The Rise of US Markets Over the Decades

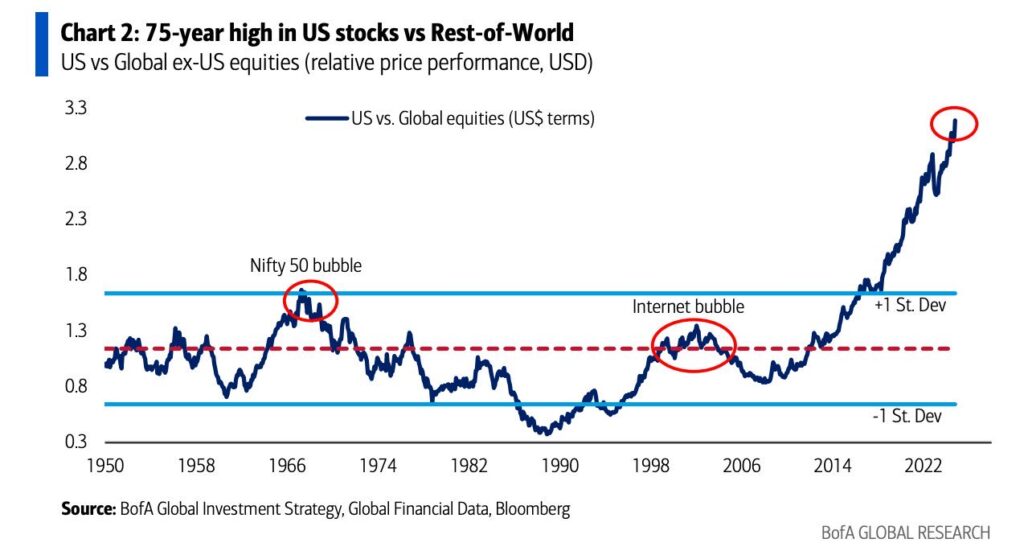

For decades, the US stock market has shown dominance over global markets. The chart we are looking at tracks the performance of US equities versus other markets worldwide. Interestingly, it highlights the long-term trend of the US market outpacing its global peers, especially since the 1990s. The data shows how strong the US market has become, particularly when viewed in dollar terms, making it one of the most resilient markets in the world.

The Nifty 50 in the US

Many people might not know that the term “Nifty 50” was originally used in the United States back in the 1960s. It referred to a group of 50 large-cap stocks that were popular among investors at that time. Although this index no longer exists in the US, it was once a significant part of their market. Over time, the US market has continued to grow, and its performance has been consistently strong compared to non-US markets. This long-term strength makes it a focal point for investors around the world.

US Market Dominance

The US market is often referred to as the “mother market” of the world. This is because the US economy has an enormous demand potential and acts as a buyer for goods and services globally. As a result, it plays a vital role in driving the global economy forward. While other markets may perform well in their local currencies, when you look at them in dollar terms, the US still stands out as the leader. This chart underscores the US’s dominance over the years and its continued importance in the world of investments.

Why Consider US Stocks?

Given the strength of the US market, it makes sense for investors to consider having some exposure to US stocks. There are many ways to invest in the US market, including opening a brokerage account or investing through mutual funds and ETFs that offer exposure to US equities. Having a portion of your portfolio in US stocks can be a smart way to diversify, as it allows you to benefit from growth in a market that has consistently outperformed many others.

Diversification Beyond INR-Based Equities

Diversification is a key part of any investment strategy, and it’s important to not only diversify within your local market but also look beyond it. Investing in non-INR based equities, such as US stocks, can provide an added layer of security and growth. While there are other global markets like Hong Kong and Germany, the US market is the most popular and accessible for many investors. Additionally, the US market offers a wide range of new and innovative companies that drive growth and opportunity.

Leading the World Forward

Over the past several decades, the US stock market has led the global markets forward, proving itself to be a major driver of economic growth. Every time markets rally, the US market is often at the forefront.

WeekendInvesting launches – PortfolioMomentum Report

Momentum Score: See what percentage of your portfolio is in high vs. low momentum stocks, giving you a snapshot of its performance and health.

Weightage Skew: Discover if certain stocks are dominating your portfolio, affecting its performance and risk balance.

Why it matters

Weak momentum stocks can limit your gains, while high momentum stocks improve capital allocation, enhancing your chances of superior performance.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com