To get this weekly report directly to your e-mail Click this

The markets finally had a bout of correction and were down four of the five days of the week. While it is pre mature to say what happens next, one of these corrections can covert into a deeper one and we will not know until it does. Hence following a system always help in keeping your sanity with no worries what ever happens.

STAIRS our index trading product did very well in the CY so far and is riding a great wave of super trades so far. This week also it was able to capture the down move early and is already sitting on good gains for the trade.

The strategy has already accumulated near 8500 points on BankNifty and near 2150 points on the Nifty in CY 2021!!

Trend followers ruled this week ! On a 3X leverage, capital of 10L became 20L+ in BN and 14.7 Lacs in Nifty futures. These numbers are as real as it gets includes transaction costs as well. If one wishes one can run a slower version on lower leverage also !

The Options4STAIRS models work off the STAIRS signal so that you only spend a few mins a day at designated time to look into the markets. No staring at the screen all day!! Our options strategies have broken the myth that simple strategies cannot yield results .

As can be seen from the table above just simple option buying yielded 42+% and 60+ % gain on capital in NF and BN respectively in 2021 so far.

The key to all trading systems is to have a tight control over the position size and to reduce the same as we go into a drawdown. Many accounts which are not well funded will not be able to reduce position size and they should wait out or add funds. If you are unable to deal with the volatility which can happen to anybody, it is best to reduce leverage, reduce position, go from Model 1 to Model 2 OR move from futures to options.

More details on the options models are here. Options are a part of the STAIRS program

Our STAIRS Discovery webinar series has met with a resounding success with thousands attending it. The LAST two sessions are planned for Feb 20 and Feb21 2021 at 10 AM each day. If you wish you attend, please add your self the FREE telegram channel at https://t.co/YzKegxmTrH?amp=1 and fill in the registration form there.

To subscribe to STAIRS click here.

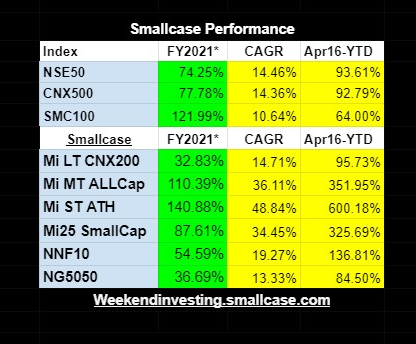

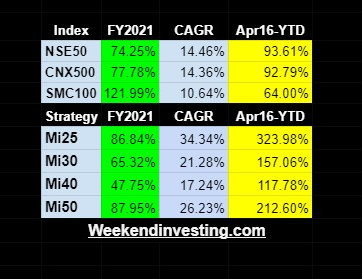

The Weekendinvesting Smallcases were a huge success this week.

These are all long term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeating this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years it has been shown that much superior CAGR returns are possible than the benchmarks.

The ATH portfolio did not fall this week also and is now up 141%!! this FY and Allcap becomes the second strategy to cross the 3 digit mark at 110%!! Mi25 the smallcap wonder is also up 87%!

All this is available at anybody’s fingertip with just 2 clicks a week at a nominal fees!

For Monday 21th Feb 2021, the proposed changes are:

Mi_LT_CNX200 : 0 ADD, 0 EXIT

Mi_MT_Allcap : 0 ADD, 0EXIT

Mi_ST_ATH : 0 ADD, 0 EXIT

Mi 25 : 0 ADD, 0 EXIT

The selection of the smallcase can be based on

a. Sub Segment of the market : Mi25 for smallcap, Mi_All_cap for all round diversification OR LTCNX 200 for large caps only

b. Activity specific smallcase like Mi ST ATH which chases all time high stocks

c. Or more passive strategies like NNF10 and NG5050 which are monthly rebalanced ones best to replace index investing with or for asset allocation.

More smallcases on existing products like Mi30 and Mi50 will be added by end of the next week and by end of the quarter we will add the new product Mi SWING

In the LIVE product strategies, there were mild gains despite the market falls in most strategies and mild losses in others.

The LIVE products area more suitable for large portfolios who are not chasing high returns and want more mature and diversified lower risk portfolios. Also the user here churns his portfolio at Fri 3 PM along with the model and there is no slip between the model the actual experience.

For LIVE Products proposed changes for week ended 19.02.21

Mi25 : : 0 ADD, 0 EXIT

Mi30 : : 2 ADD, 2 EXIT

Mi40 : : 0 ADD, 0 EXIT

Mi50: : 1 ADD, 1 EXIT

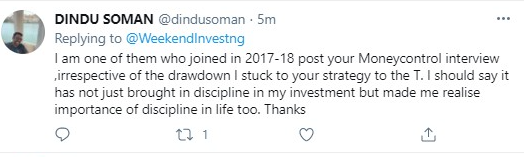

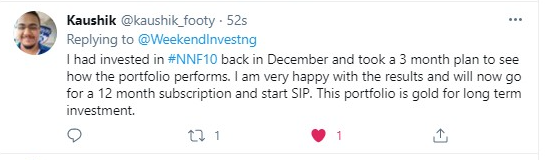

Testimonials of the week

That is all from my end. I look forward to seeing many of you on the weekend in the Webinar series.

Have a safe week…!!

To get this weekly report directly to your e-mail Click this