Market Growth Over Time

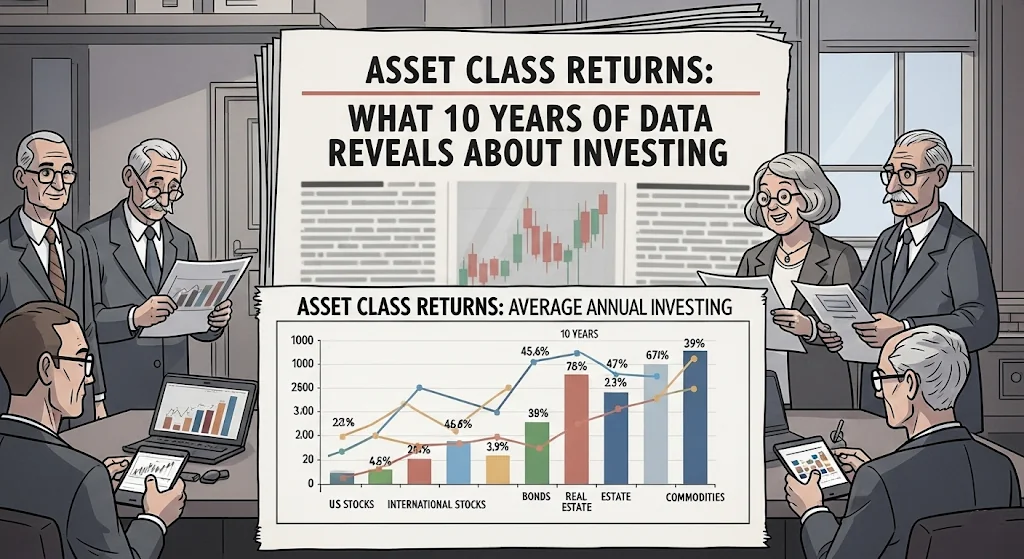

When we look at the market from January 2020, before the Covid shock, a clear picture comes out. Almost six years have passed since then. In this time, the Nifty index has gone up by about 111 percent.

Mid-cap stocks have done even better, rising around 211 percent. Small-cap stocks are also strong, up nearly 193 percent. This shows that markets can grow well when given enough time.

Annual Returns Tell a Clear Story

If we see yearly growth, the numbers are also good. Nifty has given around 13.2 percent yearly return. Mid-cap stocks have given close to 20.8 percent, while small-cap stocks have given about 19.6 percent.

Even after nearly 15 months of slow or flat movement, these returns are still very strong, especially for mid-cap and small-cap stocks.

Above the Usual Average

Normally, mid-cap and small-cap stocks give about 14 to 15 percent returns over long periods. The current long-term returns are still much higher than this usual average. This means that even if the market moves sideways for some more time, the long-term performance is still healthy and positive.

Why Short-Term Views Can Be Misleading

Many people look only at the last one year and feel that the market is not doing much. This way of thinking is risky. Equity investing is not for the short term. It works in long cycles. If you do not have a time period of five to seven years, it becomes very hard to judge equity performance in the right way.

Long-Term Thinking Matters Most

Sometimes short-term gains happen, but that is more about luck. The real base of investing is always long-term. The right way is to check how your portfolio or a sector is doing over five to seven years. Only then can you decide if your investment choice was right or wrong. Judging equities only on short-term movement is not correct.

Role of Gold and Silver in Balance

When equity markets were doing well, gold and silver stayed low. But when equity markets started falling or became flat, gold and silver moved up fast. This shows why asset allocation is important. A mix of equity, gold, and silver helps balance the portfolio. When equity falls, gold and silver often support returns, giving a smooth and stable investing experience.