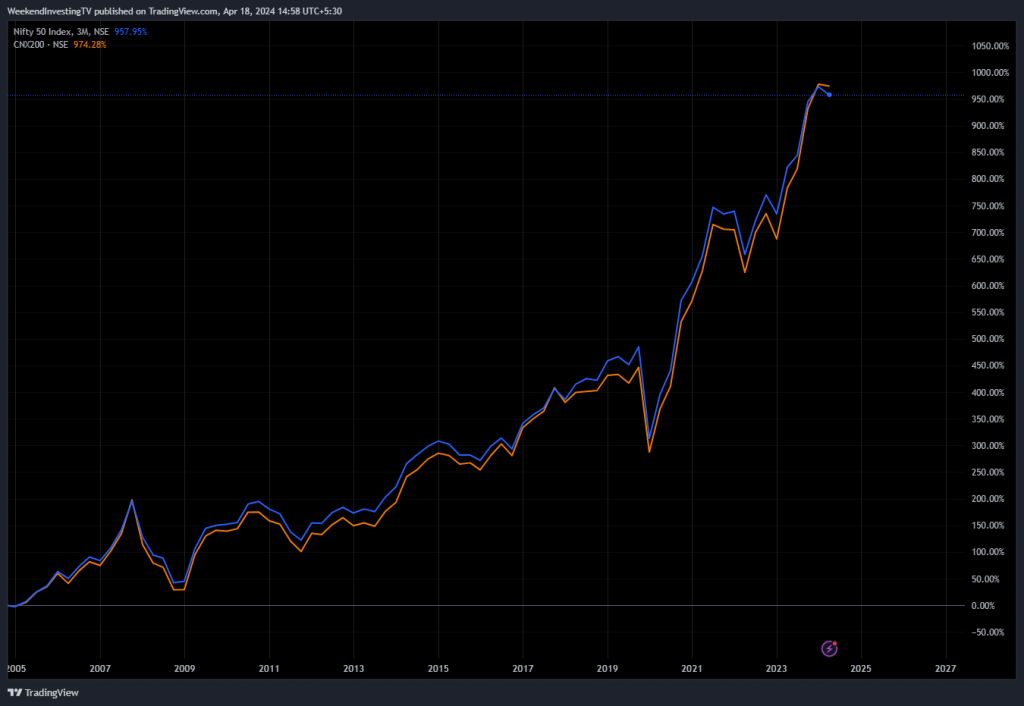

In this insightful analysis, we delve into the comparative performance of CNX 200 and Nifty over the past two decades. Surprisingly, despite slight deviations in certain years, both indices have delivered nearly identical results. This raises an intriguing question: why do these two indices, comprising mostly Nifty stocks, yield such similar returns?

Adding another layer to the analysis, let’s consider Nifty Junior, the 51st to 200th stocks in the index. Remarkably, Nifty Junior has outperformed both Nifty and CNX 200 by a significant margin, boasting over 1700% growth compared to around 1000-1100% for the other two indices. This substantial performance gap sheds light on the dynamics within the Nifty universe.

It’s clear that while Nifty and Nifty Next 50 exhibit strong performance, the remaining stocks in CNX 200, particularly those ranked from 101st to 200th, underperform in comparison. This defies the common expectation that mid-cap stocks should outshine large-cap counterparts. This revelation prompts a reevaluation of investment strategies, emphasizing the importance of focusing on the top-performing segments.

The success of portfolios like the NNF Ten Portfolio serves as a testament to the efficacy of investing in Nifty 50 and Nifty Next 50 stocks. These indices have demonstrated remarkable resilience and growth potential, making them attractive options for investors seeking consistent returns.

While CNX 200 also presents a viable investment universe, it’s essential to acknowledge the disparity in performance within this index.

WeekendInvesting Strategy Spotlight – It isn’t always about the multibaggers !

There has always been a frenzy in the stock market around multibaggers.

You will often come across stories that go like this – “Oh I bought this stock when it was trading around Rs 25 and today it is trading at Rs 250”. “I made a handsome 10x on this stock”

But, people seldom discuss negative outcomes or stories of their failure. Aspects like risk mitigation, position sizing & opportunity cost often take a back seat paving way for cooler discussions around multibagger stocks.

Consider the case of “VEDL”. After making a high of Rs 484, the stock has virtually remained flat for 14 long years. One may wonder whether it is even possible to successfully navigate through the troubled waters of a choppy stock like this one but that is where the beauty of momentum lies.

VEDL entered Mi NNF 10 back in Apr 2021 at a time when most might wonder “Why now”. The stock may not have gone on to become a multibagger for the portfolio but just the fact that a rule based approach could successfully maneuver through a stock like this without having to face a loss & instead to come out with a reasonable gain of 50% speaks volumes about the ability of momentum investing to keep you calm and composed at all times without having to worry about the outcomes too much.

So multibagger is not the only thing that sounds cool,

Identifying and extracting momentum in a stock that has remained stagnant for 14 years is also a story worthy of a discussion.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com