A Tale of Two Investors

Let’s talk about two friends, A and B. Friend A invested $10,000 in Intel Corporation in 2014. At that time, Intel was the largest chip maker and had a promising future. Fast forward ten years, and Friend A’s investment grew to $13,420. On the other hand, Friend B invested $10,000 in Nvidia instead. Today, Friend B’s investment is worth a staggering $2.9 million. This shows the huge difference that can occur in the same industry over the same period.

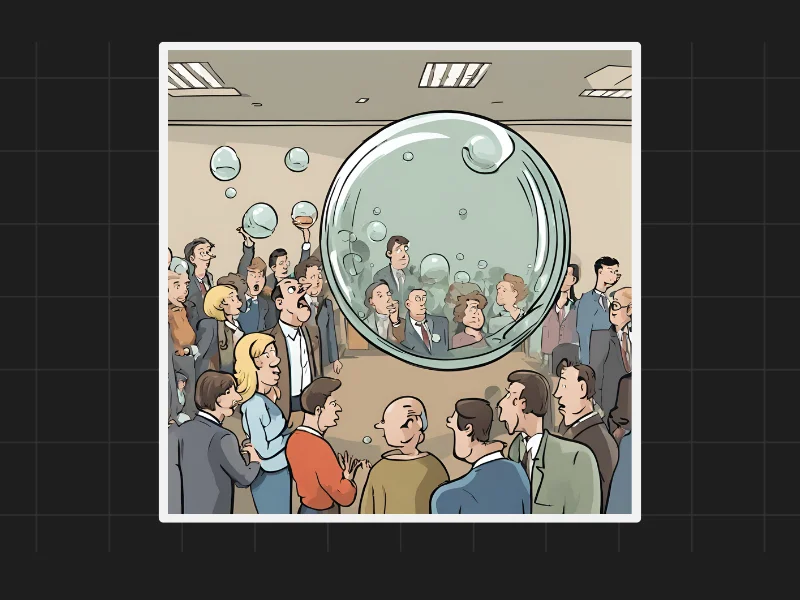

Understanding Market Changes

This example highlights how the market can change drastically. In hindsight, it’s easy to say that investing in Nvidia was the better choice. However, at the time, both Intel and Nvidia seemed like good investments. The difference lies in the ability to recognize and act on new opportunities. Nvidia showed signs of growth and innovation from 2016 onwards, yet many investors continued to hold onto Intel.

The Risk of Sticking to Old Investments

Many investors struggle with letting go of old investments. For example, Nvidia had several big rallies, signaling its potential, while Intel’s performance lagged. Holding onto a stock without considering industry changes can be a mistake. It’s essential to stay open to new developments and be willing to adjust your portfolio accordingly.

Embracing New Opportunities

To avoid missing out on new opportunities, investors should be open to incorporating new stocks into their portfolios. For instance, shifting a portion of your investment from an underperforming stock to a promising one can yield better returns. This doesn’t mean abandoning your original investment entirely but gradually increasing your stake in new, better-performing stocks.

A practical approach is to gradually move your investments. If you see a new stock performing well, consider shifting a small percentage of your funds to it. For example, if you invested in Nvidia in 2016 and saw good returns, you could have moved 25% of your Intel investment to Nvidia. Over time, if the new investment continues to perform well, increase the percentage gradually. This method allows you to test the waters without taking excessive risks.

Building Confidence with Small Steps

This approach also applies to new investors hesitant to enter the market. If you have most of your funds in a bank, start by investing a small portion in the market. For example, keep 90% of your funds in the bank and invest 10% in the market. After a year or two, evaluate the performance of that 10%. If it performs well, increase your market investment by another 10% or 20%. Over time, this gradual shift can boost your confidence and help you transition more of your funds into the market.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com