A weekly momentum strategy Mi50, which is a flagship product of weekendinvesting has turned in a great quarter with a cumulated FY returns at +35.33% at end of Q3FY17 vs +14.79% for NSE50 and +18.71% for CNX500. Recall that Mi50 had closed Q2FY17 at +10.36% vs 6.70% and 7.57% for the indices.

In both the previous quarters we managed to somehow give up all the gains and go to zero only to spring back up in the next quarter. As the saying goes “Keep trying and you will succeed eventually” !!, Mi50 has eventually succeeded in retaining the entire gains this quarter and closed the 9 months period at a all time high for the current year.

The drawdown experienced in the current quarter was the maximum at the beginning of Dec at just a modest 2.9%!

The Mi50 strategy rejected the following stocks during the quarter

| BALAJITELE |

| MURUDCERA |

| TRIDENT |

| MIRZAINT |

| OCCL |

| GUJGASLTD |

| SAKUMA |

The last stock SAKUMA was being named by several market voices as being a “operated” one, yet the strategy was able to eek out more than 60% of gains in it before finally exiting it. Mi50 is a trend based strategy and stock quality is not a concern. So far in last 2 years it has encountered some dubious stocks like ENERGYDEV (gained 100%+), SHILPI (lost 55%) and SAKUMA (gained 60%+) among hundreds of other good stocks and overall has made money even in these rotten ones.

As may be evident, the churn has been extremely low with only 7 exits in a period of 3 months in a portfolio of nearly 50 stocks. The best entrant and gainer during Q3 has been HGS which has gained nearly 30% within 4 weeks.

7 stocks of the current constituents have crossed the 12 month hold period and will avail the zero Long term capital gains advantage as and when they will be sold. This includes stocks like MOTILALOFS (100%+) and BBTC (100%+).

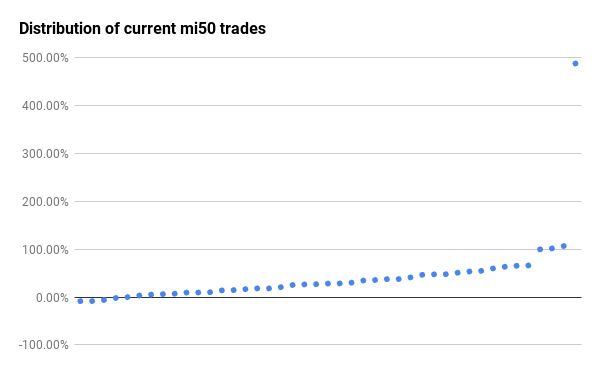

The distribution of gains of existing constituents of Mi50 is skewed by one stock namely GRAPHITE which is up nearly 500% since its entry earlier this year. Mi50 lets its winners run till they don’t. Even if for analysis sake if I were to not consider the gains in this stock, the strategy would still be up more than 25% for the same period.

Mi50 is available as a profit share strategy that I advice on for a few large clients. The portfolio allocation of each such portfolio is north of INR 50 lacs to start with. The gains here are surely muted compared to the gains in our other strategy Mi25, but the lower volatility appeals to larger accounts where 15-20% type annualized gain is the desired long term returns.

Disclaimer: I am myself heavily invested in all weekendinvesting strategies as well. All queries can be sent to alok@weekendinvesting.com.

Charges of service ?

Please inform

All listed on the website please.