Analyzing Global Market Performance: A Look at 2024

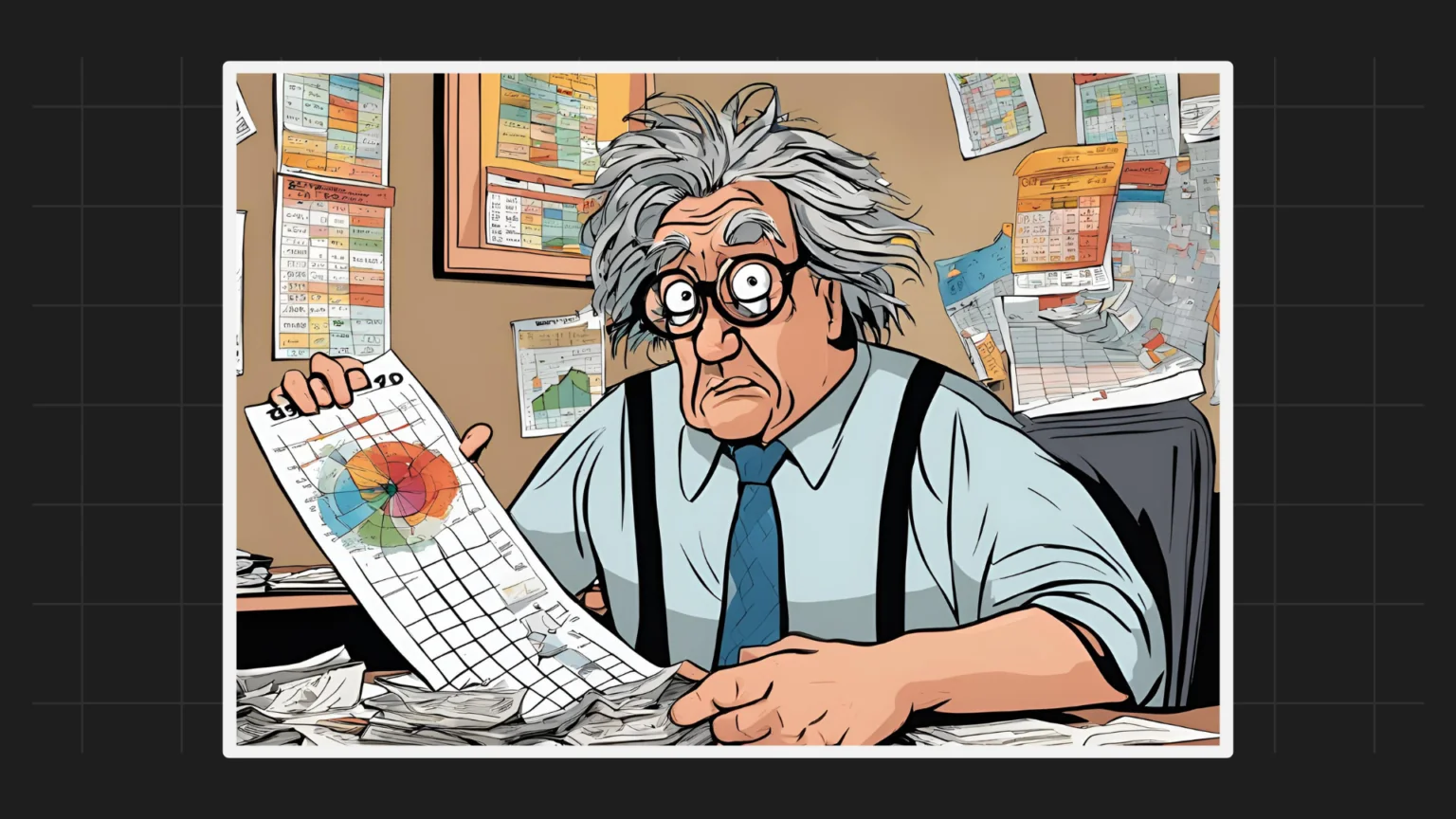

This year has seen remarkable performances across various markets globally, as reflected in ETF returns measured in US dollar terms. Let’s delve into some key highlights and understand how different countries have fared in 2024.

Argentina Leads with Stellar Gains

Argentina is the standout performer with a staggering 62% return in dollar terms. The bullish sentiment stems from the country’s new leadership, which has implemented sweeping reforms such as cutting ministries and reducing the fiscal deficit. Inflation, which had previously reached astronomical levels, has been brought down to single digits. These significant improvements in economic stability and governance have fueled investor confidence in Argentina.

Other Noteworthy Performers

Pakistan, though not included in this chart, has also experienced robust returns in 2024. Israel, despite ongoing geopolitical challenges, has shown resilience in its markets. The United States has made a strong comeback with a 26.9% return, highlighting its continued economic strength. Singapore, after several years of lackluster performance, has had a stellar year at 23%, while Canada managed an 18% return despite facing its share of economic challenges.

India’s Steady Performance

India posted a 12.4% return in dollar terms this year, aligning closely with its long-term average of around 11.5% to 12%. This performance reflects a “normal year” for the Indian markets. Domestic fund flows have played a significant role in sustaining these returns despite foreign institutional investors offloading shares. Unlike some concerns about an overheated market or a bubble, India’s performance remains grounded and consistent with its historical trend.

Contrasting Performances in Emerging Markets

Not all emerging markets enjoyed positive returns this year. Countries like Brazil, Mexico, Vietnam, Indonesia, and Hong Kong ended the year in the red. Even though some markets like China managed a modest 14.3% return, the divergence in performance underscores the varied economic challenges and opportunities faced by different nations.

What Lies Ahead for 2025?

Looking forward, 2025 may bring a more tempered performance for India and other markets. After a buoyant year like 2024, it is natural for growth to stabilize as the base effect makes year-on-year comparisons appear less impressive. Historically, after a period of strong returns, markets often witness a pause or a slight pullback, setting the stage for future growth.

A down year, if it occurs, could provide a healthy consolidation phase, paving the way for stronger performances in subsequent years. Investors should view such periods as opportunities for strategic positioning rather than reasons for concern.

WeekendInvesting launches – PortfolioMomentum Report

Momentum Score: See what percentage of your portfolio is in high vs. low momentum stocks, giving you a snapshot of its performance and health.

Weightage Skew: Discover if certain stocks are dominating your portfolio, affecting its performance and risk balance.

Why it matters

Weak momentum stocks can limit your gains, while high momentum stocks improve capital allocation, enhancing your chances of superior performance.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com