Market Overview

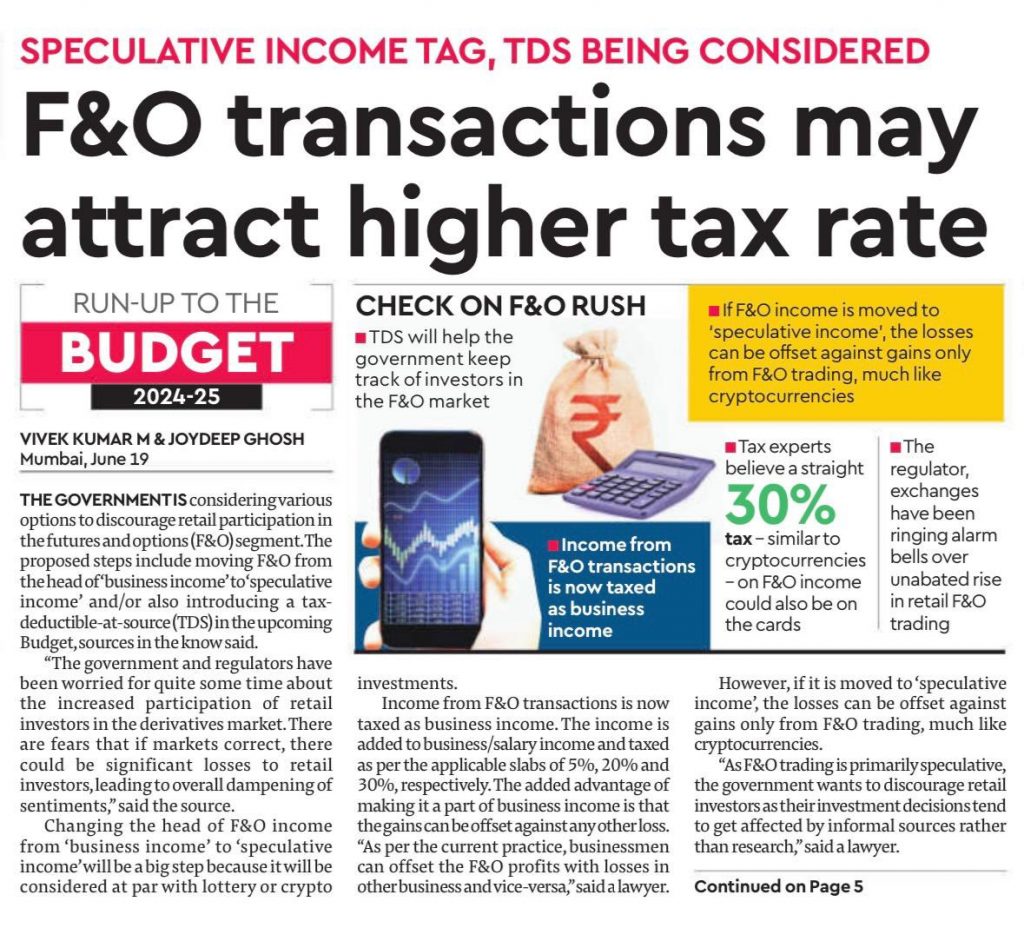

The market is just about stagnant and not moving, while the news of the day—or not news, actually, the rumor of the day—is that your F&O profits may be at risk. We’ll talk about this towards the end of the video, but there is a very strong rumor that has been going around since this morning that in the Union Budget, which is expected in the third week of July, there is a likelihood that F&O profits and F&O transactions may be classified as speculative transactions. If that happens, there are significant repercussions, and we will discuss those in detail.

First, let’s look at the market. Nifty is up 0.22%, maintaining a very mild upward trajectory, waiting for some action to happen—some trigger. It has not been able to move up beyond the election day top, so it’s just about hanging in there. However, it’s still near all-time highs.

Nifty Next 50

In terms of the Nifty Next 50, it fell slightly yesterday but was totally flat today, with a 0.13% increase. It was a listless day for the Nifty Next 50 as well.

Nifty Mid and Small Cap

Mid caps performed better, rising 0.85% and moving up gradually, very near all-time highs. They have shown a reasonable gain of 3-4% from the election top. Small caps did even better than mid caps, closing at a new all-time high. Since the election results session, there has been a remarkable run in small caps, going from nearly 14,000 to now 17,000.

Nifty Bank Overview

The Nifty Bank Index has been running for the last three sessions. It is due to the Nifty Bank Index that Nifty has been able to maintain the current level. The Nifty Bank Index was flattening out at 50,000, and in three sessions, it has gone to 51,760, which is a great sign.

FIIS and DIIS

FIIs (Foreign Institutional Investors) and DIIs (Domestic Institutional Investors) have been showing bullishness. The last two sessions before yesterday saw decent amounts of buying. Yesterday’s move, with FIIs buying 7,900 crores and DIIs buying 7,108 crores, was largely due to the institutional buying in the Indus Tower transaction that happened. Most of the buying is due to that, but nevertheless, it is money coming in, indicating bullishness from both domestic and foreign investors. Net net, there was not much gain from that transaction.

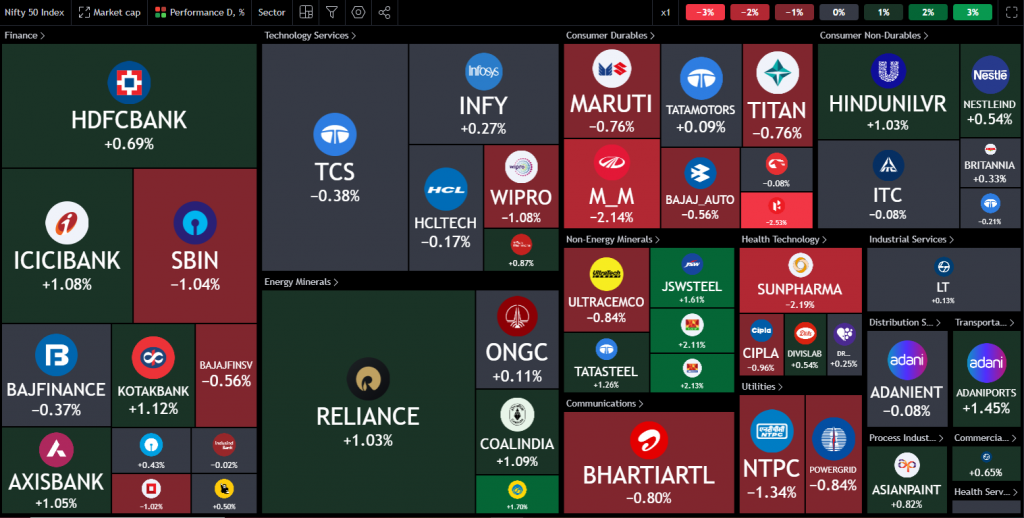

Nifty Heatmap

In today’s heat map, there are some pockets of green. Energy and minerals like Reliance, Coal India, and BPCL were up. Private banks, with some follow-on buying after yesterday’s move, saw Axis Bank, Kotak Bank, ICICI Bank, and HDFC Bank moving up. Public sector banks were down. Autos and some cement and steel stocks also declined, while power stocks were down. Some FMCG stocks were up, creating a mixed bag today.

Stocks that were running today in the Nifty heat map included DLF, Geo Finance, and Motherson. Vedanta rose almost 5%, SRF was up 3.5%, and Berger Paints gained 2.5%. On the losing side, Godrej, REC, PFC, Bosch, D-Mart, and Torrent Pharma declined, with the rest being within a percent here or there.

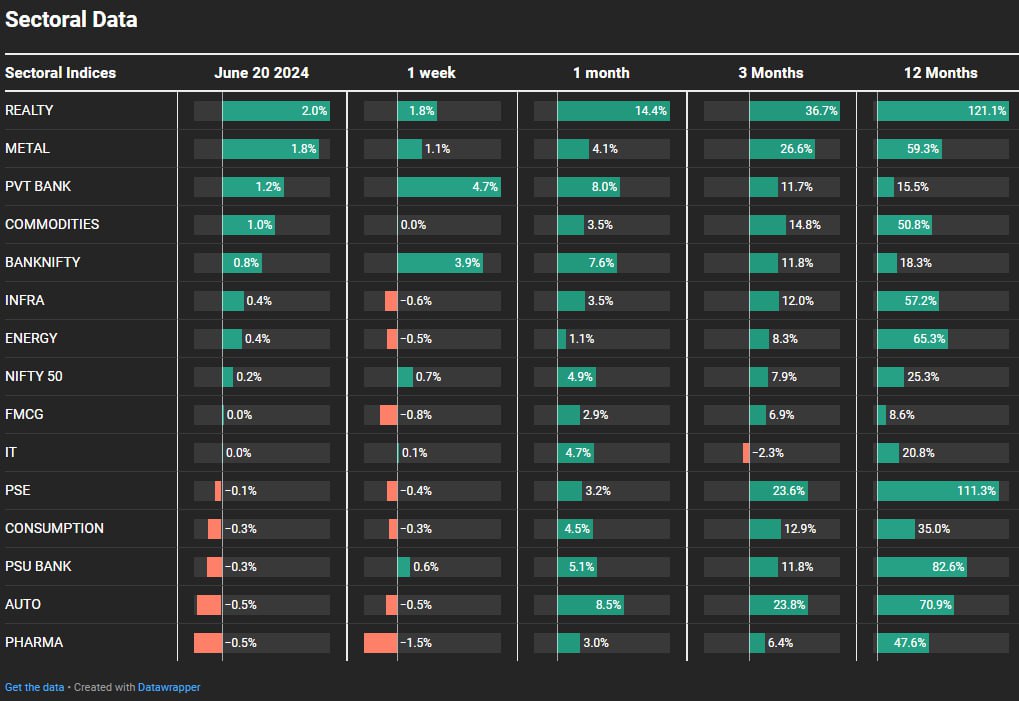

Sectoral Overview

Sectoral trends showed real estate as the top-performing sector, with a 2% move for the day and leading for the year as well. Metals followed with a 1.8% move and have done 59.3% for the year. Private banking saw a 4.7% increase this week, making it the best-performing sector in the last week. Commodities were up 1%, remaining flat for the last month but showing a decent gain of 50.8% over the year. Infrastructure, energy, and FMCG were nearly flat. Public sector enterprises, consumption, PSU banks, autos, and pharma lost some ground.

Sectors of the Day

Nifty Realty Index

Real estate recovered sharply after a dip yesterday, signaling market strength in that sector.

Nifty Metal Index

Metals are approaching an all-time high and the election day top, indicating potential for a breakout.

Stocks of the Day

Triveni Engineering

In terms of stock spotlight, the chemicals and fertilizer space saw significant gains. FACT was up 20% today, almost doubling from the election day bottom within less than two weeks. RCF also gained 20%, moving from 130 to 222 since the election day.

Gold Chart

Gold saw a small uptick due to a weakening rupee, with Indian rupee gold prices at 72,150.

Story of the Day

the hot rumor in the market is that F&O profits are at risk. The rumor suggests that F&O transactions may be classified as speculative in the upcoming Union Budget. Currently, F&O transactions are classified as business income, allowing several tax benefits. These include the ability to offset F&O losses against business income, carry forward F&O losses for eight years, and offsetting STT paid. If reclassified as speculative, these benefits would be reduced. Speculative losses can only be offset against speculative profits and can only be carried forward for four years. Additionally, if F&O is treated similarly to crypto, where speculative losses cannot be offset even within the same category, it would significantly impact market volumes and liquidity.

Another rumor suggests a TDS on F&O transactions, which would also reduce trading volumes, as traders would have to pay TDS on each transaction and reclaim it after filing taxes a year later. This could introduce a friction element, significantly impacting trading.

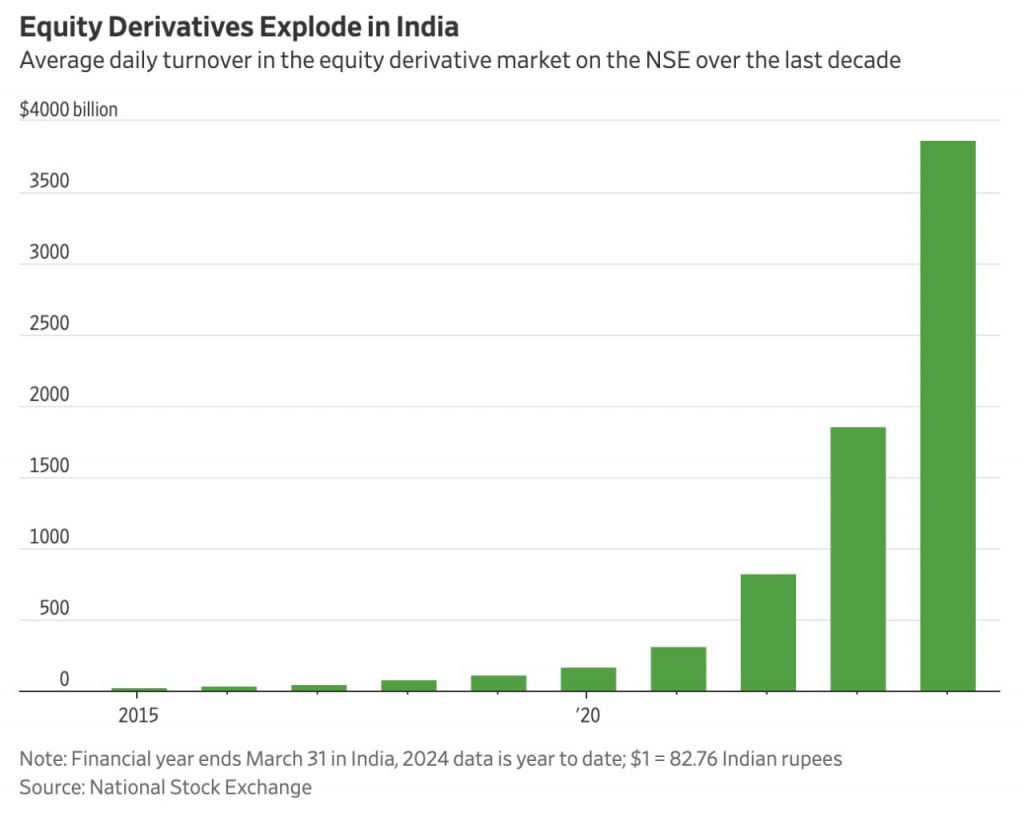

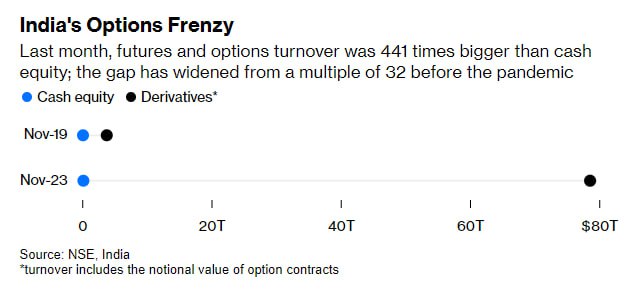

The speculation around these changes is driven by the perception of significant profits in F&O trading, despite SEBI’s reports indicating that 89% of traders actually lose money. The large F&O trading volumes have attracted tax authorities’ attention, leading to these potential changes. This narrative has been amplified by social media influencers and traders boasting about their profits, creating a perception of easy money in F&O trading.

The market is reacting to these rumors with volatility, and there’s hope that these changes do not materialize, as they could negatively impact market sentiment and liquidity. Expect more media coverage and market volatility leading up to the budget due to these speculations.