The previous week was a super super uni-directional upward trending week and this one was the complete opposite. The week was marred with a non directional choppy markets which reacted to each small move in the overseas markets with no direction.

The markets opened higher this week but immediately slid the next few sessions to rise dramatically middle of the week only to collapse on Thu and some bounce on the last day. Unless you were playing on very short time frames it was difficult to do make profits in a trend following fashion as there were no real trends.

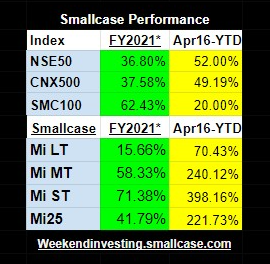

The Weekendinvesting Smallcases were also mildly hit as some of the larger holdings like AARTIDRUGS were excessively down for the week. Overall some gains have been given up.

For Monday 19 OCT 2020, the proposed changes are:

Mi_LT_CNX200 : NO CHANGE

Mi_MT_Allcap : 1 ADD, 1 EXIT

Mi_ST_ATH : 2 ADD, 2 EXIT

Mi 25 :2 ADD, 4 EXIT

Liquid bees is not being included as an add or exit.

In the LIVE product strategies, there is some cash raise now and all strategies are essentially holding ground so far. The LIVE products area more suitable for large portfolios who are not chasing high returns and want more mature and diversified lower risk portfolios. Also the user here churns his portfolio at Fri 3 PM along with the model and there is no slip between the model the actual experience.

A very nice piece on Gold from Sprott Gold Report this week. Every portfolio must a good component of Gold as a Hedge is my belief. I recommend a half you age as percent of networth in it.

The rally from March end to now is a good 6 months and 2 weeks strong. There will come a turning point sooner or later for a short or a long duration. All our strategies are ready for it with capital protection built into our models. We may get hit anytime but we will live to fight another day.

That is all this week. STAY SAFE and stay in peace !

To get this weekly report directly to your e-mail Click this