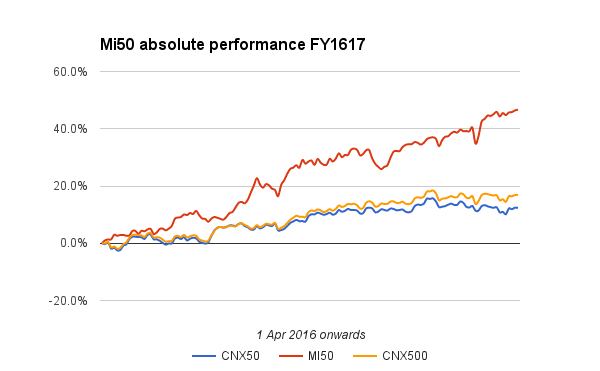

Bulls markets makes one over-confident. With every week turning out to be a record high, one starts feeling invincible. Mi50 makes yet another ATH close at 46.67% absolute. That is a crazy figure for a passive strategy like this. Of course a few bad months can bring us down to earth easily. I hope we can close the year above 20%.

There are 3 changes this week. The exits with entry and exit price are :

| 4/4/2016 | UPERGANGES | 124.57 | 376 |

| 4/18/2016 | KAJARIACER | 501.00 | 614 |

| 8/16/2016 | DHANUKA | 680.80 | 647 |

The new entries to Mi50 are :

| 10/21/2016 | GOCLCORP | 353.61 |

| 10/21/2016 | CAPLIPOINT | 399.50 |

| 10/21/2016 | AMRUTANJAN | 629.24 |

Some of these entrants have already run up a lot. But that is the nature of the strategy. The more stretched the market will be, the riskier new picks will get.

The performance of Mi50 Vs NSE50 and CNX 500 looked like this:

Max draw down for the week was -1.13%. Zero DD at close.

A 29.79% absolute out performance over CNX500..

A 34.33% absolute out performance over NSE50

For the first time, 5 stocks were above the 100% mark.and almost 10 above 85%. The exit of a 3 bagger stock today marked another profit booking record.

The weight of Real Estate/ Infra sector has gone up along with auto and pharma.

We are within three weeks of the contentious US polls. It looks like a FED hike and a Trump victory both will be a surprise if they happen. In normal course it looks like the trend still remains up.

Have a great weekend.