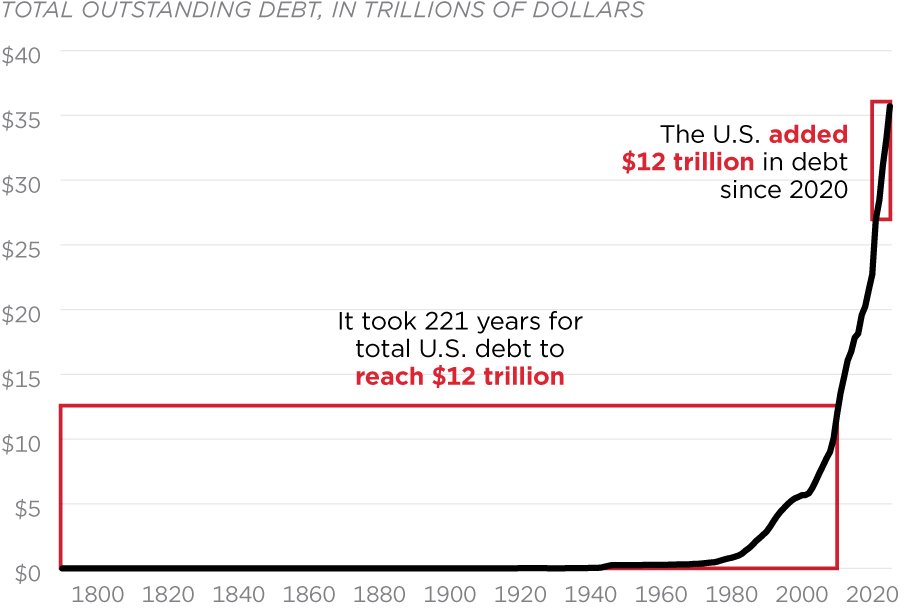

US Debt Reaches Unimaginable Heights

The total debt of the US government has grown at an astonishing pace. It took over 221 years to build up a debt of $12 trillion, but in just the last four years, that figure has doubled. This rapid increase is difficult to comprehend. It’s as if someone who spent their entire life accumulating debt suddenly doubled it in just a short time. This extraordinary growth in debt highlights the financial challenges the US faces, and yet, it seems the world is not fully grasping the long-term impact this will have.

The Scale of Debt Growth

To put it simply, the US government has taken on more debt in the last four years than it did in over two centuries. This dramatic increase is the result of significant government spending, particularly on stimulus measures, to support the economy. As a result, the debt has ballooned at an incredible rate, crossing $24 trillion today. While this has allowed the economy to function during difficult times, it raises the question: how long can this continue?

The Impact of Debt on Global Markets

The world economy seems to be ignoring the seriousness of this growing debt for now, but it won’t be able to do so forever. There is no such thing as unlimited borrowing without consequences. At some point, the massive debt will lead to repercussions, although it is unclear when or how that will happen. It’s almost like living in a world where everyone believes they can borrow without ever needing to repay the debt. However, history tells us that such imbalances eventually lead to major crises.

Foreign Dependence on US Debt

A significant portion of the US debt is being funded by other countries. The rest of the world, including major economies like China, Saudi Arabia, and Russia, are purchasing US debt in exchange for US dollars, keeping the system afloat. However, if these countries begin to lose confidence in the US government’s ability to manage its debt, they may stop holding US treasury bonds. This would create a huge problem for the US, as they would struggle to find new buyers for their debt.

The Global Ripple Effect

The consequences of the US debt problem will not just be felt in America. The US is the world’s largest consumer of goods and services, and if it stops spending, it could trigger a global economic downturn. Many countries depend on US demand to keep their own economies running. If the US government can no longer borrow to sustain this demand, the impact will be felt worldwide.

A Global Conundrum

This situation presents a unique problem. On one hand, the US economy keeps running thanks to borrowing, but on the other hand, it relies on other countries to fund this borrowing. It’s like a factory that produces goods for a customer who keeps asking for loans to buy those very products. As more countries potentially stop accepting US dollars as reserves, the US will face an even bigger challenge, affecting not just itself but the entire global economy.

WeekendInvesting launches – PortfolioMomentum Report

Momentum Score: See what percentage of your portfolio is in high vs. low momentum stocks, giving you a snapshot of its performance and health.

Weightage Skew: Discover if certain stocks are dominating your portfolio, affecting its performance and risk balance.

Why it matters

Weak momentum stocks can limit your gains, while high momentum stocks improve capital allocation, enhancing your chances of superior performance.