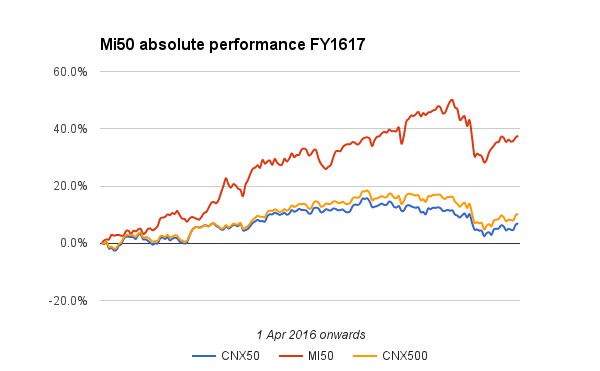

Mi50 closed the week at 37.52% vs 35.37% last week. For nifty and CNX500, the week ended at 6.8% and 10.1% respectively. The trend over the last many days is suggesting we may be have seen the intermediate bottom on 21stNov.

The draw-down recovered from 14.6% to 12.5 % . The recovery was in line with the market despite the large cash in hand position.

The additions in mi50 this week are :

| 9/12/2016 | DATAMATICS | 96.69 |

| 9/12/2016 | IMFA | 493.98 |

| 9/12/2016 | ARCOTECH | 410.84 |

| 9/12/2016 | ARIES | 161.58 |

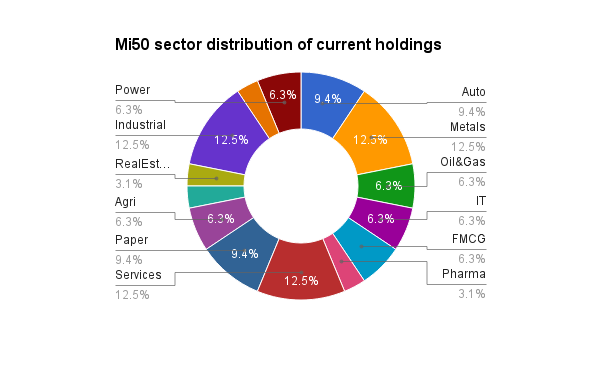

Sector-wise there are two additions on Non ferrous metals, one IT and one Agri based company.

Demonetization effects/fears have been unfortunate for the Indian markets. However with the dollar strengthening post Trump win , we would have anyways dipped along with the other emerging markets. So we get good riddance to two negatives simultaneously. This should pave the way for a monster rally into new highs going into 2017. Budget chatter to start soon. But first lets get the Fed hike out of the way!

Have a great weekend!

You did not mention cash system is suggesting ;-). Let me tell you if you override system with your gut feel or intuition based discretion results could be negative. My 2 cents.

According to my system Nifty rally could fizzle out next week and we are in for sharp down turn of 400-500 points immediately post FED hike. durable Bottom only in Feb I guess.

On demonetisation I think market is least interested. It is just following global EM trend.

Absolutely no gut feel no intuition in mi50.. Documenting gut feel only to contrast with system later.

I hope the fed hike is already baked in…lets see