The Rise of Options Trading in India

In the last few years, the number of retail traders entering the options market in India has grown at a very fast pace. Back in 2021, the 30-day average contracts traded were around 50 million. Within a short period, this number jumped all the way to nearly 375 million contracts. (see the image below)

That is almost an eight-fold rise in trading volumes, showing how quickly retail participation had expanded.

The Sudden Fall in Trading Volumes

While the rise was very sharp, the fall has also been equally striking. In the past 7 to 12 months, the number of contracts traded has dropped back to around 80 million. This kind of swing shows that sudden manias or frenzies in the market are not permanent. They often return back to normal levels once the excitement fades away.

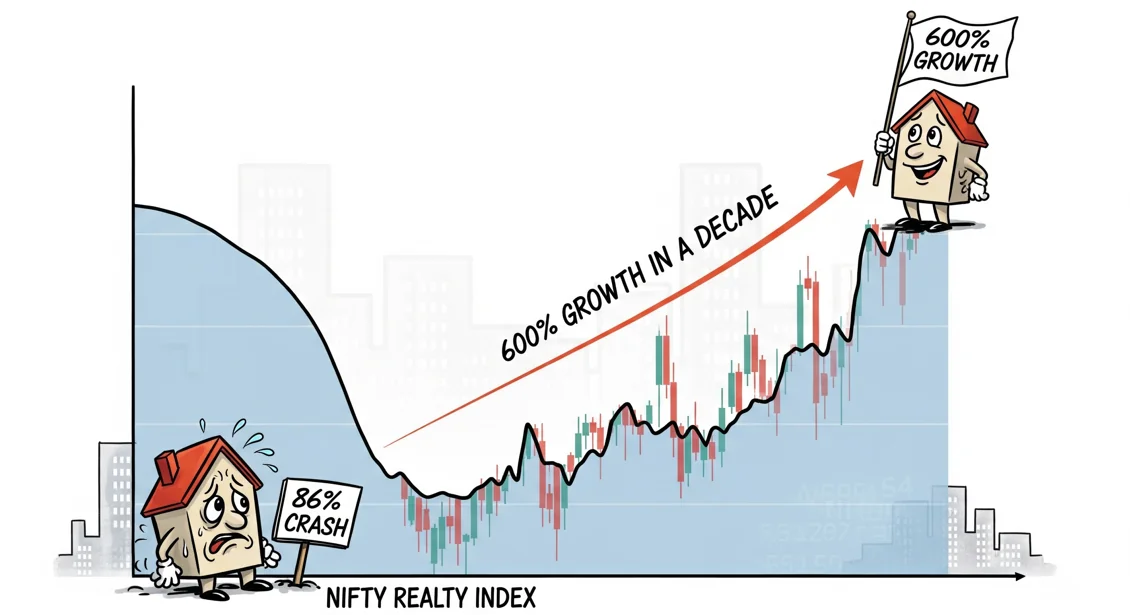

Understanding Market Frenzy

It is important to note that just because a stock or contract goes up, it does not always mean it has to fall. But when there is irrational excitement or too much hype, history has shown that markets always come back to their mean. This has happened many times in the past and continues to repeat itself over time.

Lessons from the Past

During strong bull runs, many people believe trading is the best way to make money and even think about leaving their jobs. In earlier phases of market rallies, many professionals left their stable careers to trade full-time. However, after a few years and during market corrections, several of them ended up returning to their original industries. This highlights how dangerous it can be to make emotional career decisions based only on short-term profits.

A Word of Caution for Young Traders

Trading can be exciting and rewarding if done with skill and discipline. But it is not safe to give up a good career unless one is highly proficient in handling all types of market conditions. The market can be very unpredictable, and relying on it without enough preparation can cause big setbacks. It is better to treat trading as a skill to develop while holding on to a strong main career path.