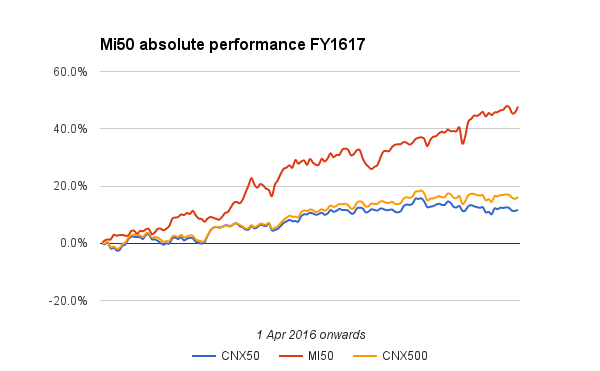

Mi50 closed up at its highest ever weekly close at +47.77% absolute gain for FY2016-17. The NSE50 and CNX500 are up 11.6% and 16.2% respectively for the same period.

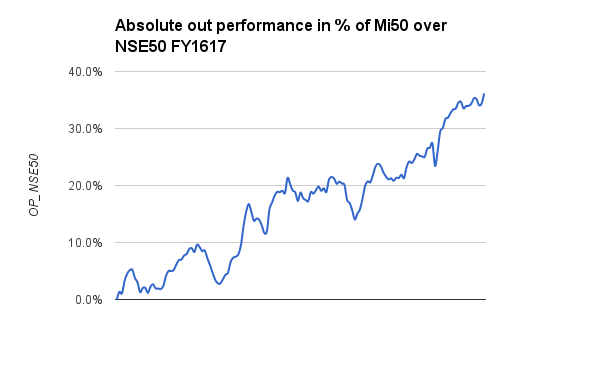

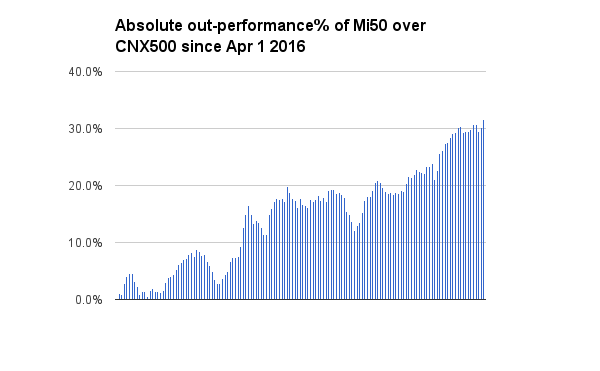

The out-performance over NSE50 reached a ATH at 36.14% while the out-performance over CNX500 reached a ATH at 31.62%.

The two exclusions done today are :

| 9/9/2016 | TORNTPHARM | 1670.70 |

| 8/12/2016 | NATCOPHARM | 631.00 |

The above trades lost 15.24% and 7.7.5% respectively.

The new entrants are :

| 10/28/2016 | PNBGILTS | 36.89 |

| 10/28/2016 | PROZONINTU | 46.49 |

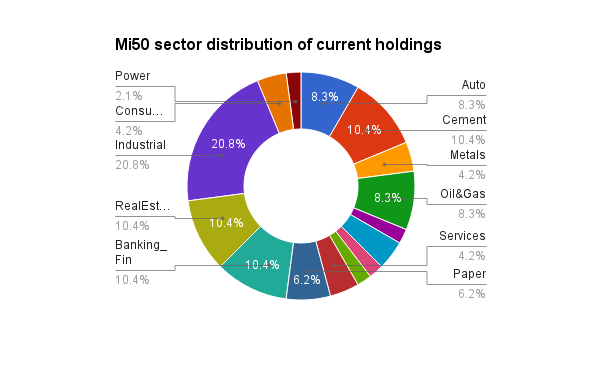

The new segment distribution looks like this : Pharma has been booted out and Real Estate/ Infra has added on.

The overall trade performance is now at :

| All trades | Wins | Avg | Losses | Avg |

| 53 | 46.27% | 24 | -4.51% |

The exits have been almost equal in number but performance is almost 5:1

| Exits | Wins | Avg | Losses | Avg |

| 14 | 31.29% | 15 | -6.14% |

The trade distribution:

The maximum daily draw down this week was (-2.5%) and it has closed at -0.6%.

The POTUS vote is less than two weeks away. Trump will surely cause a lot of Mi50 exits while Hillary may not cause much damage. I expect a sell off either way though intensity may differ.

Have a great Diwali! Let systematic investing light up your lives too next year. It certainly has mine.