Understanding the Gold-Recession Link

Gold has long been regarded as a safe asset during challenging economic times. A recent study from the In Gold We Trust (see image below) report examines how gold has performed during various US recessions over the past 50 years.

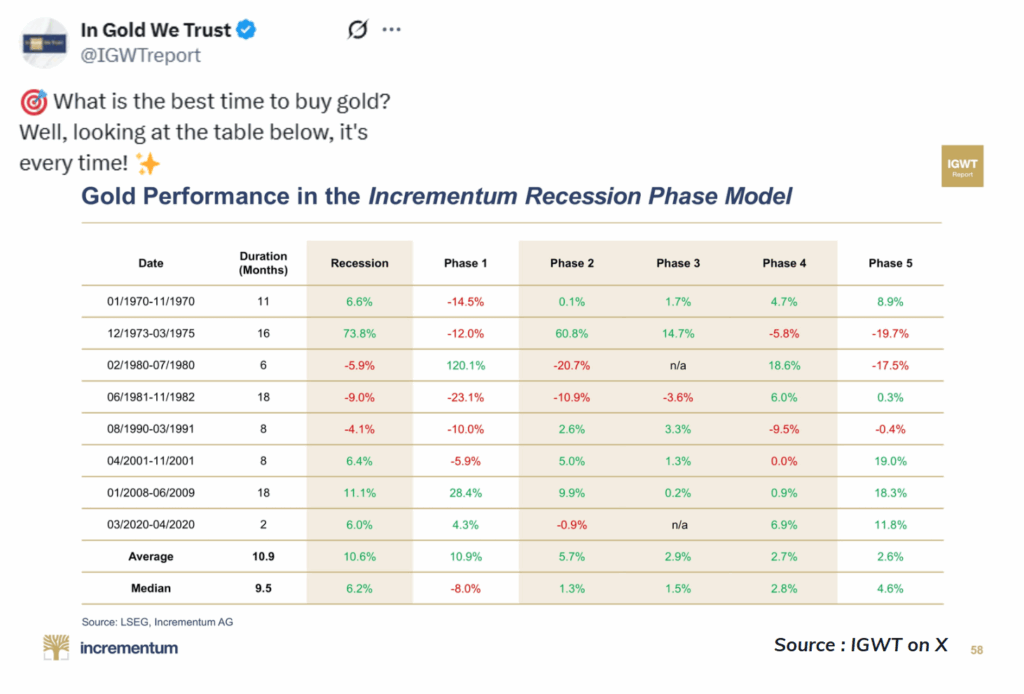

The report breaks down each recession into five distinct phases: the six months preceding the recession (Phase 1), the early part of the recession (Phase 2), the midpoint (Phase 3), the conclusion of the recession (Phase 4), and the recovery phase once the recession is over (Phase 5).

How Gold Performed in Each Phase

The central question addressed by the data is: when is the best time to buy gold? Interestingly, the study reveals that the most significant gains in gold prices typically occur during Phase 1—the six months leading up to a recession. During this period, gold has averaged returns of around 10.9%, which is notably strong. While gold still performs well during the recession, its gains are generally smaller. In Phase 5, the recovery phase, gold often sees flat or even negative returns as the economy begins to improve.

Every Recession Is Different

Every recession varies in duration, with some lasting six months and others extending beyond a year. For instance, the recent recession linked to COVID-19 lasted only two months. However, a consistent trend emerges: gold tends to perform best when market fears are increasing, and not as effectively when conditions start stabilizing.

Don’t Try to Time Gold Purchases

A key takeaway from this data is that attempting to perfectly time your gold purchases may not be effective. Gold generally performs well before and during economic downturns, but predicting the precise onset of these periods can be challenging. Therefore, rather than treating gold like a stock and trying to trade it, it is wiser to view gold as a form of insurance. When treated as a long-term safety net, gold can play an important role in balancing overall risk.

Is gold a protective measure in your portfolio, or merely an afterthought? Share your thoughts in the comments below, and if you found this article helpful in understanding gold better, please SHARE it with your friends too!