Where is the market headed?

A Santa rally appears to have arrived earlier than expected, with a strong run seen in the markets both in India and globally. There is a growing realization among market participants that a lower interest rate regime is now a worldwide reality.

Additionally, there are strong rumors regarding negotiations for an Indo-US tariff deal. It appears that the market bottom for the month has already been established. This follows a common cyclical pattern where the first few weeks of December are often dull, followed by a pick-up as the year-end approaches.

An analysis of gold over the last fifty years shows the metal has moved from 30 dollars to 4400 dollars. Technical indicators like the monthly Relative Strength Index (RSI) suggest that gold is currently in an overbought zone.

While being overbought does not mean prices will immediately fall, as assets can remain in this state for long periods, gold has never been as overbought in its history as it is right now. The same trend is visible in silver. In Indian Rupee terms, gold has not experienced a down month for thirteen months.

This indicates a gradual restructuring of the entire monetary system that mass media has yet to fully capture. Central banks are acquiring gold and moving away from U.S. treasuries. This represents a world reorder where an Eastern bloc is orienting toward gold while a Western bloc leans toward crypto and stablecoins. Living through these historic events, it is easy to miss the enormity of the shift, but this era will likely be the subject of future books.

Market Overview

The Indian markets performed very well, with the Nifty rising 0.79 percent to reach 26172. This level is less than 100 points away from its highest close ever. In just three sessions, the Nifty has shaken off previous market weakness.

Nifty Next 50

The Nifty Junior has also broken above its pivot high, moving away from a pattern of lower highs and looking reasonably stable.

Nifty Mid and Small Cap

Mid caps gained 0.83 percent and small caps rose 0.96 percent, though small caps still have more ground to recover.

Bank Nifty

Bank Nifty also climbed 0.4 percent.

GOLD

On this rare day, all market segments performed well, which also pushed gold to a new all-time high in rupee terms. Gold is now priced at 1 crore 34 lakhs 94,000 per kilogram. While this sounds like a massive increase from the 52 lakh price seen two years ago, the long-term compound annual growth rate is roughly 12 to 15 percent.

SILVER

Silver also surged 2.89 percent to reach 210,961 per kilogram. These sudden jumps often shock the system, leading people to believe prices must come down. However, this is often a reflection of the collapsing value of paper money while real assets rise.

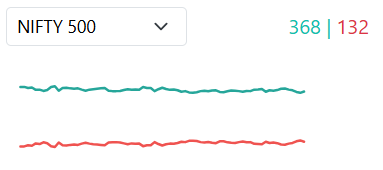

Advance Decline Ratio

The advance-decline trend was very strong today, with 368 stocks advancing compared to 132 declining.

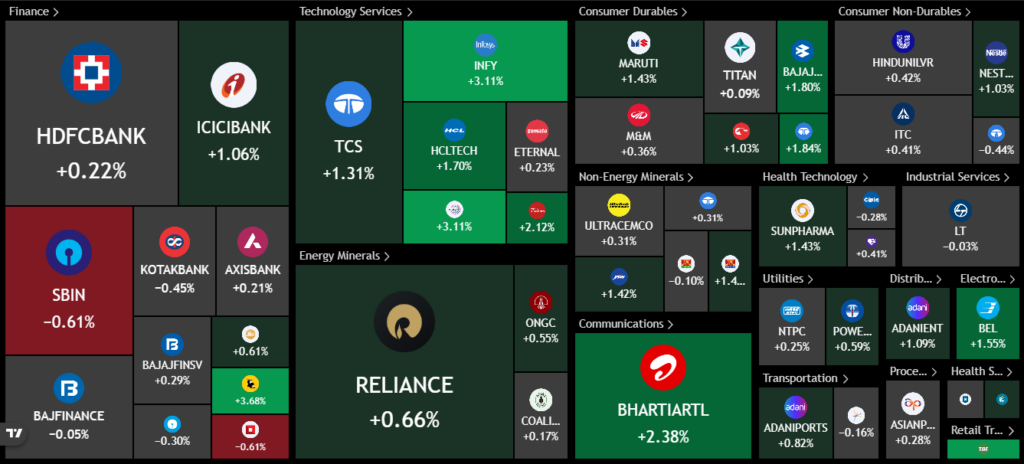

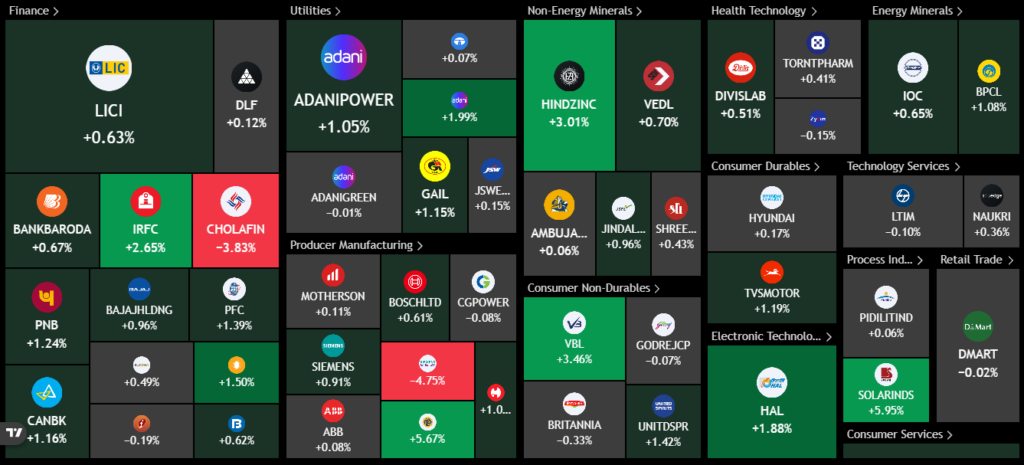

Heat Maps

Notable gains were seen in IT stocks, Reliance, TCS, Bharti Airtel, Bajaj Auto, and Tata Motors. While ICICI Bank and Bharat Electronics did well, SBI saw a small loss. Within the Nifty Next 50, there were significant gains in the commodity space with Hindustan Zinc and Vedanta, as well as in consumer goods like Varun Beverages and United Spirits. Finance stocks like Shriram Finance and IRFC performed well, alongside defense stocks such as HAL and Solar Industries.

Mover Of The Day

In contrast, R Power lost eight and a half percent as Reliance Infra faced a trading suspension.

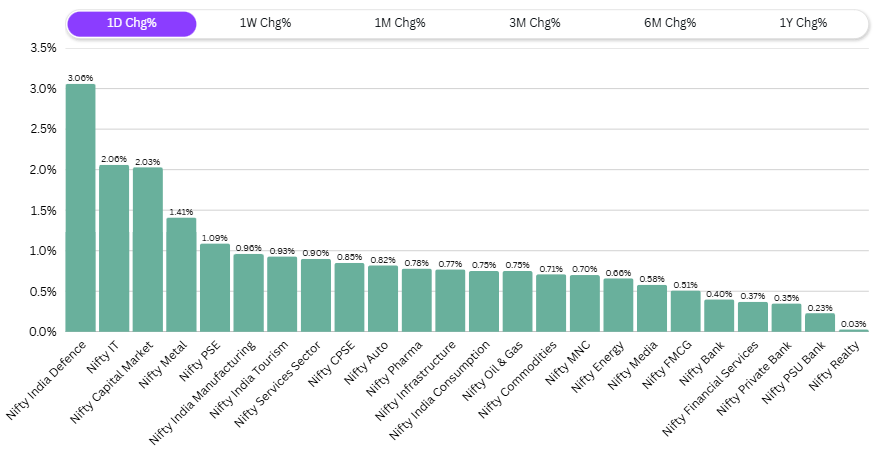

Sectoral Overview

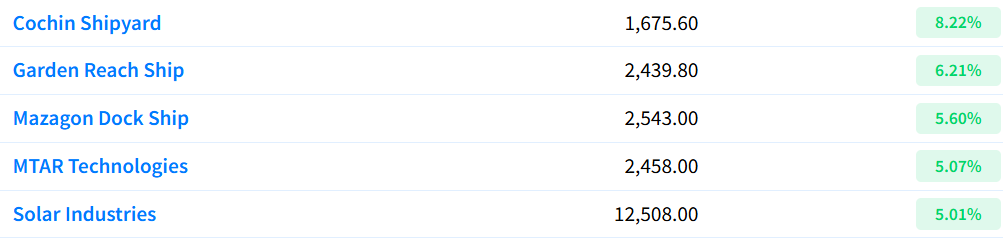

The defense sector saw a sharp single-day jump of 3.06 percent, though it remains down four and a half percent for the month and up 18 percent for the year. Metals and capital markets are also trading near their highs, while the real estate sector remained flat.

Sector of the Day

Nifty India Defence Index

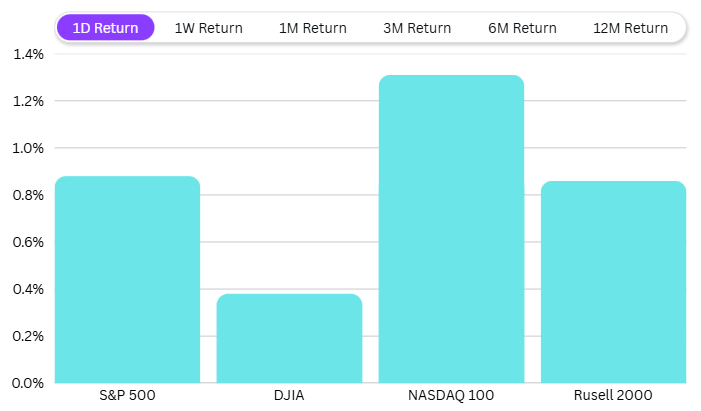

U.S. Market

In global markets, the U.S. indices performed well in their previous session. The Nasdaq rose 1.3 percent, the S&P 500 gained 0.88 percent, the Russell 2000 increased by 0.8 percent, and the Dow Jones went up 0.4 percent. These moves were powered by the AI sector, including stocks like Oracle, which rose 6 percent after being previously beaten down.

Other contributors included AMD, Palantir, Nvidia, and Broadcom, with gains ranging from 3 percent to 6 percent. While these stocks may be part of specific investment strategies, their mention is for informational purposes rather than a recommendation.

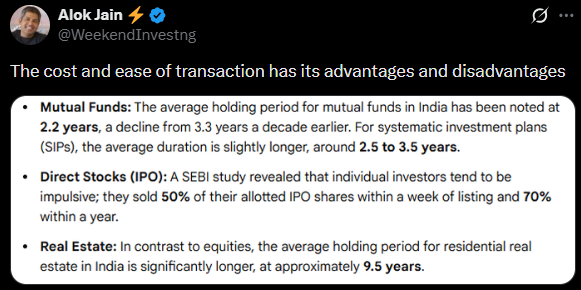

Tweet Of The Day

A critical point of discussion for investors is the decreasing average holding period for mutual funds in India. Recent data shows the average holding period has dropped to 2.2 years, down from 3.3 years a decade ago. This is alarming because equities are generally successful as an asset class only over five, seven, or ten years. Entering the market with a plan to exit within a year is often counterproductive.

Many investors who lack a long-term mindset or rely purely on hearsay end up funding the profits of more disciplined, long-term investors. The ease of modern transactions and the lack of exit hurdles often encourage people to leave the market prematurely. In contrast, the high transaction costs and difficulty of selling real estate often force investors to hold their assets longer, which frequently results in significant wealth creation.

The current trend of flipping IPOs, where 50 percent of holders sell within a week, reflects a gamification of the market that rarely leads to long-term success. Understanding that investing is a long-term game is vital.