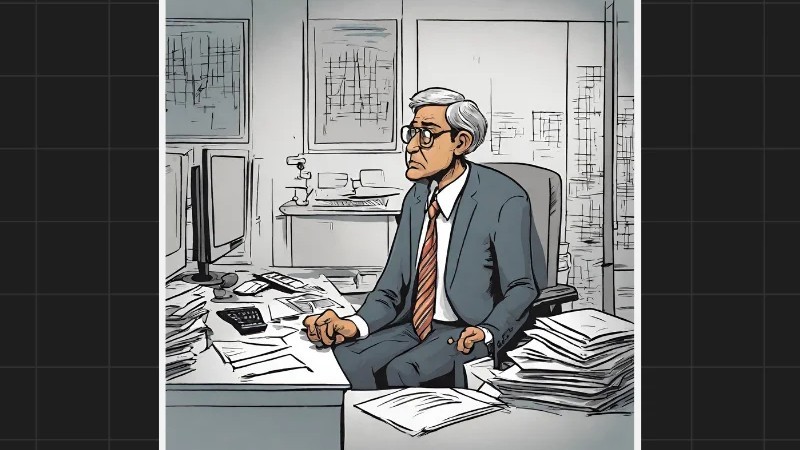

The Early Success Story

Intel has long been recognized as a pioneer in the production of CPUs for personal computers and laptops. From the early 1970s until around the year 2000, its stock experienced steady growth (see image below), establishing Intel as one of the most trusted names in the industry. This consistent upward trend over nearly three decades reflected Intel’s leadership and dominance in the global chip market.

Two Decades of Decline

However, the narrative took a sharp turn after 2000. Despite its early success, Intel’s stock price has never regained the heights it reached at the turn of the century. Even with attempts at recovery during the post-COVID period and in 2023, the stock remains nearly 50% below its peak in 2000. This significant decline following a long period of success illustrates how unpredictable markets can be, even for companies with a strong historical record.

The Power of Disruption

The drop in Intel’s stock over the past 25 years signifies how disruptions can alter the competitive landscape. New players such as AMD and chipmakers employing superior technology have started to capture market share. The emergence of innovative companies with better designs and novel approaches has led to Intel losing its competitive edge. This situation serves as a reminder that no matter how strong a company may seem, disruptions can always challenge its position.

The Trap of Past Performance

It is common to assume that a stock that has performed well for 10 or 20 years will continue to do so. However, Intel’s experience demonstrates that this is not always the case. Many Indian stocks today resemble Intel’s chart from 2000, having shown strong growth for years. But that doesn’t guarantee they will keep rising indefinitely. Numerous well-known companies from the past are no longer in discussions or even included in major indices.

Why Investors Must Stay Alert

Markets do not consistently reward the same companies. New and more efficient players often emerge to take the lead. Very few stocks achieve consistent growth over 30, 40, or 50 years. Therefore, investors must remain vigilant. The key is to stay flexible and ready to adapt when necessary. Relying solely on past performance can be risky. A sound investment strategy must evolve in response to changing market trends.

What are your thoughts? Share your views in the comments below and If you found this blog useful, don’t forget to SHARE it with your friends.