Where is the market headed?

There’s a bubble forming—make no mistake about it—and it’s poised to impact the entire world. The global economy is inching ever closer to a tipping point, with the U.S. debt spiral at its centre. The signs of an impending climax are becoming increasingly difficult to ignore.

Market Overview

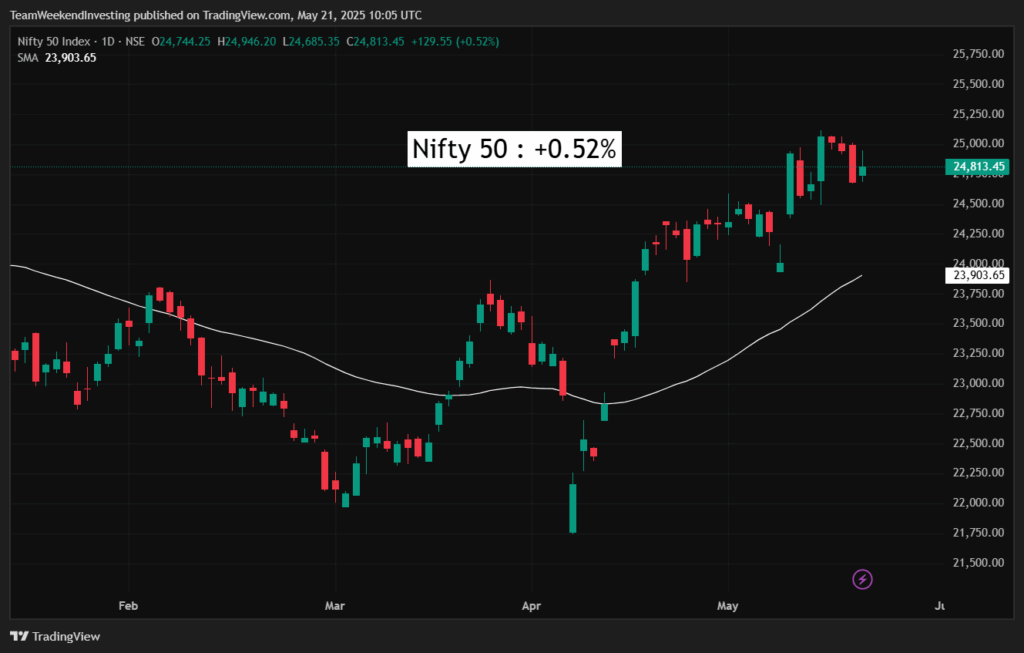

0.5% gained on Nifty

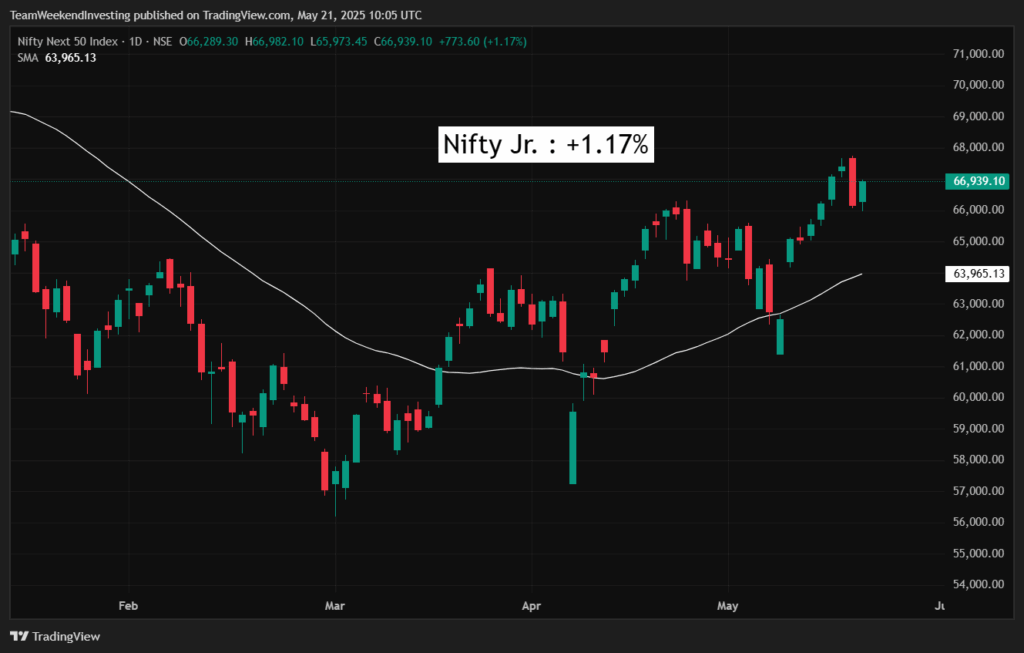

Nifty Next 50

There was a strong rebound of 1.17% following yesterday’s sharp decline.

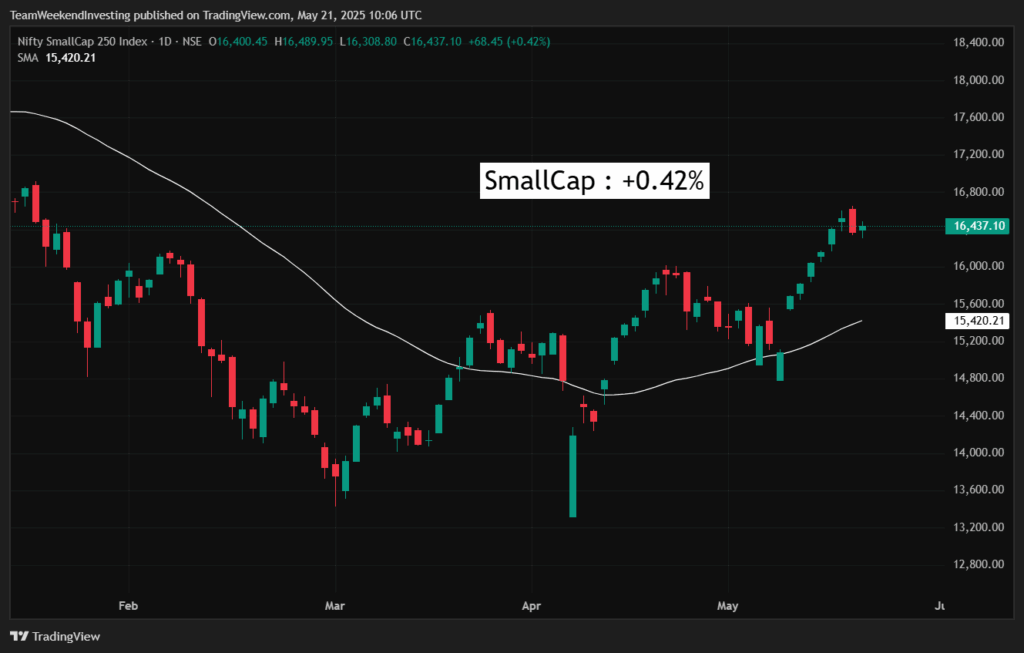

Nifty Mid and Small Cap

Mid caps also gained 0.8%. Across all segments, there was partial recovery of the losses from yesterday. Small caps rose by 0.42%.

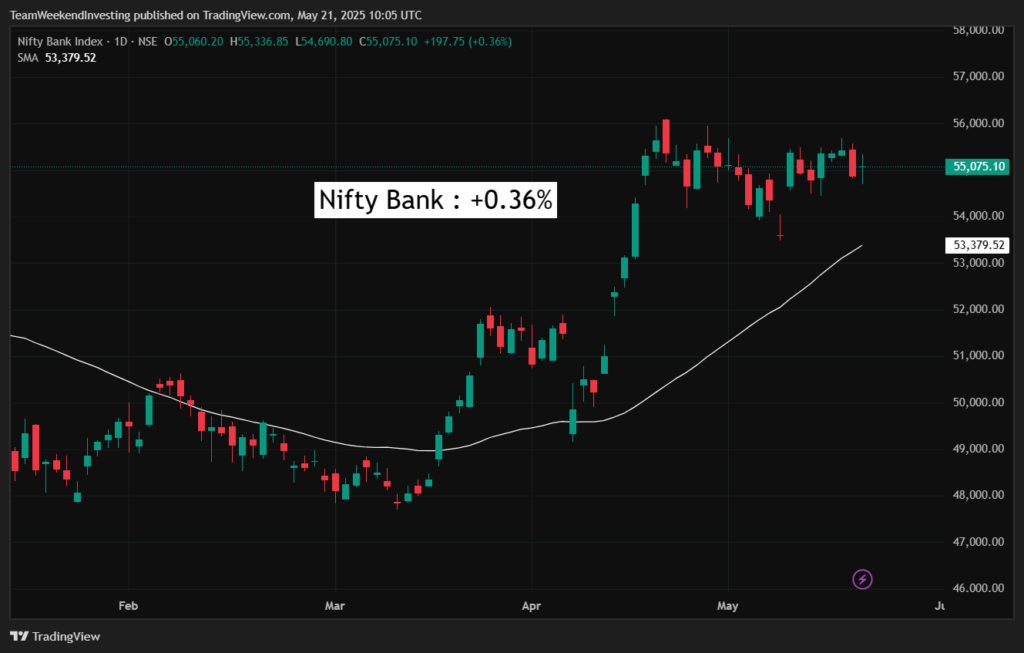

Bank Nifty

Bank Nifty remained nearly flat, with a marginal increase of 0.36%.

GOLD

Gold is beginning to show signs of recovery, with a notable increase of 0.83% in Indian rupee terms. This upward momentum suggests the potential for a strong rally ahead.

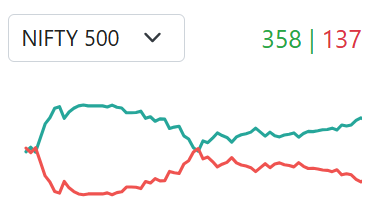

Advance Decline Ratio

The advance-decline trends showed 358 advances compared to 137 declines. There was an initial drop in advances during the first half of the session, followed by a slight recovery in the second half. Overall, advances managed to hold steady throughout the day, avoiding a complete fall-off.

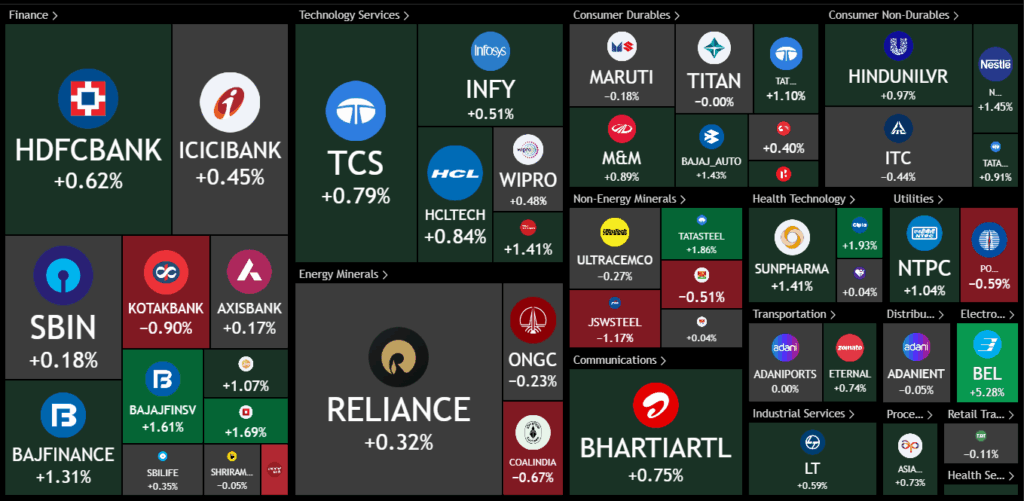

Heat Maps

In the Nifty heat map, Bharat Electronics emerged as a top performer with a notable 5% gain. Defence stocks, which had remained subdued over the past two or three sessions, witnessed a sharp rebound, with Bharat Electronics leading the charge. Cipla followed with a 2% gain, while Tata Steel also showed strength with nearly a 2% uptick.

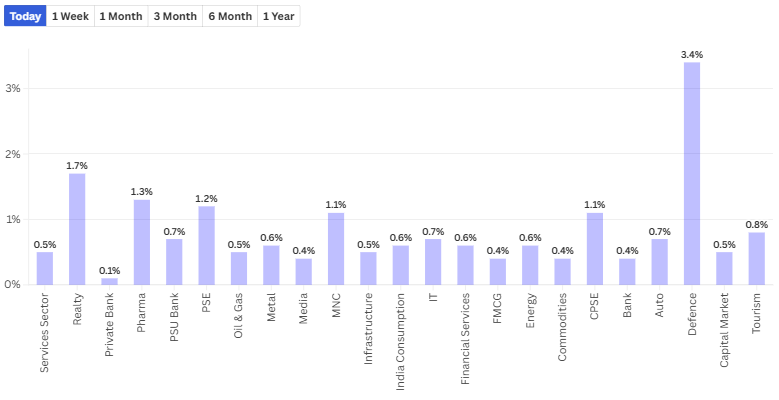

Sectoral Overview

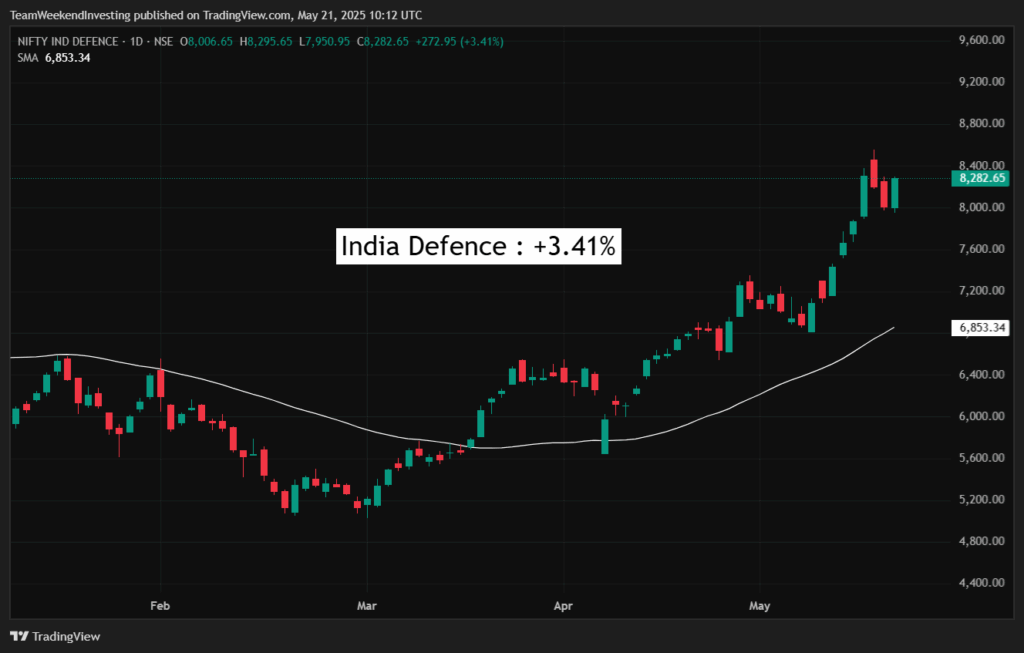

Defence stocks witnessed a strong surge, climbing 3.4% today. Despite facing a pullback over the past two to three sessions, the defence sector remains up by an impressive 8% for the week, highlighting remarkable momentum and investor confidence in this segment.

Capital markets also recorded a modest gain of 0.5%, while the tourism sector advanced by 0.8%. Public sector enterprises and real estate stocks were among the other sectors showing positive movement. Pharma stocks added to the bullish sentiment, contributing to the overall recovery in the market.

Sector of the Day

Nifty IND DEFENCE

The Nifty IND Defence index showed exceptional resilience and strength, closing not only above yesterday’s opening level but also surpassing the previous day’s closing mark. This indicates a strong bullish reversal in the defence segment.

Nearly all of the losses experienced by non-defence stocks over the past two sessions were recovered by today’s gains in defence stocks. The recovery underscores the sector’s robust performance and investor interest, marking defence as the standout performer of the day.

Notable gainers within the defence space included Bharat Electronics, which was up 5%, while Solar Industries, Bharat Dynamics (BDL), Garden Reach Shipbuilders, and Data Patterns posted gains ranging from 4% to 5%.

Story of the Day: America’s Debt Spiral: A Storm Brewing Beneath the Surface

Though this issue has been simmering for years, it’s now reaching a point where it can no longer be ignored. Renowned investor Ray Dalio recently warned that the US is entering a “debt death spiral“—a stage where the growing burden of debt becomes unsustainable.

Historically, every fiat currency and empire—from Rome to Britain—has followed this trajectory. At some point, the debt overwhelms the system. Today, the US appears dangerously close to that point.

Ray Dalio’s warning has been followed by action: all three major credit rating agencies have downgraded US bonds below AAA. The US, once considered the ultimate safe haven, now finds itself behind more than ten countries in bond ratings.

The numbers are staggering—$37 trillion in on-the-books debt, with additional off-book obligations. The challenge now is how to finance these obligations. Like an individual living beyond their means, the US is borrowing to meet its commitments, but creditors are growing wary. Allies are no longer as willing to buy US debt.

Historically, there have been two ways out: refinance the debt or inflate it away. But both come at a cost. Refinancing at higher interest rates increases debt servicing costs, while inflation erodes trust and damages bondholder value.

This has real consequences. Bond ETFs like TLT have failed to deliver returns for over a decade. Foreign holders like China and Japan have steadily reduced their US Treasury exposure. Only the UK has increased its holdings—possibly for strategic reasons.

Meanwhile, Japan, dealing with its own yield issues, may soon withdraw further. With fewer foreign buyers, the US must either offer higher yields or print money—both of which lead to deeper problems. Higher yields mean higher interest payments, crowding out essential government spending. Printing more money sparks inflation, triggering a vicious cycle.

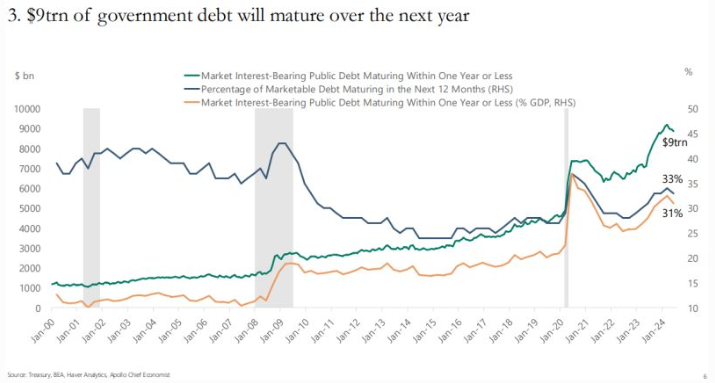

Yields on long-term US bonds have risen sharply—from near zero to nearly 5% since the pandemic. Rolling over maturing debt now requires issuing new bonds at these elevated rates. Nearly $9 trillion in debt is set to mature soon, with no easy way to refinance it affordably.

Treasury Secretary Janet Yellen rightly says GDP growth must outpace debt growth. But current trends show the opposite—debt is surging much faster than GDP. The gap continues to widen, leaving the US with fewer and riskier options.

The US debt spiral may no longer be a slow-burning issue. It is rapidly becoming a central threat to economic stability—and the world is watching closely.

What’s your view on America’s growing debt crisis? Do you think the spiral can be reversed—or is it too late? Share your thoughts in the comments below! If you found this blog insightful, don’t forget to SHARE it with your network and keep the conversation going!

WeekendInvesting launches – The Momentum Podcast

This episode of The Momentum Podcast unpacks 15 years of investing experience! We cover:

✅ Early investing mistakes and learnings

✅ Navigating market fluctuations (including the 2020 crash)

✅ The transition from direct stock picking to managed funds

✅ The role of momentum investing in long-term strategy

✅ Key takeaways for building a resilient investment portfolio.

Whether you’re new to investing or looking to refine your approach, this episode is packed with practical advice!