The 60/40 Portfolio and Changing Market Trends

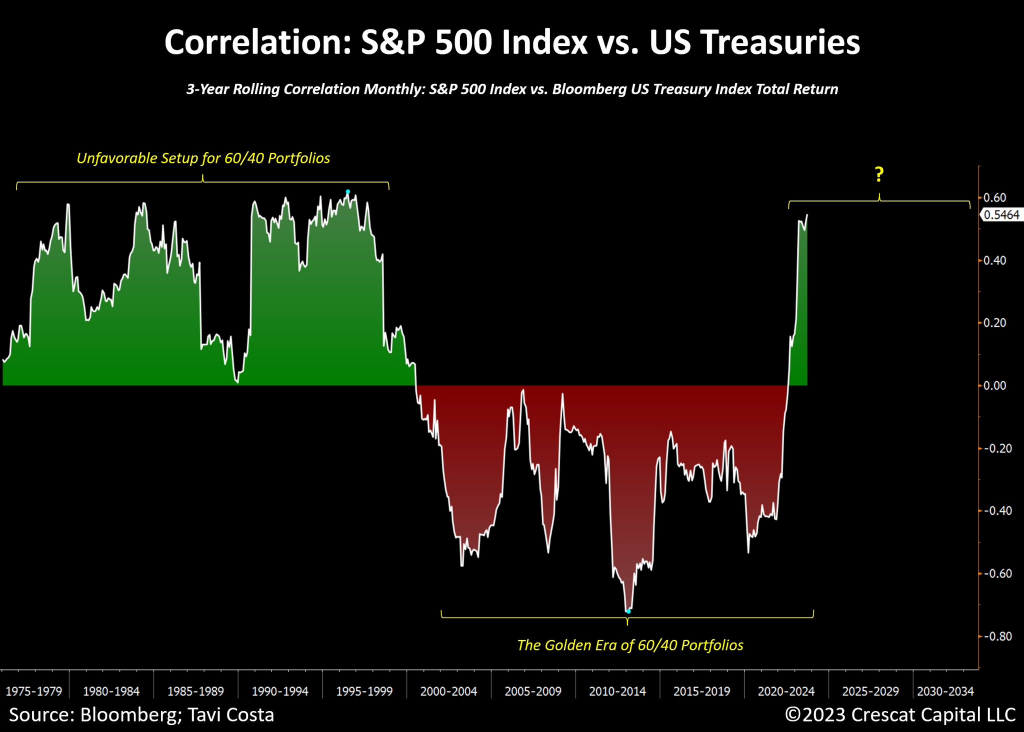

A recent chart from Tavi Costa on Twitter highlights a significant change in the financial markets. This chart looks at the correlation between S&P 500 returns and US Treasury returns. For many years, the 60/40 portfolio, which consists of 60% stocks (S&P 500) and 40% US Treasuries, has been a popular investment strategy. However, current trends suggest this strategy may no longer be as effective as it once was.

Historical Patterns of the 60/40 Portfolio

From the 1970s until about 1999, the 60/40 portfolio faced challenges because there was no inverse relationship between stocks and bonds. This meant that both asset classes often moved in the same direction, providing less diversification. However, from 2000 onwards, the 60/40 portfolio enjoyed a golden era. During this time, stocks and bonds often moved inversely, meaning when stocks fell, bonds typically rose, and vice versa. This inverse relationship was largely due to falling interest rates, which boosted bond prices.

Rising Interest Rates and Market Impact

Recently, there has been a significant shift. Interest rates have been rising, causing bond prices to fall. This change creates a potential problem for the 60/40 portfolio because both stocks and bonds could fall simultaneously. This scenario challenges the traditional belief that bonds can serve as a hedge against stock market declines. If stocks and bonds both drop, investors could face losses in both parts of their portfolio.

Central Banks and Gold

Another important trend is the behavior of global central banks and institutions. Many of them are reducing their holdings in US Treasuries and are instead investing in gold or other reserves. This shift suggests a growing lack of confidence in the stability and returns of traditional bond investments. As a result, the traditional allocation of 40% to treasuries or bonds is now being questioned.

Considering Alternatives: Sovereign Gold Bonds

Given this new landscape, investors might consider alternatives to the traditional 60/40 portfolio. One such alternative is the Sovereign Gold Bond (SGB) in India. SGBs offer bond-like characteristics while also providing a hedge against equity market downturns. Historically, when Indian equities do not perform well, gold prices tend to rise, offering a counterbalance.

Evaluating New Investment Strategies

Switching from traditional bonds to instruments like Sovereign Gold Bonds could provide the diversification and stability that the 60/40 portfolio once offered. This strategy leverages the inverse relationship between gold and equities, similar to the previous relationship between bonds and stocks. By investing in SGBs, investors can achieve bond-like returns while also benefiting from gold’s performance during equity market downturns.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com