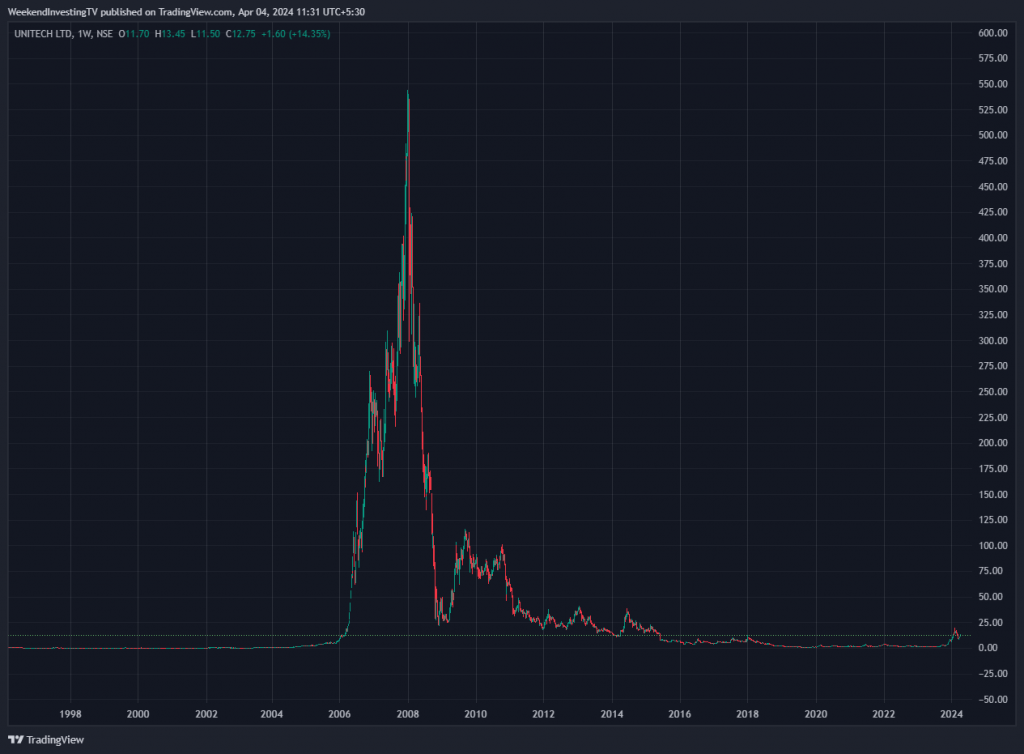

The Unitech chart spanning the last 25 years serves as a powerful reminder of the unpredictable nature of the stock market. It illustrates how stocks can experience unimaginable surges and dramatic declines, often defying conventional expectations. Despite our tendency to assess stocks based on past performance, earnings potential, or market sentiment, the reality is that during bull markets, anything can happen.

Lessons from Euphoria and Frenzy

The case of Unitech, soaring from a few rupees to an astonishing Rs500 within a short period, only to plummet back to its initial value, offers valuable insights. Many investors found themselves trapped at peak prices, highlighting the risks associated with euphoric market conditions. As we witness similar euphoria in today’s market, it’s essential to recognize that many inflated prices may never recover once the frenzy subsides.

Establishing Exit Strategies

Setting clear exit rules is crucial for managing investments effectively. Whether basing decisions on company performance, price movements, or broader market trends, having predetermined parameters is essential. Establishing exit points based on specific criteria, such as a percentage drop from the peak or breaking key moving averages, helps mitigate risks and prevent emotional decision-making during market downturns.

Understanding that every stock experiences cycles of revaluation and devaluation is fundamental. Even stalwart stocks like HDFC Bank and Bajaj Finance undergo phases of earnings growth coupled with price stagnation or decline.

Planning for Uncertainty

While some strategies like weekend investing offer automated exits, those directly investing in stocks must plan meticulously for adverse scenarios. Having a clear exit plan in place beforehand prevents indecision and panic-selling during market turbulence. Every investor should prepare for the inevitable ups and downs of the market to safeguard their portfolios and long-term financial goals.

WeekendInvesting Strategy Spotlight

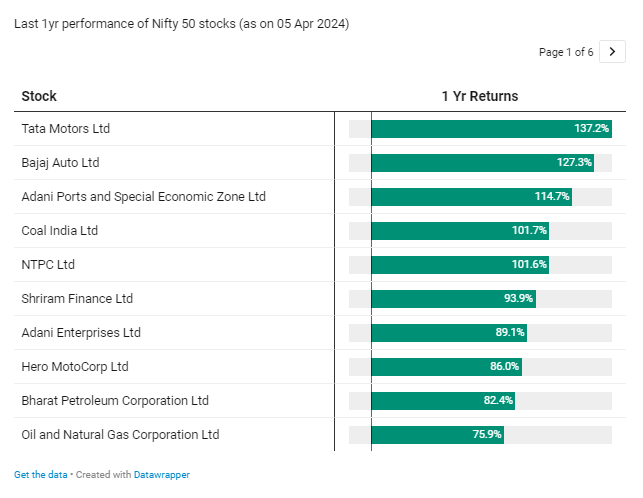

In the past 1 year, several stocks from Nifty 50 have performed well.

– 5 stocks clocked more than 100% gains

– 14 stocks returned between 50% and 99%

– 35 out of 50 stocks outperformed Nifty 50 in last 12 months

Nifty 50’s performance of 28% in FY 24 despite having so many outperforming stocks is primarily a result of the skew in weightage.

The top 5 performers of Nifty 50 in FY 24 hold a very small weightage varying between 1% to 1.8% each (collectively 6.7%).

This means that 10% of the stocks in Nifty 50 together hold 39% of the weights while the remaining 90% of the stocks hold only 61% weights collectively.

Chart link for top performers of Nifty 50 in FY 24 – https://www.datawrapper.de/_/bLoIj/

Navigating this skew

Mi India Top 10 rides only the top 10 performers of Nifty 50 and also allocates an equal 10% weightage to them thus providing all stocks with equal opportunity to contribute to the overall performance of the strategy.

Today is the last day to avail 25% discount on Mi India Top 10. Go use code FY2025 and subscribe soon before the offer ends.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com