| 7/31/2017 | 10.17% | 10077 | 9.84% | 8793 | 9.98% |

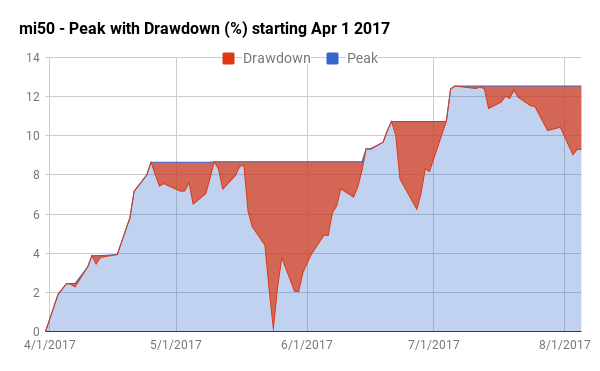

At the close of July 2017, the strategy is up 10.17 pct for the FY vs 9.84% for the Nifty 50 and 9.98% for the broader CNX500. The strategy high point achieved this month was at 12.54% and low at 9.98%

The corresponding figures for June end were

| 6/30/2017 | 7.90% | 9521 | 3.78% | 8332 | 4.22% |

The new entrants this month have been:

| EVERESTIND |

| SAKUMA |

and the deletions have been :

| MPHASIS |

| VIPIND |

| NCLIND |

There are now 42 constituents in the strategy and cash level is Zero.

The biggest gainer this FY is MEP at near +85% while top loser is SIMPLEXINF at -14%. The strategy has under-performed the indices this month.

This strategy is lagging my other strategy Mi25 so far this year. A new strategy Mi40 is intended to be launched shortly in month of Aug 2017.

The Mi50 strategy remains open for new entrants. Do write in to alok@weekendinvesting.com or visit weekendinvesting.com for further queries.

Alok,

What will make you think smallcap index itself has made some intermediate top? What is the highest % gain for a week till date in Mi50?

My Indicators suggest we are entering final 6-8 weeks of euphoric zone in Smallcap Index so asked.

Hello! On a gross basis if the previous intermediary low is yet to be broken, till then I will assume the trend is ON . Don’t have the weekly stat for Mi50. Noted your expectations. Tks