Indian Household Investments on the Rise

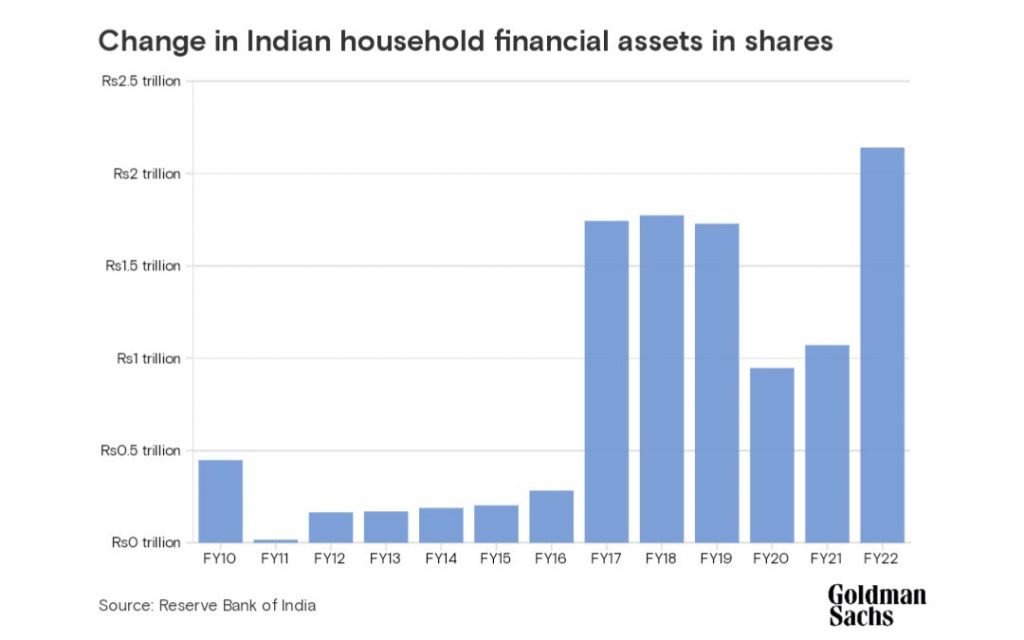

The data released by RBI and analyzed in the Goldman Sachs report reveals a significant trend in Indian household financial assets, particularly in shares. Over the past few years, there has been a remarkable increase in the flow of liquidity into the stock market from household financial assets, indicating a structural shift in investment behavior.

Steady Growth in Market Liquidity

In 2011, there was minimal inflow of new money into the market from household financial assets. However, since FY 17, there has been a notable uptick, with billions of rupees flowing into the market each year. Despite a slight drop during the COVID-19 year of FY 20, the trend has continued upward, with FY 21 seeing over 20,000 crores entering the market.

Financialization of Savings

This surge in investment can be attributed to a growing awareness among Indians, particularly younger individuals entering the workforce, about the benefits of investing in equities, mutual funds, and SIPs. With traditional savings avenues like bank deposits failing to beat inflation, more people are turning to the stock market in pursuit of higher returns.

Impact on Market Dynamics

While only a small percentage of household savings currently find their way into the stock market, even a slight increase represents a significant boost in liquidity. This influx of funds has the potential to sustain market growth and resilience, mitigating the impact of any short-term fluctuations.

Liquidity: the Driving Force

In the world of finance, liquidity is paramount, and the stock market is no exception. The influx or withdrawal of domestic liquidity has a direct correlation with market movements. As long as liquidity continues to flow into the market, there is optimism for sustained growth and stability.

Opportunities Ahead

With a large segment of non-equity investors expressing interest in entering the stock market, there is a vast untapped potential for further growth. Every market dip presents an opportunity to attract new investors, expanding the investor base and fueling market growth.

If you have any questions, please write to support@weekendinvesting.com