Foreign Portfolio Investors Reshuffling Sector Allocations in Indian Markets

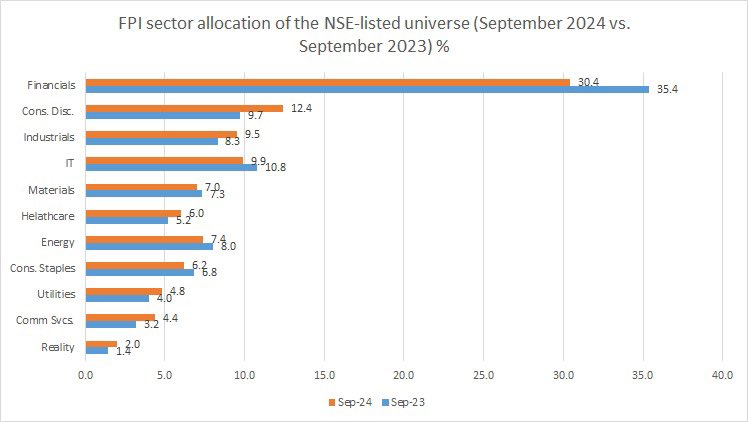

Recently, there has been a noticeable shift in the investment strategies of Foreign Portfolio Investors (FPIs) in the Indian stock market. While many are aware that FPIs have been selling, it is important to understand that this is not a simple sell-off. Instead, there is also a significant restructuring of their investments across different sectors. This change highlights a deeper trend in how global investors are adjusting their portfolios to align with market conditions.

Decline in Financial Sector Allocations

One of the most significant changes has been in the financial sector, which includes banks and financial services companies. Over the past year, FPIs have reduced their allocations to this sector. The allocation has dropped from 35% in September 2023 to 30.4% in September 2024. This decline represents nearly a 20% reduction in their investment in financials. The financial sector, which once attracted a large portion of FPI funds, is now seeing a shift away as investors look for more stable or growth-driven opportunities.

Rising Interest in Consumer Discretionary and Industrials

On the other hand, the consumer discretionary sector has seen a significant increase in FPI investments. The allocation to this sector has risen from 9.7% to 12.4%, marking a nearly 20% jump in just one year. This sector includes businesses related to goods and services that people buy with discretionary income, such as automobiles, entertainment, and luxury products. Similarly, the industrials sector has also seen a rise in allocation, growing from 8.3% to 9.5%. These shifts indicate that FPIs are becoming more interested in sectors that show potential for stable growth, especially in the post-pandemic world.

Decline in IT and Energy Sectors

Another noteworthy change is the reduced allocation in the Information Technology (IT) and energy sectors. The IT sector, which has traditionally been a strong performer, saw its allocation drop from 10.8% to 9.9%. This reduction shows that while IT still remains a significant part of FPI portfolios, investors are becoming more cautious about its future growth potential. Energy also witnessed a drop, reflecting changing global market dynamics and perhaps a shift towards more sustainable and diversified investment opportunities.

Healthcare and Utilities Gaining Attention

FPIs have increased their focus on more defensive sectors like healthcare, which saw an increase in allocation from 5.2% to 6%. This suggests that investors are looking for safer bets amid market volatility. Utilities, which provide essential services like electricity and water, have also seen a rise in FPI investments. These sectors are known for their stability, especially during economic downturns, making them attractive to investors who seek lower risk.

Sector Rotation Instead of Mass Exit

The changes in sector allocations reveal that FPIs are not simply exiting the Indian market. Instead, they are rotating their investments across different sectors. While there may be a net outflow of funds, the allocation adjustments show a strategic approach. FPIs are moving away from sectors that may be considered overvalued or have reached their peak, such as financials, IT, and energy. At the same time, they are increasing their exposure to more defensive and growth-oriented sectors like consumer discretionary, healthcare, and utilities.

WeekendInvesting launches – PortfolioMomentum Report

Momentum Score: See what percentage of your portfolio is in high vs. low momentum stocks, giving you a snapshot of its performance and health.

Weightage Skew: Discover if certain stocks are dominating your portfolio, affecting its performance and risk balance.

Why it matters

Weak momentum stocks can limit your gains, while high momentum stocks improve capital allocation, enhancing your chances of superior performance.