The week saw Mi50 loose three components. The gains in these trades were :

| GALLISPAT | 14.22% |

| KIRIINDUS | 32.73% |

| SAGCEM | 1.39% |

The three added are

| 9/9/2016 | JAYBARMARU | 192.66 |

| 9/9/2016 | SUBROS | 134.95 |

| 9/9/2016 | TORNTPHARM | 1670.70 |

The stock Kiriindus was bought at 213 at end of Apr 2016. It went to a high of 405 and now it got sold at 283. So majority of the intermediate gains were lost. This is the downside of a slow momentum system. A faster momentum system would have exited much earlier but would result in much higher trade frequency. It is better to highlight the shortcomings of the system than the positive. Once we learn not to switch strategies because of an incident like this, we will do well sticking to our original tested system.

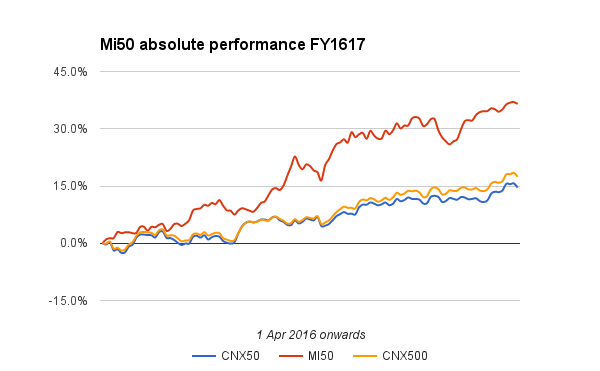

Anyways, Mi50 closed at its highest weekly close. This week it outperformed the broader index marginally. It closed the current FY at +36.4% vs 14.6% for NSE50 and 17.4% for CNX500.

The composition of win:loss for the portfolio stands healthy at:

| All | Wins | Avg | Losses | Avg |

| 56 | 33.49% | 13 | -4.60% |

And those for the exits at :

| Exits | Wins | Avg | Losses | Avg |

| 7 | 19.58% | 10 | -5.41% |

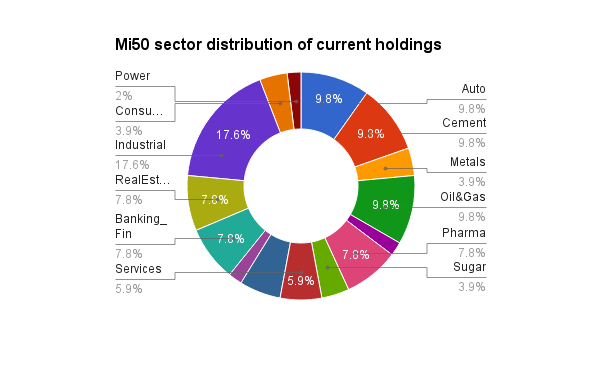

The components added are 2 in automotive and 1 in pharma.

With the markets having seen singular directional move last many months, we are mentally ready for some rough weather ahead in the month. It is always good to be cautiously optimistic. A good friend taught me not to worry about the general market if your stock selection is sound and I believe if in addition to that if exit criterion is pre-decided and executed, there is no way we will lose capital.

Have a great weekend!

Hi,

Does your system ever go out of the market completely ( not happened till now of course) and go into cash/bonds? Reason for the question being the inevitable fall in momentum that would occur at some point in time of the system. Thanks in advance for your reply

A great question. Yes it is designed to move money to Liquidbees when spare cash is available. In second part of 2008 back-test it was almost completely out of market and it went into partial cash in 2011 and 2013 as well.

Dear Alok,

Just went through this Blog. Very good work. My only question is when selecting a stock for your system, do you look at fundamentals (e.g. Q earnings) at all? Or just technicals? If not looking at fundamentals how you make sure you don’t buy companies which is experiencing just a technical rebound in long term structural downtrend (e.g. Infra stocks from 2008) ?

Thanks for your encouraging comments.

No fundamentals in Mi50

My recent tweets on 2 yesbank reports ( tgt 650 and 1590)from revered fundamental investors is the reason for my non belief in timing using fundamentals.

If infra or anything goes up without fundas and crashes back it will be a small dent..after all allocation is only 2 pct….so all that is part of the game which is acceptable.

In 2000 and 2008 stocks went up 1000 2000 pct and crashed. Mi50 would have minted in that scenario without fundamentals.

The simulated 2008 drawdown for mi50 was 27 pct.

Thanks for replying. So you do not make concentrated bets on 2-3 sectors but diversify among multiple sectors/stocks to hedge against Infra like sector down trend of multiple years good strategy. Without giving exact technical criteria is it possible to share parameters for selecting stocks? Also if you can give number of stocks you always hold ?

No. of stocks can be upto 50 with 2 pct of current asset value