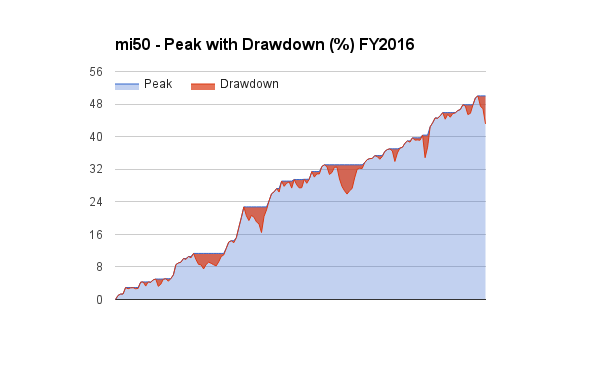

Finally a correction starts in the market. Mi50 closed at +43.13% absolute vs 47.77% last Friday. Nifty and S&P500 gains for the year to date are 9% and 12.7% respectively. We are comfortable from a relative point of view.

Draw down at end of week was -6.88%, the worst since we started.

The stocks that exited this week and the respective gains/losses are :

| 4/13/2016 | GRASIM | +10.3% |

| 4/1/2016 | PEL | +54.01% |

| 4/1/2016 | AHLUCONT | -4.42% |

| 4/13/2016 | 3MINDIA | -6.61% |

| 4/13/2016 | ITDCEM | +14.91% |

| 4/1/2016 | FINPIPE | +22.27% |

| 4/1/2016 | DHAMPURSUG | +24.68% |

The new addition was

| 11/4/2016 | MOIL | 334.50 |

The portfolio has 42 stocks and rest of the the funds are in Liquid Bees.

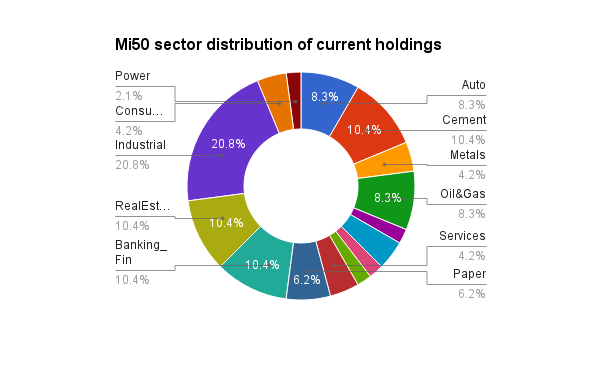

The sector distribution now looks like this:

The win-loss ratio for all trades:

| Wins | Avg | Losses | Avg |

| 55 | 41.46% | 23 | -6.70% |

And for the exited trades:

| Wins | Avg | Losses | Avg |

| 19 | 29.70% | 17 | -6.07% |

The D day is only 3 days away. Next Friday either we will be all smiles or ready for a deep hibernation.

Have a great weekend.

Very good performance and well done Alok. I know your logic is proprietory but let me tell you I did lot of permutations and combinations ‘may be’ like your model starting 2009 (e.g. Buy a stock goes above 41 week MA AND is down at least 50% from last 4 year high, Buy if stock crosses 1 year high and relative strength of stock vis-a-vis benchmark index is above 41 week MA, Sell if stock falls 30% from 52 week high and so on) but my experience tells me If you are not selecting right SECTOR you may find difficult to generate consistently out-performing returns over different cycles.

My model gives me ranking of possible out-performing sectors over next 1 year and today it tells me PSU Banks to be best performer for next 1 year :-).

Tks Jigs. I always wanted to add a sector based model too. But i have not been able to crack that code. My model will likely gauge relative momentum and hopfully get some stronger momentum stocks from a strong sector group. Tks. Will keep an eye out on PSU Banks.

I notice lot of people do number crunching and data massaging like Nifty return in Nov is X and return from taking support of 200 DMA is Y etc but when it comes to making good amount of real money they fail may be because of non-understanding of sector momentum (my guess). I appreciate you are putting REAL money on your model and doing well so thought I should add 2 cents to add to your returns. Any one coming with original thinking should be appreciated as 90% of gurus talk same thing so they are definitely NOT smart enough to generate out-performance relative to benchmark.

My model suggested chemical in May 2014 and I see that now people realizing its potential. Let us see where PSU Banks go in next 1 year as 25% of my portfolio is in PSU bank.

Wow. Amazing pick on chemicals…do you write on some blog?