Understanding the CNX 500 Index

The CNX 500 index is one of the broadest market indices in India. It is made up of 500 different stocks, but the weight is not evenly spread across all companies. (see the image below)

Big names like HDFC Bank, ICICI Bank, Reliance, Infosys, Larsen & Toubro, ITC, Tata Consultancy Services, State Bank of India, and Axis Bank hold a large part of the index. For example, HDFC Bank alone has a weight of about 7.7%, while ICICI Bank holds 5.3% and Reliance around 5%. Together, the top 10 stocks make up almost 32% of the total index.

Why Big Stocks Matter So Much

Because of this heavy concentration, the performance of the CNX 500 depends a lot on these top companies. If the leading 10 stocks are not doing well, the index as a whole struggles to show growth. Even though the index includes 500 stocks, the reality is that only a small group of large companies have the power to move it in either direction. This makes the CNX 500 less balanced than it might appear at first glance.

Nifty 50 and Its Role

When we look deeper, we see that the Nifty 50 stocks alone make up about half of the CNX 500. That means only 50 companies carry 50% of the total weight, while the other 450 companies together share the remaining 50%. This shows how skewed the structure is. For example, even if the smallest 50 stocks in the CNX 500 perform extremely well, their impact on the index is very small compared to the large players.

Comparing Nifty and CNX 500

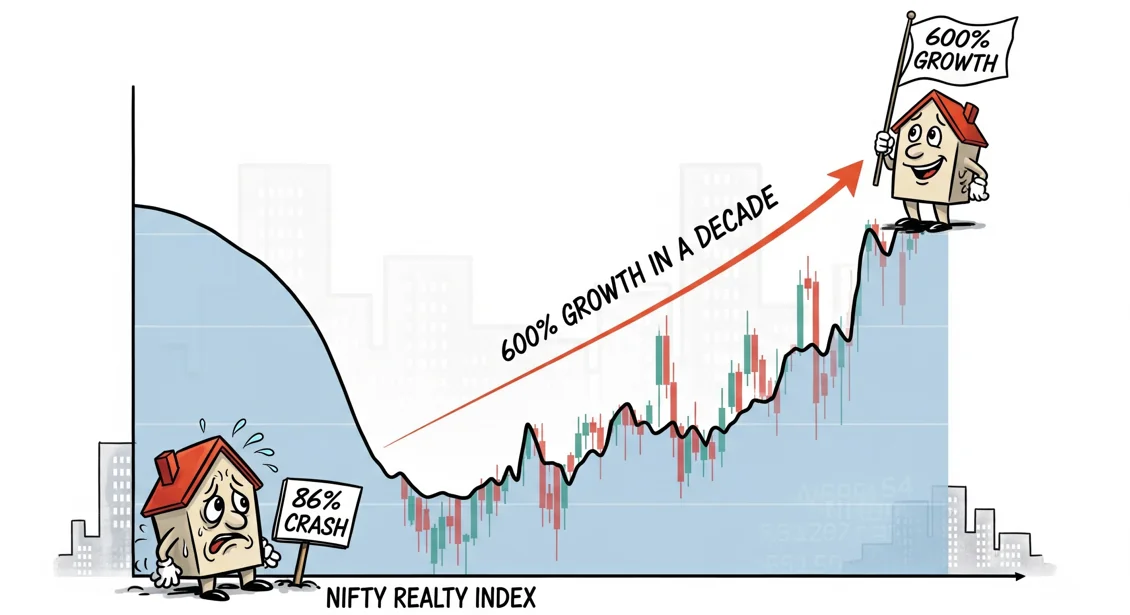

One interesting way to understand this is by looking at the Nifty-to-CNX 500 ratio. (see the image below)

Over the years, this ratio has been coming down, which tells us something important. It shows that the broader market, especially the smaller and mid-sized companies within the CNX 500, has been performing better than the Nifty 50 stocks. Investors have been seeing more strength in the rest of the market rather than only the large companies.

What the Future Could Mean

If in the future this ratio starts moving up again, it may signal that the Nifty 50 stocks are finally beginning to outperform the rest of the CNX 500. Until that happens, the broader group of 450 companies will continue to shine brighter compared to the top 50 names. This gives investors a useful perspective: while big stocks carry the weight, the real growth may often be found in the broader base of the market.