The Importance of Diversification in Your Investment Portfolio

When it comes to investing, one of the most common questions is how to ensure that your money lasts over time, especially if you’re making regular withdrawals. A recent case study provides a great example of how different strategies can impact the longevity of an investment portfolio. This article will walk through the key insights from the study and highlight the importance of diversification and asset allocation.

A Balanced Portfolio That Lasts

Imagine starting with a Million dollars 25 years ago and withdrawing $50,000 per year from that amount. What would your portfolio look like today, after adjusting for inflation? In the first scenario, the portfolio consists of an even split: 25% equities, 25% gold, 25% bonds, and 25% cash. Each year, the portfolio is rebalanced to maintain these proportions.

After 25 years of withdrawals, the portfolio remains around the original value of $1 Million. While the value of money has decreased over time due to inflation, this balanced approach has ensured that the portfolio didn’t significantly shrink. This case shows the importance of spreading risk across various asset classes to maintain financial stability over time.

The Risk of Putting All Eggs in One Basket

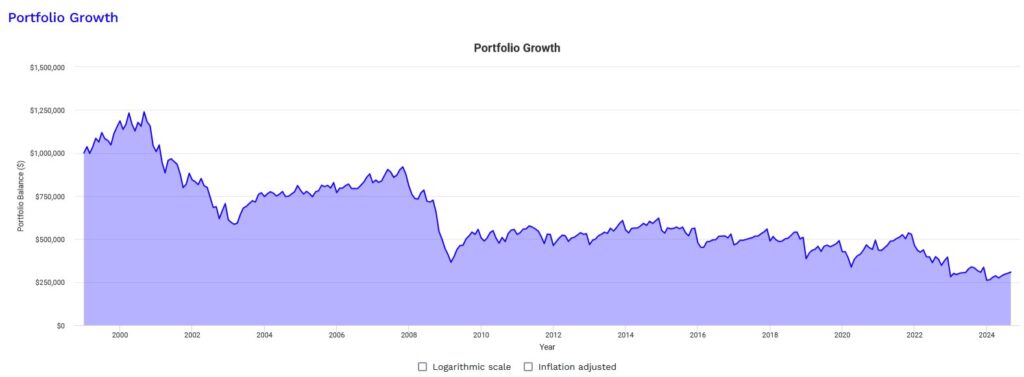

Now, let’s look at another scenario. What if that same million dollars was invested only in equities, such as the S&P 500, while still withdrawing $50,000 per year? Surprisingly, this portfolio would have shrunk dramatically, leaving you with just around $300,000 after 25 years.

Despite the overall growth of the stock market, inflation and the high level of withdrawals severely reduced the portfolio’s value. This shows that investing only in stocks can expose your portfolio to greater risks, especially when regular withdrawals are being made.

The Impact of Inflation

One of the main factors that eats away at your investment returns is inflation. In this case study, even though stock markets were growing, the real returns (adjusted for inflation) were much lower. In countries like India, where inflation might hover around 6%, you may only be earning a small real return, even if your portfolio shows higher nominal gains.

This means that if you are withdrawing more money than the real return your portfolio is generating, your overall wealth will decrease over time. Inflation is a silent but powerful force that can erode your purchasing power, and this must be considered when planning for the future.

The Power of Rebalancing

The key difference between the two portfolios in the case study is how rebalancing helped maintain stability. In the diversified portfolio, rebalancing was done at the end of each year, ensuring that each asset class returned to its original 25% allocation. By doing this, the investor was able to benefit from whichever asset class was performing well while keeping risks spread out.

Rebalancing allows you to take advantage of market fluctuations without overexposing yourself to any single asset class. Whether it’s stocks, bonds, gold, or cash, each asset class has its own cycles. By regularly adjusting your portfolio, you can reduce the risk of large losses and improve your chances of long-term financial stability.

Why Diversification Matters

The case study shows that having a diversified portfolio with a mix of assets can protect you from the risk of running out of money in the long term. Particularly as you near retirement or other significant life stages, it becomes even more important to spread your investments across different asset classes. This way, you can reduce the chances of losing everything in one market downturn.

Putting all your eggs in one basket, such as relying entirely on equities, may seem tempting during times of market growth. However, as the case study reveals, this strategy can lead to a much smaller nest egg when you’re making regular withdrawals.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com