This is a monthly review series of the smallcases at weekendinvesting.com

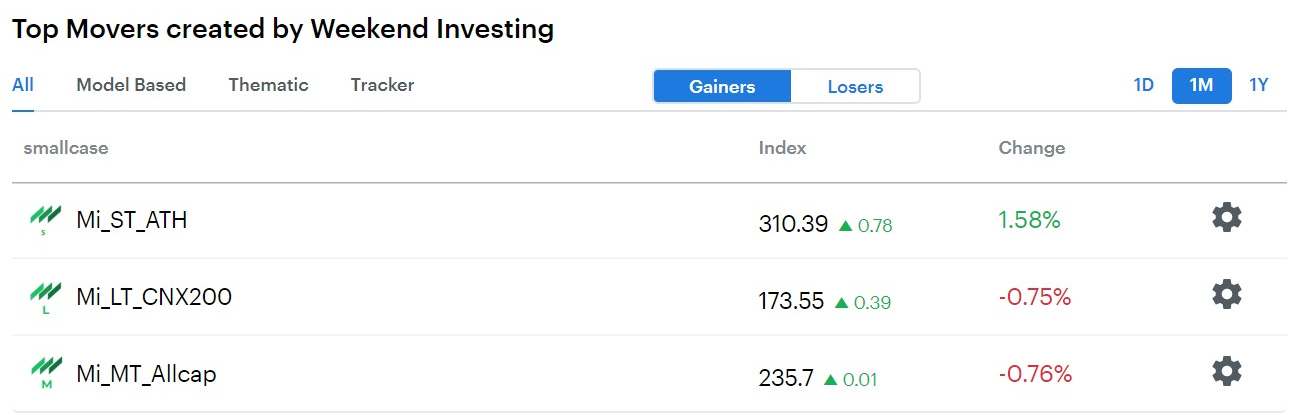

This last month has been mostly flattish for Mi_LT_CNX200 and MI_MT_Allcap and there have been small gains on the Mi_ST_ATH smallcase.

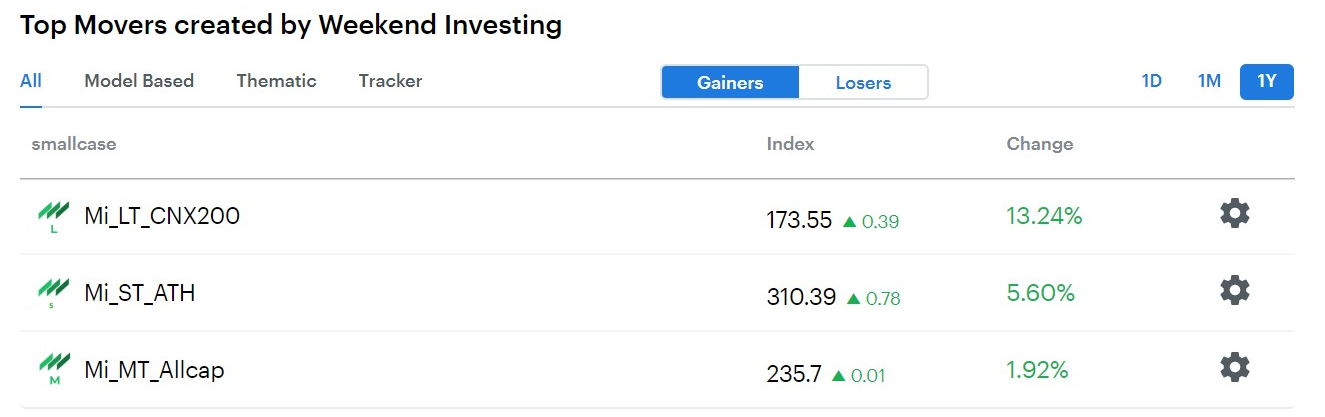

On a yearly basis the large cap CNX200 has done well and the others are catching up

The top movers in each smallcase have been among others

Mi_LT_CNX200 : ICICIBANK, BATAINDIA and PIINDS

Mi_MT_Allcap : ICICIGI, IPCALABS and BERGEPAINTS

Mi_ST_ATH : LALPATHLAB WHIRLPOOL and IGL

The advantage of smallcases are many. You only need to spend a few seconds and do a few clicks and your account in your own brokerage gets mirrored to the model portfolio every Monday morning. To know more about this please watch this video or visit our site

All the smallcases here are geared towards momentum investing and hence will do very well in up-trending markets but not lose too much in sideways or downwards markets. All are non discretionary systems that have been running for a while on my own capital and the performance has been more than expected so far.

In the last 3.5 years since Apr 1 2016, this has been the benchmark beating performance

The smallcase team is providing excellent support and users are giving feedback of a delightful experience. I am also available at any time over email.

We are happy to see our 200th user has now joined the weekendinvesting smallcases service.

Have a great Holiday season and I will be back at the end of the year with another update!

0 thoughts on “Weekendinvesting Smallcases Nov 2019 Review”