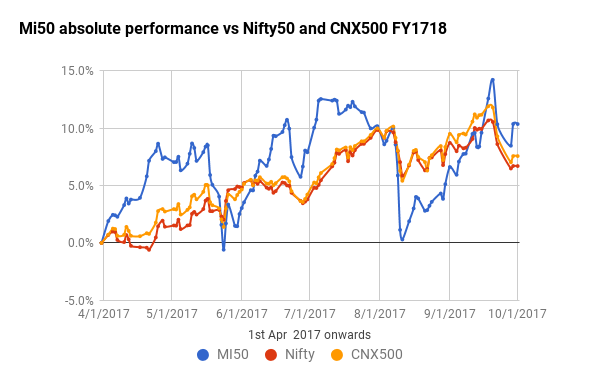

Q2 July to Sep 2017 quarter has been quite a subdued ride for the Mi50 strategy. We started the period at +7.9% absolute gain and ended the period at +10.36%. The CNX50/ CNX500 also moved from +3.8%/+4.2% to +6.7% /+7.6% in the same timeperiod.

The performance of Mi50 has largely been in line with the market and has not been able to create any out-performance in this quarter.

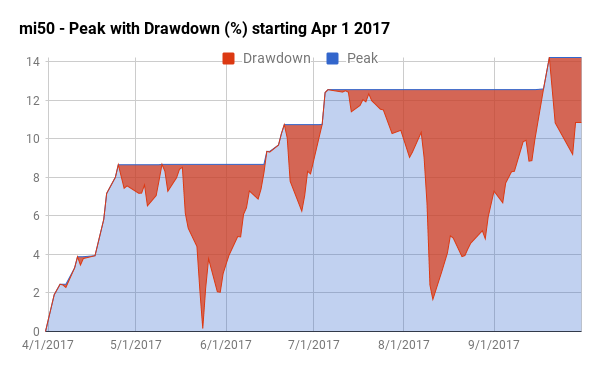

The max drawdown witnessed during the period was -10.88% on 11 Aug 2017 while the highest point was +14.21% on 20 Sept 2017.

The stocks that powered the mi50 performance the most and which continue in the portfolio this year are..

| BBTC | 49.41% |

| MOTILALOFS | 78.28% |

| GRAPHITE | 208.70% |

while some of the key existing laggards are..

| MURUDCERA | -15.99% |

| VADILALIND | -12.58% |

| EVERESTIND | -10.50% |

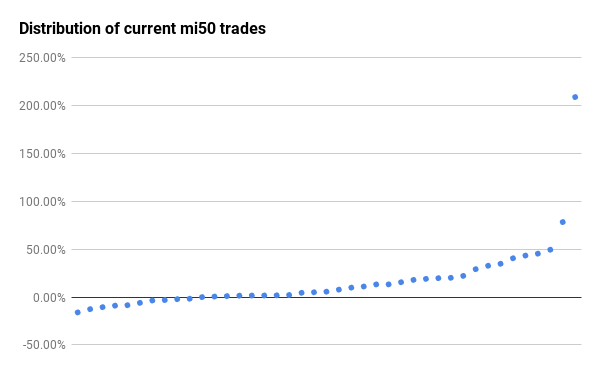

Like any other system, Mi50 derives its advantage by outpacing the losers by a wide margin in each win. The current FY stats on the internals are :

| Wins | Avg | Losses | Avg | |

| Invested | 31 | 24.43% | 10 | -7.30% |

| Exited | 18 | 1.29% | 40 | -10.56% |

The strategy has 7.3 % cash at the end of the quarter.

Some of the best picks of Q2

| KAMATHOTEL | 22.12% |

| CGCL | 29.13% |

| GRAVITA | 32.70% |

| SAKUMA | 43.32% |

and worst

| VIPULLTD | -18.29% |

| MURUDCERA | -15.99% |

| SUDARSCHEM | -13.36% |

other notables stocks picked and exited are:

| JAYBARMARU | 22.34% |

| CORDSCABLE | 33.94% |

| SWARAJENG | 34.75% |

| MEP | 51.80% |

The current trade distributions:

The outlier gainer here is GRAPHITE at 3X+ gains.

Overall it has again been a dull second quarter for Mi50 this FY after a spectacular performance last FY ( Full year report 2016-17). We shall still hope to achieve 20% plus growth this year.

Have a great Q3 FY17!