Hello folks,

Continuing from the previous blog piece on Mi_LT_CNX200 smallcase, today I want to discuss about our second (out of three) smallcase called Mi_MT_Allcap. Also if you have missed the introductory smallcase primer blog piece for this series you can read it here for a better understanding of the current one.

Subscribe to the Smallcase Mi_MT_Allcap or read more about the steps to subscribe to it.

Mi_MT_Allcap as the name indicates is a momentum portfolio run as a smallcase on smallcase.com with a niche focus at medium term trends in all NSE market capitalization stocks (except those under INR 1000 Cr at time of entry)

An up-to 20 stock portfolio with equal weights for each component has been selected from the NSE universe based on their Momentum ranking. Momentum ranking is quantitative list of relative out-performance of each stock with respect to its peer group over the last many periods subject to some minimum qualifications. Every week the portfolio is reviewed and stocks which do not hold up the momentum ranks are shelved while new ones enter. At times, when new momentum picks are not available the portfolio will sit in cash (in interest bearing instruments like LIQUIDBEES ).

The core advantages of such a strategy are:

1. Survival of the Fittest : You are are always with the strength in the market

2. Letting Winners Run : No case for early profit booking if stock is performing well

3. Cutting your Losers early : No case for allowing your holding to go into deep losses from where recoveries are usually difficult

4. Portfolio diversification : Moderate diversification across 20 stocks ensures no high risk pertaining to any one exposure

5. Noise cancellation : Once a week decision cuts out a lot of market noise which conventionally causes bad decision making and elimination of emotions.

6. Low Time spent : Under a few minutes a week on Monday morning to press a button and getting your portfolio to auto execute and mirror the model portfolio. No back-office hassles, no exposure calculations, simply peace.

7. Playing the Casino Math : The central theme is to compensate low number of winners with much larger on average winners than losers. In the past, we have had about 49% winning trades but each winning bet made more than avg of 48% vs an avg of losing 12% for a loser.

8. Prevents large shocks : The portfolios go into cash if draw-downs start to get very deep and earn risk free returns till blue skies appear again. Prevents deep agonizing periods for the investor.

9. Service Guarantee: Weekendinvesting makes sure that you get a fair deal on your investment . Read more about this unique offering here

10. Low churn and Long term Trends : Here we are giving enough room for the price to play around seeking larger up trends. The average hold for this strategy is upwards of 21 weeks and the churn is less than one time a year.

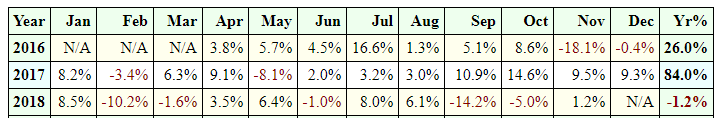

The results of this strategy from Apr 2016 to Nov 2018 are presented here ( real results before the launch of the smallcase):

Indexed to 100 on Apr 1 2016, the smallcase index stands today on 9th Aug 2019 at 215.13, down 3.4% for the FY-1920 to date.

The strategy generated 117 trades in this period (up-to Nov 18) and the winner: loser ratio was 49:51. Each winner however was up on average +48% while each loser was down -12%. The portfolio max drawdown recorded was -22%. The average holding period for any investment was about 21 weeks.

Updated latest results (as of Aug 09 2019) in comparison:

| MI_MT_AllCap | Nifty 50 | |

| FY 1617 | 40.09% | 10.21% |

| FY 1718 | 58.78% | 8.60% |

| FY 1819 | 2.38% | 14.55% |

| FY 1920* | -3.42% | -4.42% |

The max draw-down witnessed so far in this period is 22 pct.

The major gainers (booked) during this period have been

HEG +800%

GRAPHITE +410%

VMART +233%

ITI +110%

BIOCON +77%

HINDZINC +69%

PEL +53.6%

TATAMETALIK +50%

Some of the biggest losers have been

MUTHOOTCAP -34%

ADANIPOWER -28%

TTKHEALTH -18%

SUVEN -17%

TCIEXPRESS -16%

As you can see the quantum of wins is much much larger than the biggest losses and it is this magical math that creates the performance even when the number of winner and losers are about equal.

To know more about how to subscribe to this strategy, you can visit weekendinvesting.smallcase.com or write to me at alok@weekendinvesting.com. The recommended portfolio size is 2 lacs or higher. You can also build your portfolio gradually as you gain confidence.

A non emotional rule based approach may not get you the maximum returns in the market by direct investing but it ensures good returns and control over ones’ biases and emotional mid-adventures.

I have been running these and many other momentum strategies for long and most of my money is now into rule-based investing. It is just much more peaceful for me. I hope it can be for you as well.

Next week we will visit our third smallcase Mi_ST_ATH.

Have a great long weekend!