mi_MT_Allcap : 3 ADD, 0 EXIT

Mi_ST_ATH : 0 ADD, 1 EXIT

Mi 25 : 0 ADD, 0 EXIT

Liquid bees is not being included as an add or exit.

(IF YOUR PF IS LESS THAN 2 LACS YOU CAN AVOID BUYING LIQUIDBEES BY CUSTOMIZING YOUR ORDER IN CASE MIN INVESTMENT IS BEYOND YOUR EXISTING CAPITAL})

In the LIVE product strategies, there is some churn but there are opportunities for deployment. That suggests the breadth of the market is still intact. All strategies are essentially holding ground and gaining. The LIVE products area more suitable for large portfolios who are not chasing high returns and want more mature and diversified lower risk portfolios. Also the user here churns his portfolio at Fri 3 PM along with the model and there is no slip between the model the actual experience.

This week everything was Good and there were no BAD or UGLY !!.

We are now at the door step of the US elections outcome. The US market is the leading indicator for the markets globally and is the trend setter. Lets see what is in store for us next week.

All our strategies are ready for any eventuality with capital protection built into our models. We may get hit anytime but we will live to fight another day.

That is all this week. STAY SAFE and stay in peace ! Do share this newsletter with your friends who you think can benefit from the momentum way ! Send me your suggestion what you do or don’t like about our strategies, updates or anything else. We are always keen on listening to you!

To get this weekly report directly to your e-mail Click this