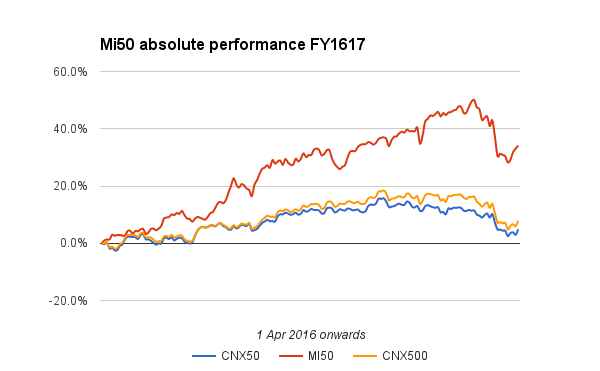

Mi50 closed at +34.13% for the FY a gain of almost 4 pct on the week. The nifty closed at +4.9% for the FY up 0.6% for the week.

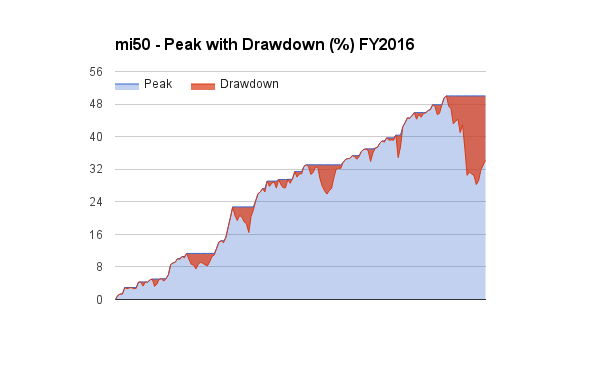

The drawdown reached a low of 21.77% on monday but has clawed back to about 16% by EoW today.

Strategy now is operating on 24 stocks with more than 45% in Liquid Bees. I would expect under-performance w.r.t. indices for some time due to being lightly loaded if we go up from here.

There was one exit today. (Exit Price, Profit /Loss on trade)

| GULFOILLUB | 662 | 20.29% |

Last weeks pick UJAAS seems to be doing well. PNBGILTS has been the star performer of the week with it going up about 30% this week itself. The beauty of strong stock momentum despite overall weak markets is on display. (ps : The links will give you the relevant charts)

Things looks good and stable despite the mini storm. Lets enjoy the weekend. Lets get ready to discuss ITALEXIT

Till RBI policy on 7th Dec possibility of upside in Nifty as lot of investors expect 50bps cut. But, strangely no one talking about 14th Dec FOMC meet wherein FED may hike rate by 50 bps (93.5% probability). I think we may see continuation of recent market decline post FOMC decision. 45% cash looks good call by your system.