Understanding exponential growth and the magic of compounding may seem like familiar concepts, but their true impact often eludes our grasp due to our innate linear thinking. Despite our theoretical knowledge, appreciating the profound effects of compounding requires a deeper exploration.

Consider a simple scenario: a stadium with a single drop of leakage from a tap every minute. Now, imagine that the number of drops doubles every subsequent minute. Initially, progress seems slow, but astonishingly, it only takes 50 minutes to fill the entire stadium. Even after 45 minutes, the stadium is merely 7% full, highlighting the remarkable acceleration of growth in the final minutes.

The Warren Buffet Effect

Renowned investor Warren Buffet exemplifies the power of compounding. Starting his investment journey at a young age, the majority of his wealth was amassed after the age of 52, showcasing the exponential nature of wealth accumulation over time.

Folded Paper Analogy

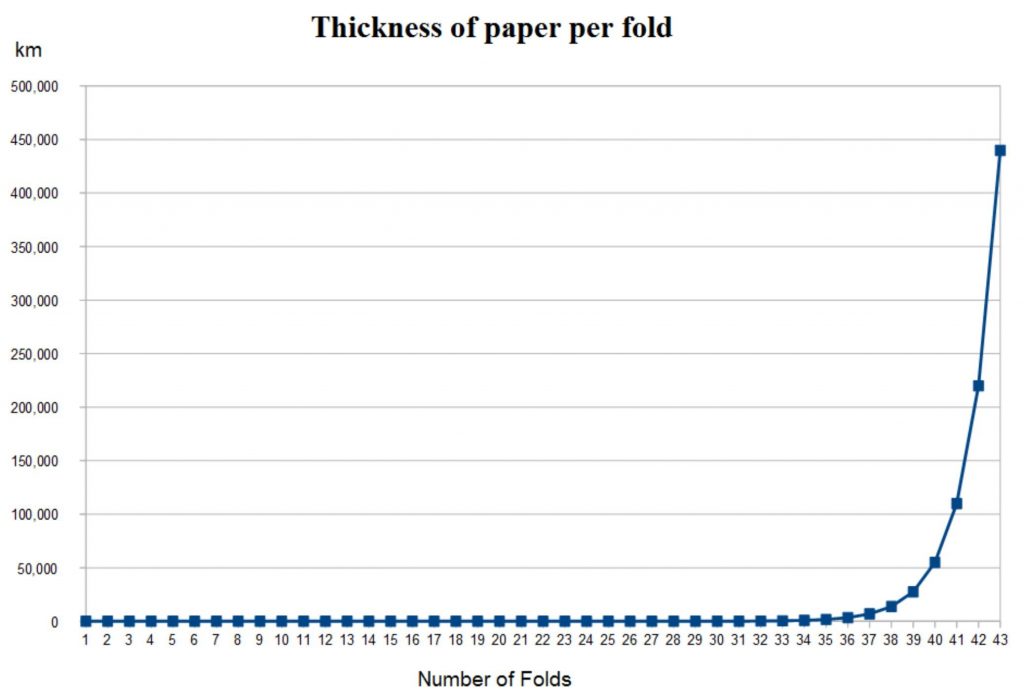

Another compelling example is folding a piece of paper. With each fold, the thickness doubles, seemingly insignificant at first. However, after just 42 folds, the thickness reaches the distance between the Earth and the moon. This exponential increase illustrates the dramatic impact of compounding, especially in the later stages.

Patience and Persistence

Whether aiming for returns of 12%, 15%, or 18%, the key lies in patience and persistence. By allowing sufficient time and committing meaningful capital, even modest returns can snowball into extraordinary wealth over time. Embracing the power of compounding is essential for long-term financial success.

Applying Exponential Growth in Life

Beyond finances, exponential growth permeates various aspects of life. From biological mechanisms within our bodies to technological advancements, exponential trends shape our world in profound ways. Recognizing and harnessing these patterns can lead to transformative outcomes.

WeekendInvesting Strategy Spotlight – Mi EverGreen

Russia faced a currency crisis in August 1998 when the government defaulted on its debt and devalued the Russian ruble (RUB). The crisis stemmed from a combination of economic mismanagement, declining oil prices, and the Asian financial contagion.

Having exposure to GOLD is no more a choice in this rapidly evolving world, it is an absolute must. Mi EverGreen is a delightful mix of 20 strongest stocks from CNX 200 universe combined with 25% fixed allocation to GOLD to protect you from unpredictable events.

Use code GOLDRUSH to avail a flat 20% discount on your subscription to Mi EverGreen.

Offer ends today !

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com