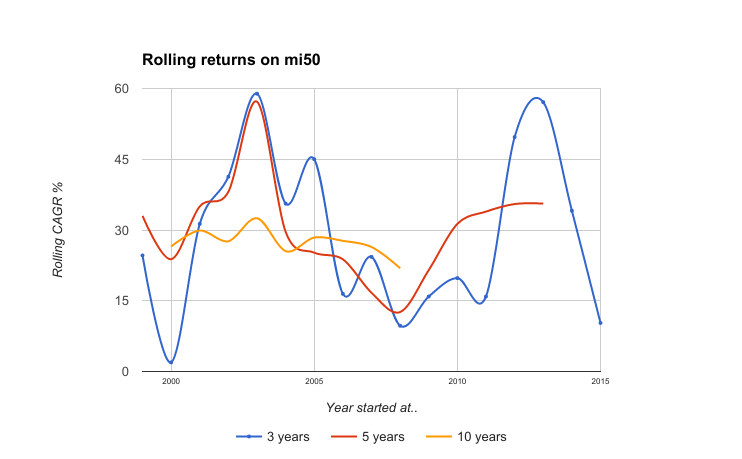

Mi50 backtests from 1999 show the following rolling returns:

The backtest itself may be subject to errors due to non availability of survival bias free data or erroneous data but overall we should get some sense of confidence on the positive outcome of this strategy. In no 3/5/or 10 year rolling period to date from 1999 has the strategy had a negative return period.

Just curious , how did the strategy performed in Jan – Feb 2016 . this was a brutal period for the kind of stocks that the portfolio has been invested in .

Drawdown during that period was 20-22%. Brutal indeed.

Wonderful returns Sirji.

Its quite tough to track the entry and exits of the Mi50 list. What is the current Mi50 stock list? Is it possible to display “Latest Mi50 stock list” is your blog to be visible always?

Yes it is extremely tough. And that is by design. The blog is intended to motivate others to emulate the structure , record keeeping and to develop their own strategies . However, soon a new format is being planned with current stocks and allocations lists will be displayed. Tks

Does this back tested rolling return chart means max holding period of 3 years for any small/midcaps? 🙂

I personally do not give much importance to results of back-testing of current stocks.

Yes.