Understanding Index Concentration

Understanding the dynamics of stock market indices is crucial for investors navigating the financial landscape. A recent analysis sheds light on the concentration levels within various indices, revealing interesting insights into market composition and potential investment strategies.

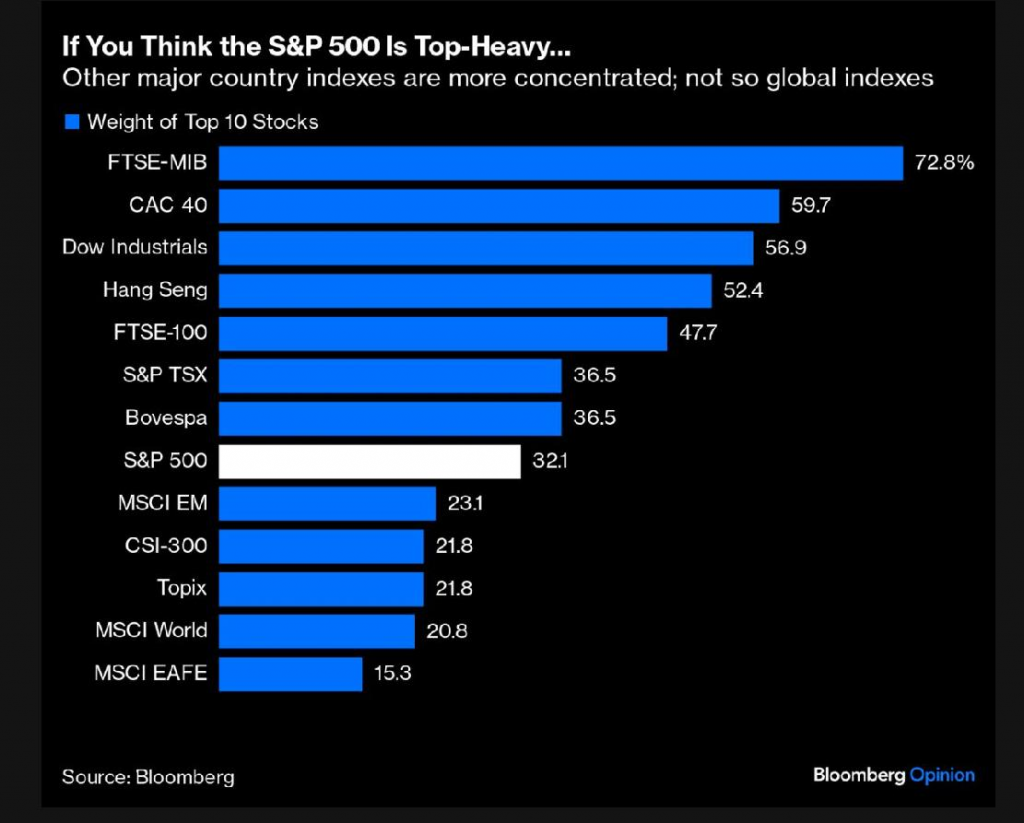

According to data compiled by Bloomberg, the top ten stocks exert a significant influence on several major indices, including the FTSE, DJIA, Hang Seng, and S&P 500. Surprisingly, some markets display remarkable concentration, with a handful of stocks dominating a considerable portion of the index. For instance, the France’s CAC 40 index derives a whopping 60% of its value from just ten stocks, highlighting the substantial impact of a select few companies on market performance.

Similarly, the Dow Industrial index is heavily reliant on its top ten stocks, which collectively contribute 56.9% of its total value. The scenario is mirrored in other indices like Hang Seng (52.4%) and S&P 500 (32%), albeit to varying degrees. While the popular narrative often emphasizes the influence of certain high-profile stocks, their actual market capitalization may not align with their perceived significance within the index.

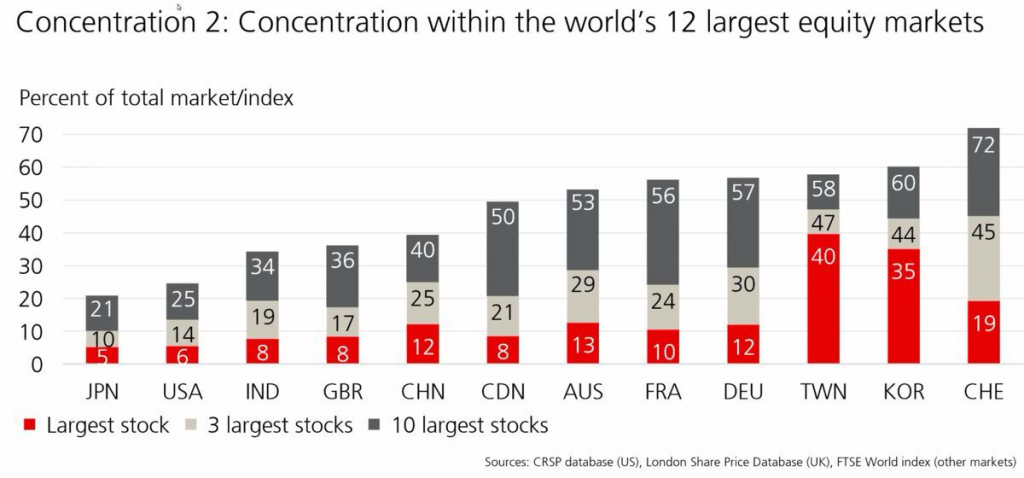

A closer examination of global market indices, sourced from the CRSP database World Index, underscores the disparities in concentration levels across different regions. In markets like Taiwan and Korea, a single stock commands a staggering 40% and 35% of the index, respectively, indicating a high level of dependence on individual companies. Contrastingly, markets such as Japan, the US, and India exhibit a more balanced distribution, with the largest stock holding only a modest share of around 5-8%.

Nevertheless, outliers persist, with some markets witnessing concentration levels surpassing 50% for the top ten stocks. While India’s market concentration at 34% remains relatively reasonable, it still poses potential risks, particularly if the dominant sectors underperform. Notably, the banking and finance sector, which accounts for a significant portion of India’s largest stocks, holds considerable sway over market movements, underscoring the importance of sectoral momentum in driving index performance.

Despite the challenges posed by concentrated indices, savvy investors can capitalize on sectoral trends to outperform the market. By identifying and capitalizing on sectors with favorable momentum, investors can potentially generate market-beating returns. Strategies focusing on isolating high-performing components of the index, such as those employed by Mi India Top 10 or Mi NNF Ten, offer a pathway to superior performance amidst concentration risks.