The Uncertainty of Financial Markets: Lessons from the Past 5 Years

As an investor, it is crucial to understand the unpredictability of financial markets and the importance of diversification in asset allocation.

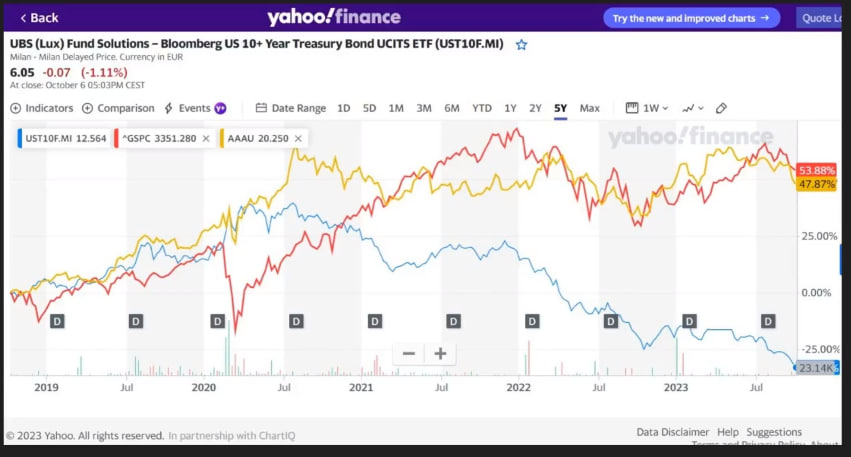

To illustrate this point, let’s analyse a comparative chart featuring three Exchange-Traded Funds (ETFs): the US tenure bond ETF (blue line), the S&P 500 ETF (red line), and the gold ETF (golden line). The chart covers a period of five years and provides valuable insights into the performance of these assets.

Analyzing the performance of S&P 500 ETF < EQUITIES >

The S&P 500 ETF, which represents the performance of the top 500 US companies, showed a commendable gain of 47.53% over the five-year period. This result aligns with the initial assumptions of most investors, as the S&P 500 has historically performed well. However, it is crucial to recognize that past performance does not guarantee future success. The performance of equities in different countries can vary significantly, and adhering to the notion that certain assets will always perform favourably can lead to detrimental outcomes.

Analyzing the performance of GOLD 500 ETF < GOLD >

The gold ETF, on the other hand, exhibited a growth of 48% within the five-year timeframe, surpassing initial expectations. Gold has long been considered a safe investment, particularly in India, where it typically experiences an annual Compound Annual Growth Rate (CAGR) of 11-12% in Indian Rupee terms and 7-8% in Dollar terms. Thus, achieving a 47% increase in just five years is a noteworthy accomplishment for gold as an asset class.

Analyzing the performance of BOND 500 ETF < DEBT >

However, the most striking observation is the performance of the bond ETF. Despite being a significant market globally, the bond market demonstrated a decline of -28% during the same period. This fact challenges the common perception of bonds as a safe haven asset. Many wealth managers, catering to high net worth individuals, family offices, and institutions, would have recommended bonds as a safe investment during the COVID crisis. This misguided advice may have possibly resulted in significant losses for investors who allocated a substantial portion of their assets to bonds, potentially experiencing a decline of more than 50%.

This example serves as a wake-up call, emphasising the importance of embracing the uncertainty of financial markets. While bonds have historically performed well over the past 40 years, it does not guarantee that they will continue to do so in the future. Markets are subject to continuous change, and one must remain vigilant and adapt their investment strategy to align with evolving circumstances. Blindly adhering to traditional investment strategies, such as the popular 60-40 portfolio (40% allocated to bonds), can ultimately lead to substantial losses.

For those who might be concerned about their bond investments, it is essential to understand that if you hold onto your bonds until maturity, you will likely recover your initial capital. However, the erosion of purchasing power due to inflation can erode the value of your capital by more than 50-60%. Therefore, it is crucial to carefully consider the potential effects of inflation when investing in fixed-income securities.

Key Takeaways

The key takeaway from this analysis is the significance of maintaining a well-diversified asset allocation. By not overly favouring any single asset class, you can mitigate the risks associated with market uncertainty.

Diversification allows investors to spread their investments across various asset classes, sectors, and even geographical regions, reducing their exposure to any specific risk. This strategy helps cushion against potential losses in one area by capitalising on gains in another.

Additionally, it is crucial to be mindful of what you are buying, when you are buying, and how you plan to exit positions.