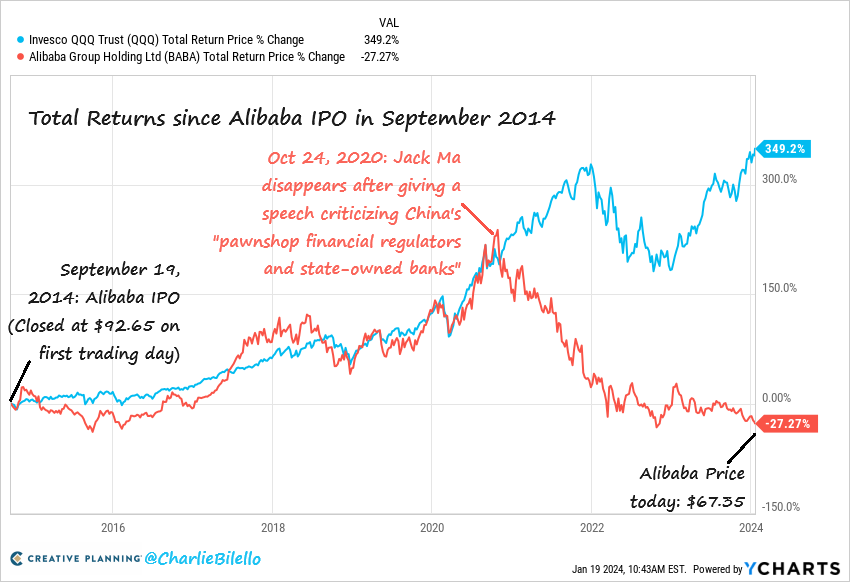

During the past eight years, Alibaba Group Holding Ltd. has experienced both remarkable growth and a significant decline. This observation is highlighted in a chart shared by Charlie Belello, which compares the trading performance of Alibaba with the total returns of Investco, a technology ETF. The chart reveals important insights about the company’s journey and the implications for investors.

For the first five to six years, Alibaba traded in line with the industry ETF, demonstrating its position as a leading player in the industry and the Chinese market. However, certain developments within the company, such as the mysterious disappearance of Jack Ma in October 2020, marked the beginning of a downward spiral. From its peak at $300, Alibaba’s stock price has plummeted to around $67, experiencing a staggering decline of approximately 80%.

This decline is in stark contrast to the overall performance of the technology industry, which has seen a 349% increase over the same eight-year period. Despite being part of a growth-oriented industry, Alibaba’s stock has faltered due to undisclosed reasons, causing shareholders to bleed their investment.

Interestingly, Alibaba’s earnings have not seen a significant reduction, and the company continues to grow, maintain cash reserves, and engage in buybacks. Yet, something is brewing in the background, undisclosed by both the company and the Chinese government, leading to the continued downfall of the stock.

This situation raises several important questions. What is happening within Alibaba that is causing such a dramatic decline? And how can investors protect themselves from similar situations in the future?

One crucial lesson to learn from Alibaba’s decline is the importance of diversification. As an investor, being impartial and open to exposure in various technology stocks can help mitigate risks associated with a particular company’s performance.

Consider a scenario where an investor desired exposure to technology stocks but didn’t focus solely on Alibaba. A robust investment strategy with predefined rules could have prompted them to exit Alibaba as soon as its stock price started dropping, reallocating funds to other promising stocks like Apple, AMD, Netflix, or Nvidia. The ability to adapt and shift investments based on price movements is essential for long-term success.

Successful long-term investment strategies recognize that, over time, most stocks will encounter challenges. The competition within the technology industry, driven by advancements in AI and other technologies, is ever-ramping. The impact on individual companies, especially in the long term, remains uncertain. Moreover, questions about a company’s management and leadership can arise, further impacting its trajectory.

Hence, it is essential to allow market prices to dictate investment decisions rather than attempting to fight against them. The market is like an ocean, and investors are like individuals with buckets trying to collect gains. Instead of trying to swim against the currents, investors should go with the flow of the market, adapting their strategies based on prevailing conditions. Aligning investment decisions with market trends and price movements can help protect against significant losses and maximize long-term returns.

If you have any questions, please write to support@weekendinvesting.com