Understanding the Large Cap to Small Cap Ratio

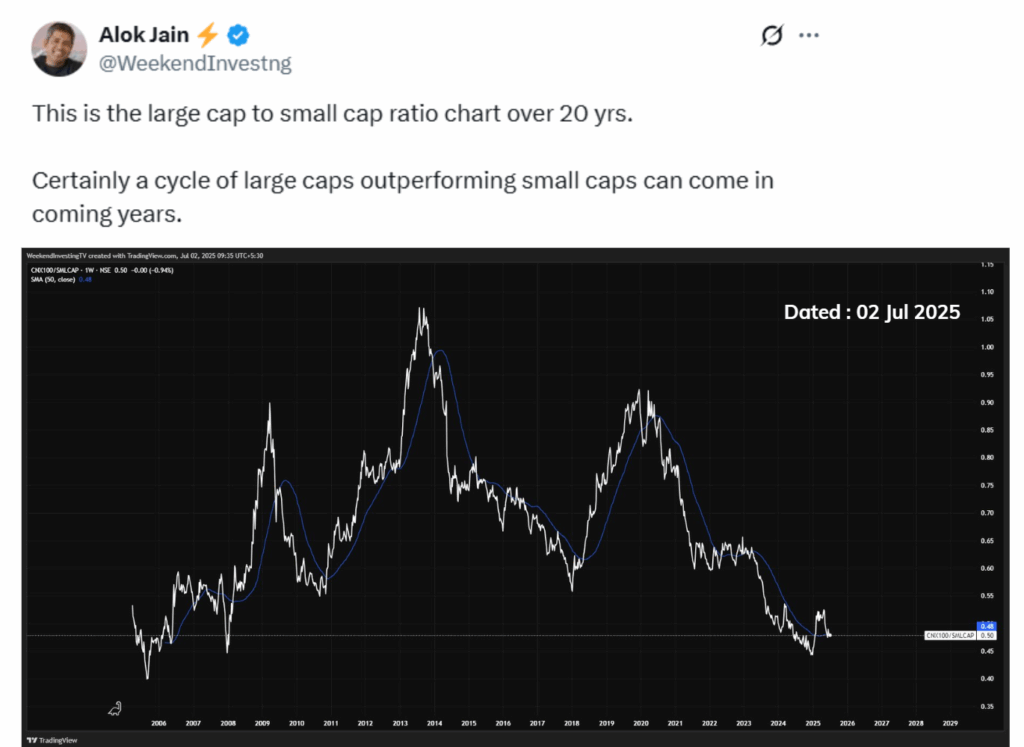

Over the past 20 years, the performance gap between large-cap and small-cap stocks has exhibited powerful cycles (see image below). The ratio of large-cap to small-cap stocks indicates which group is performing better. When this ratio rises, it means large caps are outperforming small caps. Conversely, when it falls, small caps are doing better.

Major Cycles from 2000 to Present

Between 2000 and 2009, large-cap stocks remained strong, even during the Global Financial Crisis. Although small caps experienced a sharp decline, large caps did not drop as significantly, resulting in a high ratio favoring large caps. After the crisis, small caps rebounded vigorously, outperforming large caps and causing the ratio to decrease.

New Trends Post-2011

From 2011 to 2013, large caps regained their lead. However, starting in 2013, small caps began to shine. This trend continued until 2018, when small caps faced challenges. From 2018 to 2020, large caps regained dominance in the market.

🌟 Searching for perfect balance in investing?

Mi AllCap GOLD is here to solve the big questions:

🔶 Where should you invest in equities? 🔶 How to stay calm in volatile times?

✅ 25% each in Large, Mid, Small Caps + Gold

✅ Strongest stocks picked in each segment

✅ Gold as your hedge when markets tumble

✅ Monthly rebalanced – rotational, momentum strategy

Don’t just diversify — balance wisely.

Impact of the COVID Era

Following the COVID crash, small caps performed exceptionally well, surpassing large caps in gains and maintaining their lead for some time. Recently, however, large caps have shown signs of recovery, and the ratio chart is starting to trend higher once again.

What Could Happen Next

If this ratio continues to rise, it could indicate one of two possibilities: either large caps will begin to outperform small caps, or small caps may decline more sharply than large caps during a market correction.

Is your portfolio balanced for the next market cycle? Will large caps take the lead once again? Share your thoughts in the comments below, and if you found this article helpful, don’t forget to SHARE it with your friends!