The markets continued the correction that started last week and the global headwinds caused quite a dramatic drop on the last day of the week. The day long exchange snag on Wednesday caused quite a disruption and led to fierce short covering post the market open that day . The Q3 GDP numbers that were released post market are below expectations and we may have some more correction going into the next week as well.

The Weekendinvesting Smallcases were a huge success this week.

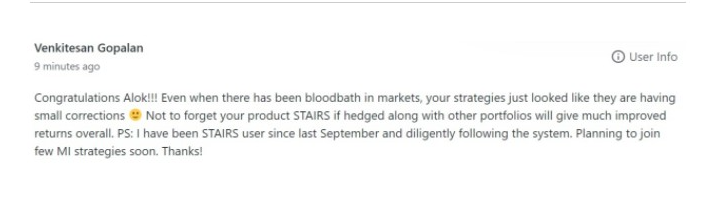

These are all long term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeating this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years it has been shown that much superior CAGR returns are possible than the benchmarks.

The ATH portfolio did not fall this week also and is now up 145%!! this FY and Allcap becomes the second strategy to cross the 3 digit mark at 112%!! Mi25 the smallcap wonder is also up 91%! All this gain despite the markets moving down this week !

All this is available at anybody’s fingertip with just 2 clicks a week at a nominal fees!

For Monday 1st Mar 2021, the proposed changes are:

Mi_LT_CNX200 : 0 ADD, 0 EXIT

Mi_MT_Allcap : 0 ADD, 0EXIT

Mi_ST_ATH : 0 ADD, 0 EXIT

Mi 25 : 2 ADD, 2 EXIT

NNF10 : 1 ADD and 1 EXIT

The selection of the smallcase can be based on

a. Sub Segment of the market : Mi25 for smallcap, Mi_All_cap for all round diversification OR LTCNX 200 for large caps only

b. Activity specific smallcase like Mi ST ATH which chases all time high stocks

c. Or more passive strategies like NNF10 and NG5050 which are monthly rebalanced ones best to replace index investing with or for asset allocation.

2 new smallcases on existing products like Mi30 and Mi50 have been added which suit portfolio size of 10L and more. Detailed blogs on both will be released next week. By end of the quarter we will add the new product Mi SWING

In the LIVE product strategies, there were good gains despite the market falls in most strategies

The LIVE products area more suitable for large portfolios who are not chasing high returns and want more mature and diversified lower risk portfolios. Also the user here churns his portfolio at Fri 3 PM along with the model and there is no slip between the model the actual experience.

For LIVE Products proposed changes for week ended 26.02.21

Mi25 : : 2 ADD, 2 EXIT

Mi30 : : 2 ADD, 2 EXIT

Mi40 : : 0 ADD, 0 EXIT

Mi50: : 1 ADD, 1 EXIT

Yours truly was also featured on a podcast by the famous Ankit Chawla

That is all from my end.

Have a safe week…!!