A Decade of Strong Growth

Relaxo Footwear is a well-known stock in the Indian market. From 2011 to around 2021-22, this stock increased nearly 80 times in value. For almost a full decade, it consistently rose, with only a brief pause between 2015 and 2017. Many investors who entered the stock early reaped substantial profits during this period.

The Trap of Past Performance

However, such strong performance can create a trap for new investors. When people see a stock that has always gone up, they may start to believe it will never decline. This overconfidence leads them to consider it a safe investment at all times. This mindset can be perilous; people often forget that just as a stock can rise, it can also fall — sometimes very sharply.

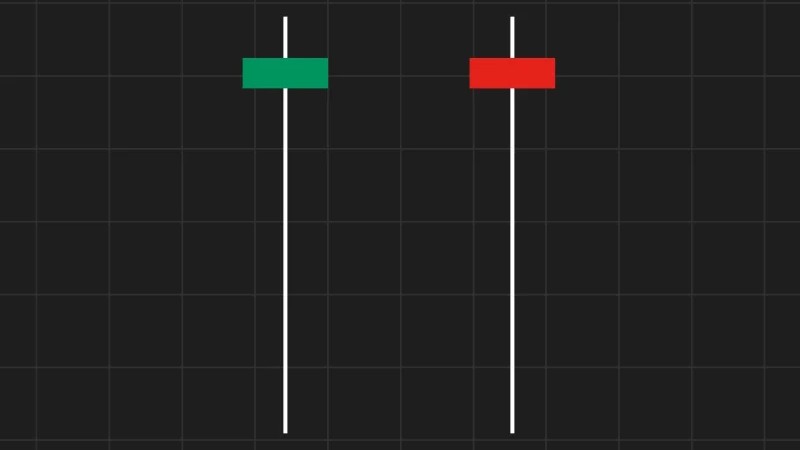

A Sudden Fall

This is exactly what happened with Relaxo. After experiencing an impressive 80-fold increase, the stock subsequently dropped around 70% within three years.

Those who hurriedly bought the stock, especially when its price ranged from ₹400 to ₹1,400, are now facing significant losses. This situation serves as an important reminder that entering at the wrong time can be detrimental, even with strong companies.

The Importance of an Exit Plan

Having a clear rationale for both entering and exiting a stock is crucial. If you buy based on market trends, you should also be prepared to exit based on those trends. You cannot claim, “I purchased this for the trend,” but later change your reasoning to, “This company has great growth potential,” just because the stock has dropped. This inconsistency, known as double standards, can trap you for a long time.

Stay Focused and Honest

It’s essential to be honest with yourself about the reasons for your investment. If the trend shifts or your original rationale is no longer valid, be willing to exit — even if it results in a small loss. This will free up your capital to pursue better opportunities. Remaining stuck in a declining stock solely due to its past performance can be costly in the long run.

A Simple Rule for All Investors

Always remember to know your entry point and your exit strategy before investing. This straightforward rule can help you avoid being trapped in any stock for too long. Focus on protecting your capital, rather than merely chasing returns.

Have you ever held onto a stock just because it had performed well in the past? Share your experience in the comments below! If you found this blog helpful, don’t forget to SHARE it with your friends!

WeekendInvesting launches – The Momentum Podcast

This episode of THE MOMENTUM PODCAST features Manubhav, a third-generation real estate professional, sharing his unique journey navigating both worlds.

Discover:

✅ FROM PROPERTY TO PORTFOLIO: Manubhav’s transition from his family’s established real estate business to exploring equity investments.

✅ MARKET WISDOM: His candid experiences with market swings, including COVID-19’s impact on his SIPs, and lessons learned from F&O and smallcase.

✅ THE BIG COMPARISON: A fascinating look at real estate vs. equity returns, featuring real-world numbers from his family’s 40-year property investment.

✅ UNCOMMON INSIGHTS: Why gold is a family favorite and the surprising state of equity investing in smaller Indian towns.