It is often not just about picking the right stocks; it’s about using your capital effectively. Take NBCC stock, for example. Over the past eleven years, there have been three major uptrends, each presenting an opportunity for significant gains. By employing a momentum-based strategy, investors could have capitalized on these trends, making substantial profits along the way.

An effective strategy not only yields decent returns but also keeps investors out of harm’s way. While some may advocate for a buy-and-hold approach, the reality is that prolonged drawdowns can test even the most resilient investors. By having a systematic approach to entering and exiting positions, investors can mitigate risks and optimize returns.

Market volatility is inevitable, and without a proper plan in place, investors may find themselves at the mercy of unpredictable price movements. The allure of holding onto a stock through thick and thin often fades when faced with substantial losses. Having a clear exit plan allows investors to cut their losses and reallocate capital to more promising opportunities.

The Fallacy of “Buy and Hold”

While the idea of buying a stock and holding onto it for the long term may sound appealing, the reality is that many stocks fail to deliver sustained growth. In fact, a significant portion of stocks either underperform or stagnate over time, resulting in missed opportunities and wasted capital. It’s essential to recognize when a stock is no longer delivering returns and have the flexibility to adapt accordingly.

Opportunity Cost: A Critical Consideration

Every moment your capital remains tied up in an underperforming stock is a missed opportunity. With only a finite number of years to invest and grow your wealth, it’s crucial to make the most of each opportunity. A disciplined approach to capital utilization ensures that your investment journey remains on track, allowing you to capitalize on emerging trends and avoid prolonged periods of stagnation.

Embracing an Exit Plan

In the ever-changing landscape of the market, having an exit plan is paramount. Whether it’s cutting losses during a downturn or reallocating capital to more promising stocks or sectors, knowing when to exit a position can make all the difference.

WeekendInvesting Strategy Spotlight – Mi EverGreen

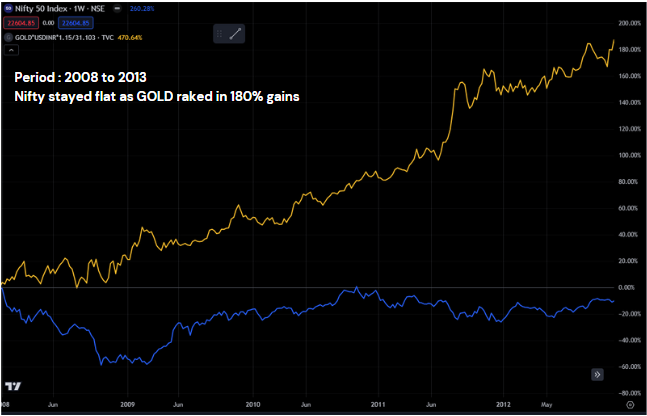

The Global Financial Crisis is a very strong reminder that there is no room for assumptions in the markets. Yes, Nifty might have delivered a 12% CAGR over a long period of time, but ask all those who were invested between 2008 to 2014 and you will hear a contrasting story of agony.

Some allocation to GOLD during this difficult phase could’ve done wonders to your wealth creation journey and that is exactly what Mi Evergreen aims to do. It combines strong CNX 200 stocks with gold, aiming to reduce volatility and protect your wealth.

Use code GOLDRUSH to avail a flat 20% discount on your subscription to Mi EverGreen.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com