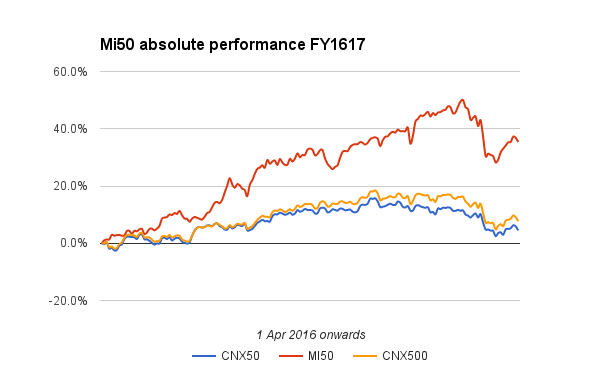

Mi50 closed the week at +35.37% gains for the yr vs 4.5% and 7.7% for NSE50 and CNX500 respectively. Moderate out-performance was seen relative the indices this week.

The first three days of the week were encouraging while last 2 days gave up most of the gains.

The draw down improved from 15.88% to 14.64% this week. From the lows 2 weeks back we have clawed back about 7% despite having large portion of cash on hand.

The strategy added 4 stocks today

| 12/2/2016 | MERCK | 955.85 |

| 12/2/2016 | ITI | 36.48 |

| 12/2/2016 | HINDOILEXP | 70.25 |

| 12/2/2016 | SHEMAROO | 398.27 |

I don’t like 3 of them personally but then, this is not about me 🙂

Mi50 now has 28 stocks in play and is holding LiquidBees at approx 37% of the portfolio. We have good dry gunpowder.

The internals of Mi50 still look good. A 50:50 win loss and a 2:1 avgwin to avgloss ratio is the minimum I aspire for. We are at 50:30 and 4:1 respectively, much ahead of expectation so far. All strategies get marginalized over time and keeping track of these ratios can give us a sense of timing, if ever we need to abandon this.

| All | Wins | Avg | Losses | Avg |

| 55 | 36.26% | 31 | -8.43% | |

| Exits | Wins | Avg | Losses | Avg |

| 36 | 33.51% | 22 | -8.58% |

The sector distribution :

The next couple of weeks should be flat to mildly positive in my expectation before we start building the budget rally.

Lets hope the Italians don’t surprise us on Sunday! Have a good weekend.

How do you make the selection of scrips?and how u exit?

Hello. The strategy is proprietary but works on simple logic of chasing momentum and trailing it.