Gold ETF Inflows See a Big Jump

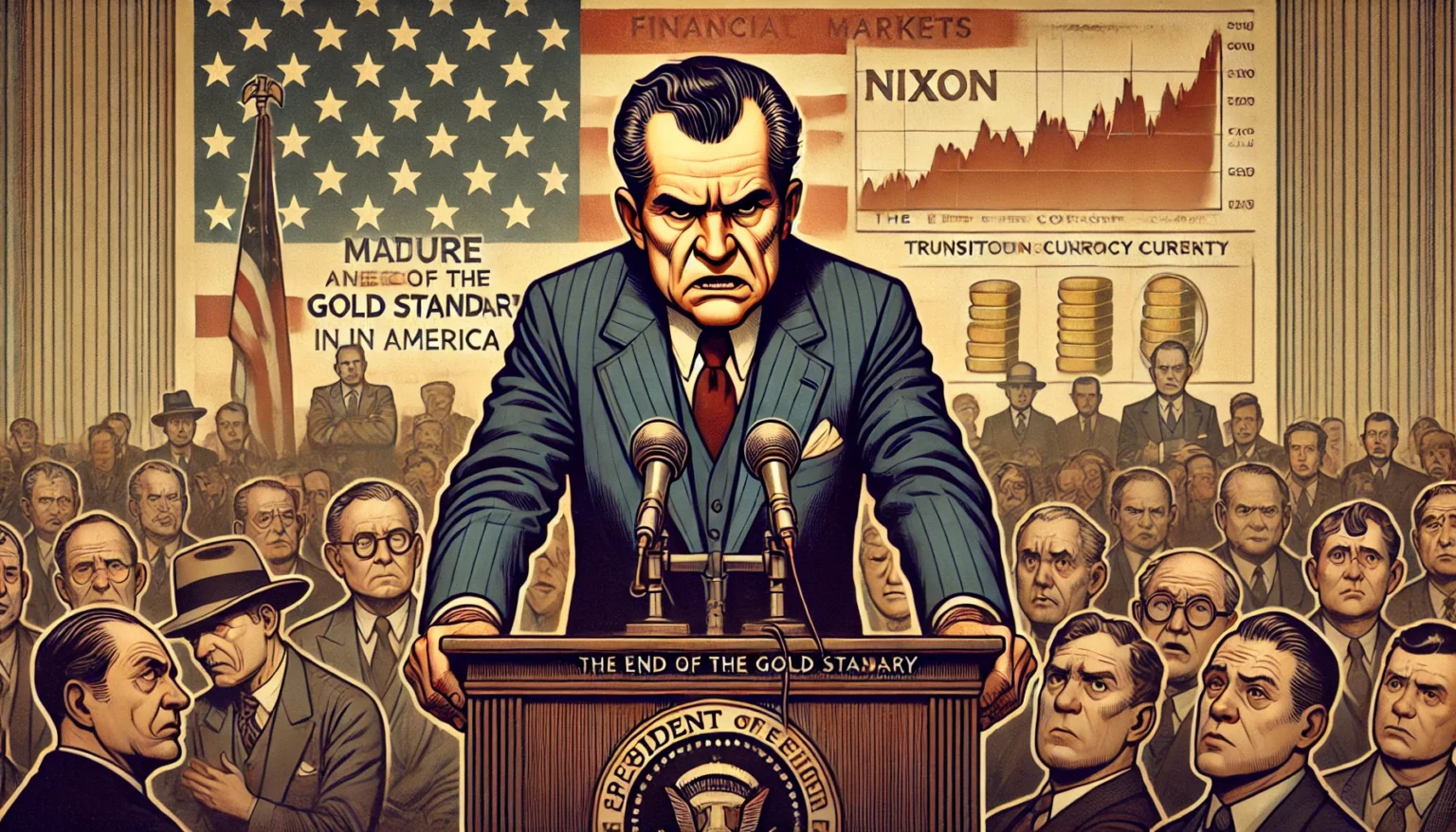

In the past year, gold ETFs in India have seen a very strong rise in inflows. Data shows that by October 2025, gold ETFs had received about 2.9 billion dollars of new money, which is equal to around 26 tons of physical gold. (see the image below)

What makes this trend interesting is that the inflow in just one year is almost equal to the total inflow of the last five years combined. This shows that gold investing through ETFs has suddenly become very popular.

Monthly Numbers Show Strong Momentum

The monthly inflows also tell the same story. In October alone, around 850 million dollars came into gold ETFs. In September, the inflow was even higher at around 942 million dollars. Because of this sharp rise, the total AUM of Indian gold ETFs has now reached nearly 11 billion dollars. Out of this, more than 30% has come in this single year itself, which shows how fast people are adding gold to their portfolios.

A Long-Term Trend Is Building

This rise does not look like something that will end soon. For many years, people did not pay much attention to gold ETFs. But now, for the first time in the last five years, investors are clearly shifting their focus toward gold as an investment. Trends like this usually run for many years before they reach their peak. Even after that, gold prices do not always stop growing. This points to a strong and steady long-term trend.

Demand Rising Across All Gold Forms

It is not just gold ETFs that are seeing more interest. India’s physical gold imports are rising. The demand for gold mutual funds and digital gold is also increasing. People are slowly understanding the importance of asset allocation. Equity, real estate, and debt markets cannot perform well every single year, so spreading money across different asset classes is becoming important for many investors.

Pure Investment Demand Is Driving This Trend

One special thing about ETF inflows is that they represent pure investment demand. Physical gold buying can happen for many reasons like jewellery or gifting. But ETF buying happens only for investment. This makes the trend stronger and more meaningful. The continuous upward flow into ETFs shows that a new investment pattern is forming among Indian investors.

Gold’s Role Is Becoming More Clear

As more people learn about smart money management, gold is again finding its place in portfolios. With rising inflows, higher imports, and growing digital gold usage, the overall demand cycle looks solid. This upward trend in gold ETF investments highlights how investors are preparing for stability and balance in the coming years.