Where is the market headed?

The session was exceptionally quiet, with the Nifty hovering within a 100‑point band all day. India has reportedly submitted its proposed trade‑deal terms, but the United States has yet to respond—and fresh headwinds keep emerging. US is also weighing an additional 200 % tariff on pharmaceutical imports and a 50 % duty on copper, sending copper prices surging 10 percent in a single session. Such abrupt pronouncements and market‑moving reactions underscore how unpredictable the negotiating backdrop has become.

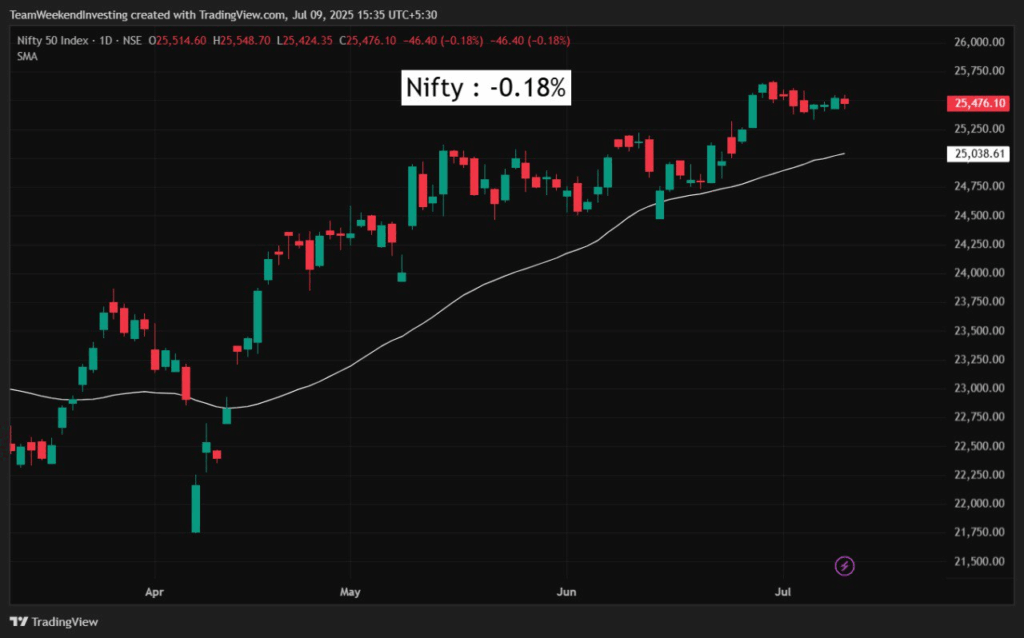

Market Overview

An extremely flat day for the markets, with the index closing down 0.18%. The day’s high was 25,548, while the low touched 25,424—showing a narrow trading range and lack of clear direction.

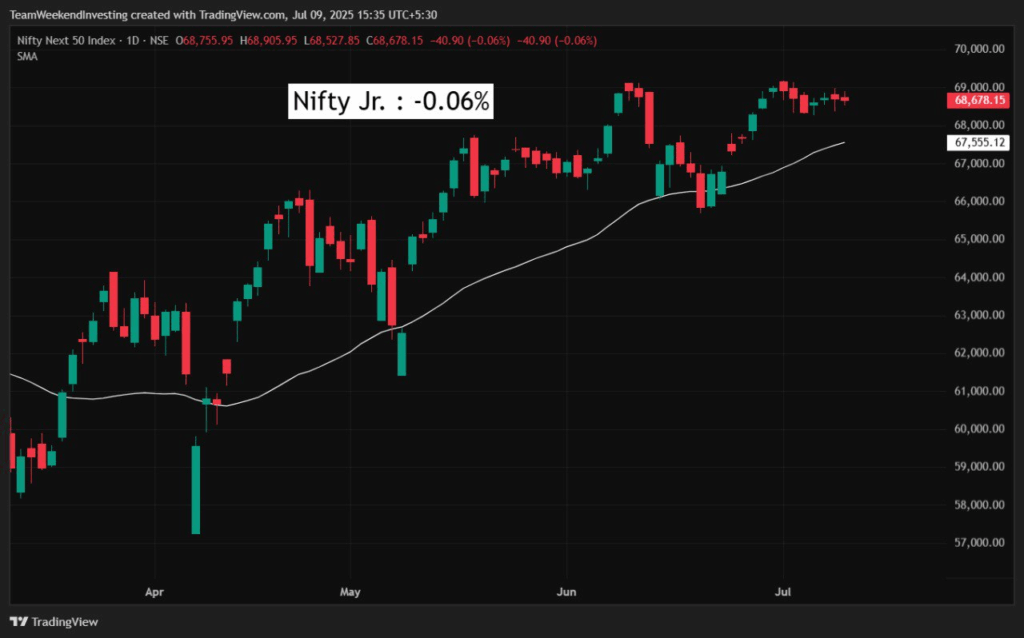

Nifty Next 50

Nifty Junior mirrored the broader market trend, ending nearly flat with a marginal loss of 0.06%, reflecting the overall lacklustre sentiment across indices.

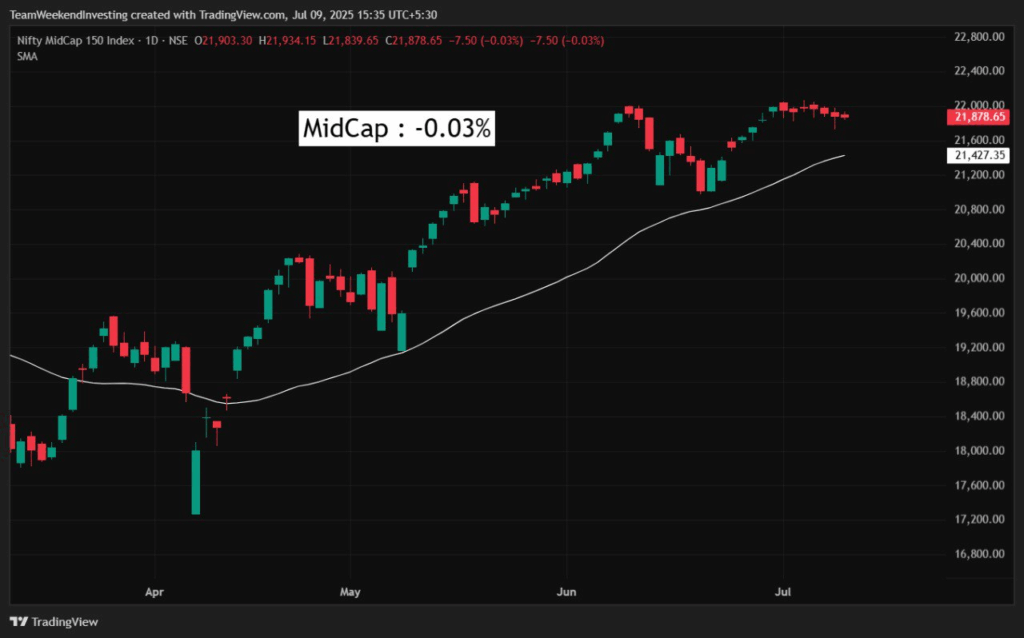

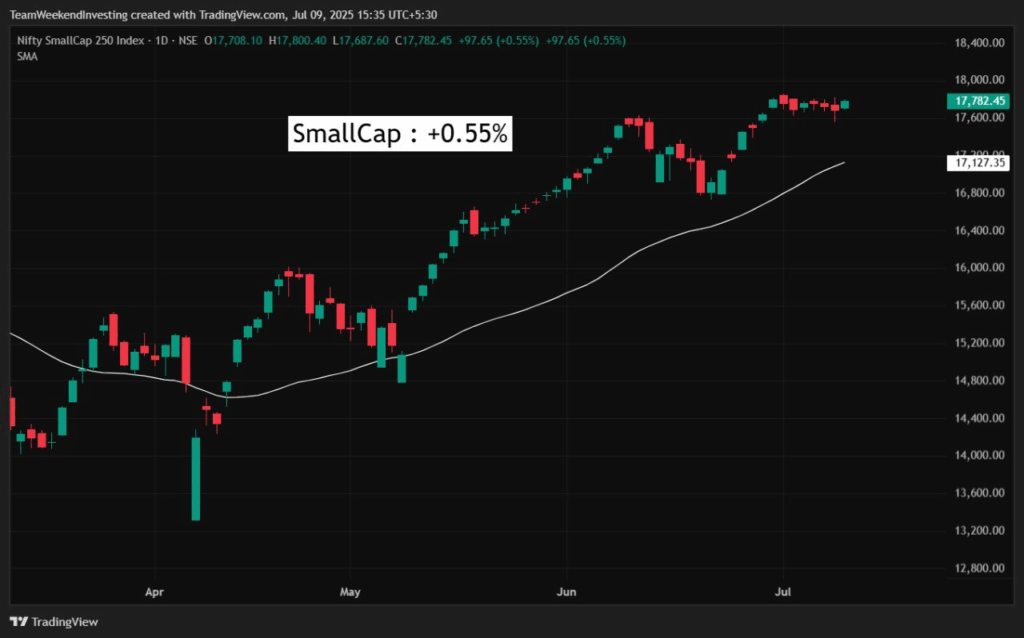

Nifty Mid and Small Cap

Mid caps slipped marginally by 0.03%, reflecting a flat performance overall. In contrast, small caps edged up by 0.55%.

Bank Nifty

Nifty Bank remained extremely flat, closing with a negligible loss of 0.07%, underscoring the overall subdued tone across major indices.

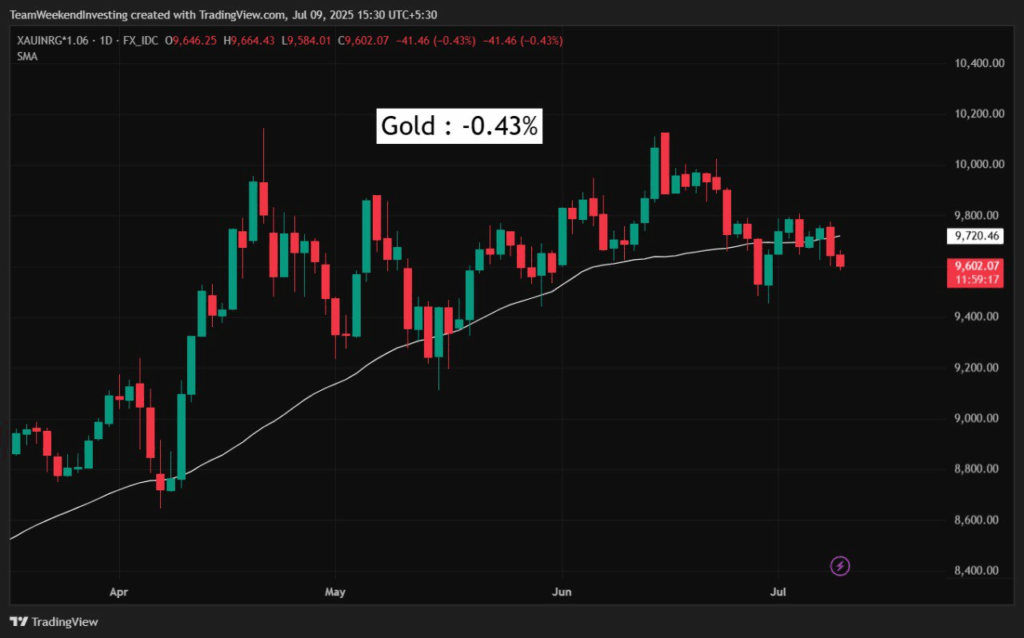

GOLD

Gold slipped 0.43% today, settling around ₹9,600 per gram, continuing its recent consolidation phase.

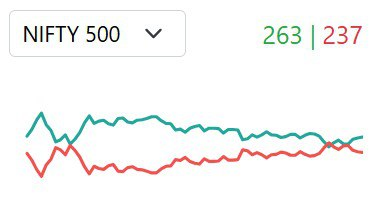

Advance Decline Ratio

The advance-decline ratio remained balanced through the first half of the session, with advances holding steady until around 11 AM. However, as the day progressed, declines picked up while advances tapered. By market close, the ratio stood at 263 advances to 237 declines—a classic no man’s land scenario with no clear directional bias.

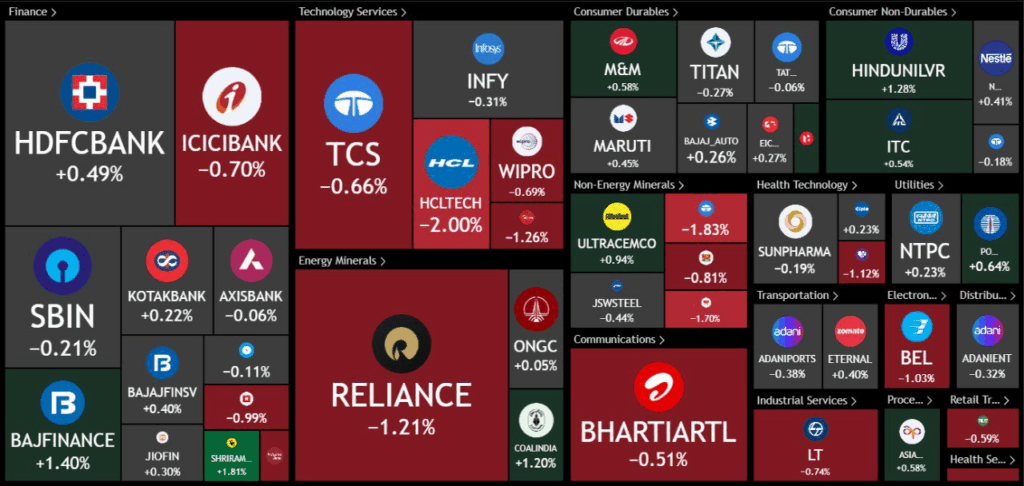

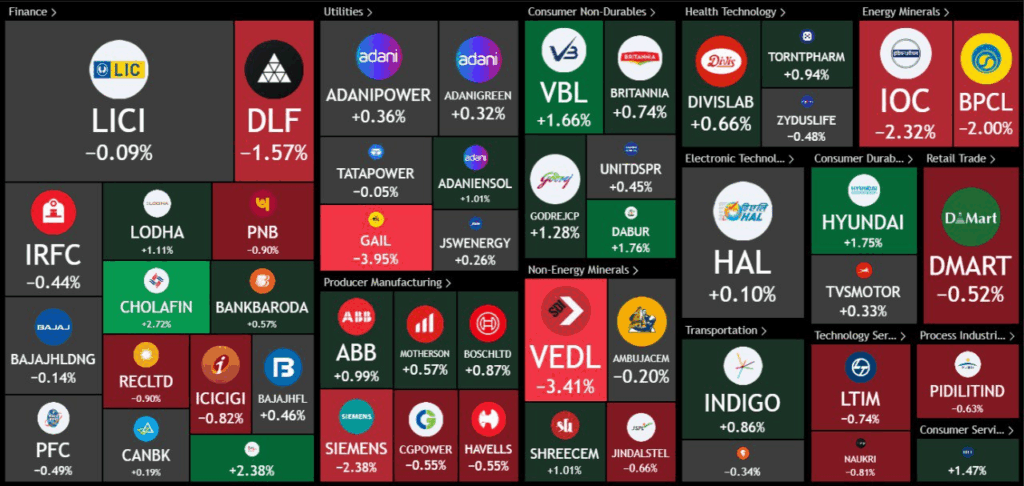

Heat Maps

Reliance lost 1.2% following news that the Jio Platforms IPO, expected in the second half of 2025, has been shelved—disappointing investors who were anticipating the issue.

Other notable losers included Tata Steel, Hindalco, Grasim, HCL Tech, TCS, ICICI Bank, and Bharti Airtel.

In the Nifty Next 50 space, Vedanta fell 3.4% on the back of a report the company has since refuted. GAIL dropped 3.9%, DLF was down 1.5%, and Siemens, CG Power, and Havells also declined—likely reacting to the recent copper price spike.

Stocks like IOC, BPCL, ICICIGI, REC, and PNB also saw declines.

On the gaining side, Chola Finance, Sriram Finance, Bajaj Finance, Coal India, Asian Paints, Hindustan Unilever, Varun Beverages, Dabur, and Hyundai showed modest strength.

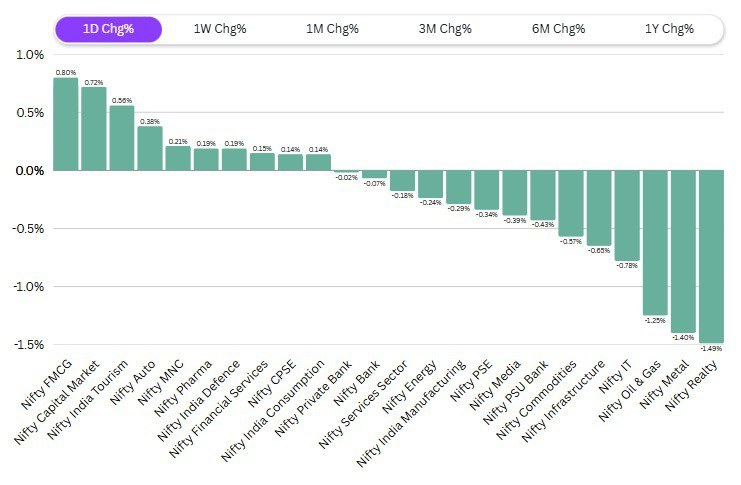

Sectoral Overview

Sectoral trends remained weak across the board. After leading the gains yesterday, Real estate turned into the biggest loser, down 1.4%, alongside Metals, which also fell 1.4%. Oil & gas dropped 1.2%, IT declined 0.7%, and Infrastructure was down 0.6%.

On the positive side, FMCG continued its outperformance for the second or third session in a row, indicating a defensive rotation away from high-beta sectors. FMCG was the top weekly gainer, up 2.77%, though its monthly return remains flat.

Capital markets saw a mild bounce, likely a relief rally after yesterday’s sharp fall. However, sentiment remains fragile and any regulatory developments could reignite pressure—particularly on listed exchanges and brokerages.

Other marginal gainers included Tourism (+0.5%) and Autos (+0.38%), but overall, only a couple of sectors provided support while broader weakness persisted.

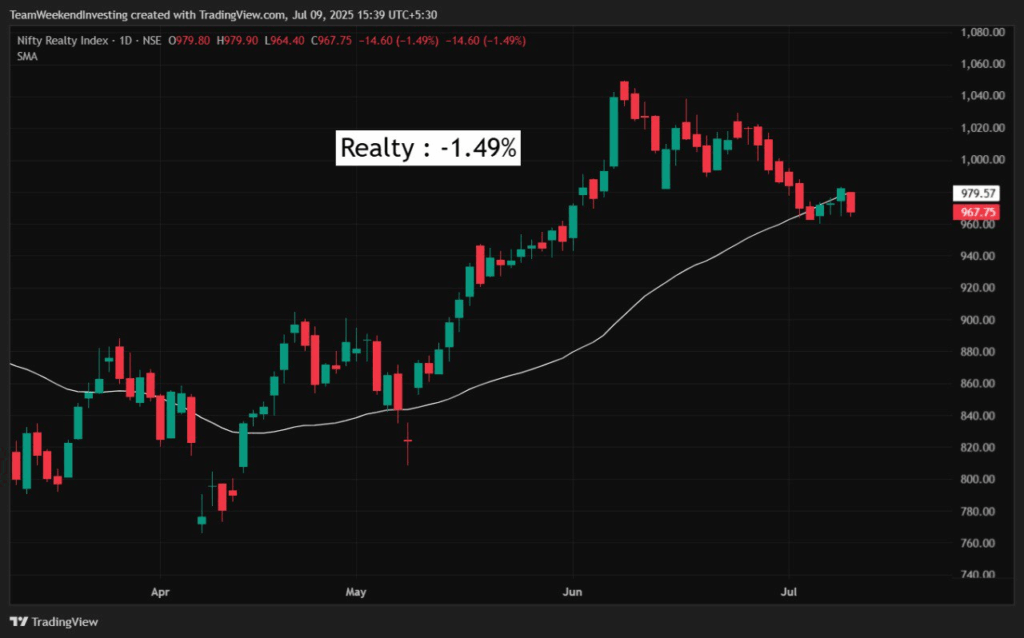

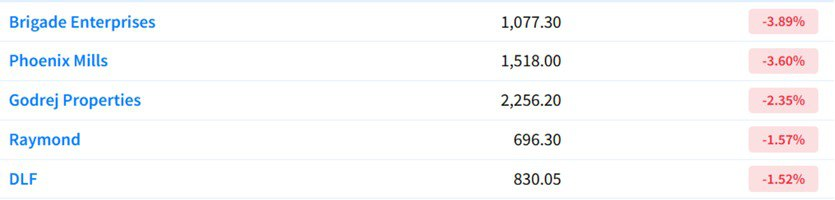

Sector of the Day

Nifty Realty Index

Real estate appears to be in a limbo, with stocks like Brigade, Phoenix, Godrej, Raymond, and DLF down sharply—contributing to a 3.9% decline in the sector.

While the broader market isn’t experiencing a major fall, the underlying momentum seems to be fading, suggesting growing caution and a lack of strong buying interest.

Story of the Day: Top Habits of Wealthy & Rich People

Retail participation in Indian markets has surged significantly over the past five years, especially post-COVID. This influx is most visible in short-term trading activity—particularly in small caps, IPOs, unlisted firms, and the booming F&O space. However, the trend reflects a worrying shift towards speculative behaviour and a ‘get-rich-quick’ mindset, with many participants entering without planning or long-term financial vision.

SEBI’s data confirms that 91% of retail traders in F&O are losing money, often driven by poor financial habits, lack of discipline, and peer influence. The ease of entering the market with minimal capital has only encouraged unchecked speculation. The need for investor education and behavioural awareness is pressing. Even individuals from modest backgrounds—like auto drivers—have entered high-risk instruments without sufficient buffers.

The most basic principle—living below one’s means—is often ignored across all income groups. The financial collapse of celebrities earning in crores highlights how spending habits, not income level, determine financial stability. The fundamental step is saving and investing first, then spending what remains. Consistency, rather than timing the market, is the proven path to wealth creation.

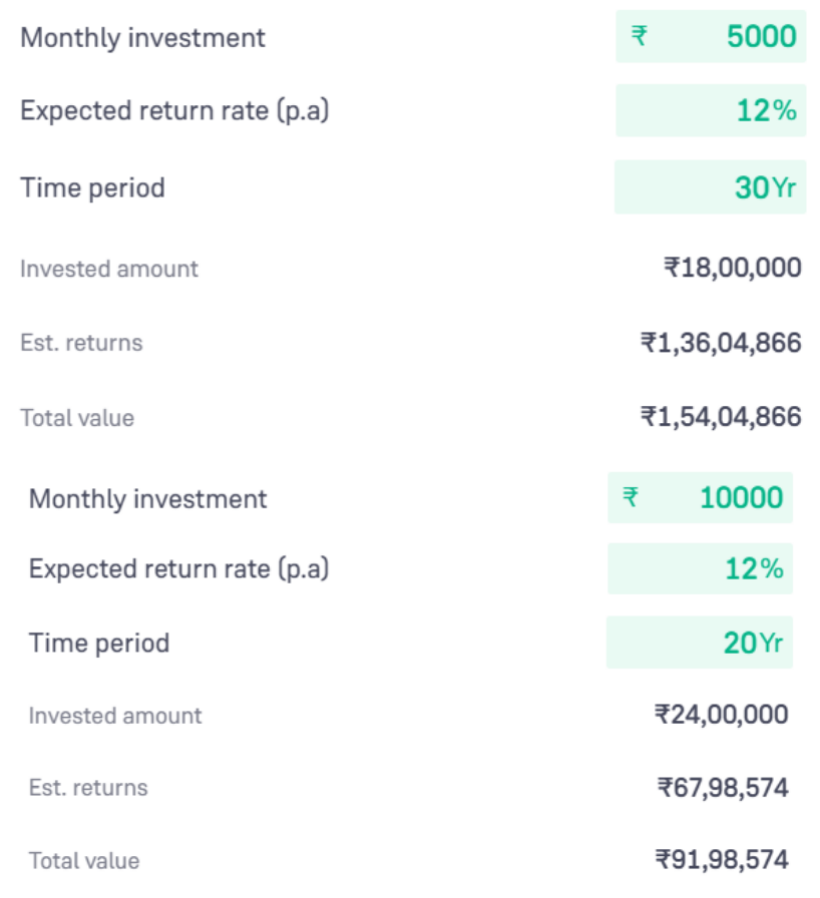

A case study shows (see the image below) that someone investing ₹5,000/month for 30 years ends up with ₹1.5 crore, while someone starting 10 years later and investing ₹10,000/month only accumulates ₹91 lakhs—proving the power of starting early.

Along with regular investing, building multiple income streams adds financial resilience—from rental income, content creation, freelancing, to side businesses. Even small contributions beyond a primary income can grow significantly over time.

Thinking long-term is essential—not just for wealth, but for major life goals like children’s education or retirement. This includes continuous self-investment through learning. AI, business, and finance tools are evolving rapidly, and adapting to them boosts earning potential and financial literacy. Many investors have successfully taken charge of their finances by consistently learning and applying basics.

The final takeaway is simple: Start small, start now. Build habits, allocate sensibly, invest regularly, diversify income, and never stop learning. True wealth is built quietly, with discipline, time, and patience.