The Pitfalls of Buy and Hold Investing: Lessons from Delta Corp

As an investor, it’s essential to evaluate strategies and make informed decisions to maximise returns. One widely recognized investment strategy is buy and hold, where investors purchase stocks with the intention of holding them for a long time, regardless of short-term market fluctuations. While buy and hold can be a lucrative approach for some stocks, it doesn’t always work out as planned. Delta Corp, a well-known casino – gaming company, provides a prime example of the pitfalls of buy and hold investing.

Delta Corp has faced various challenges over the years, including tax issues, debt burden, and regulatory changes. These factors have heavily impacted the company’s stock performance, resulting in disappointing returns for long-term investors. Let’s take a closer look at Delta Corp’s journey and the important lessons we can learn from it

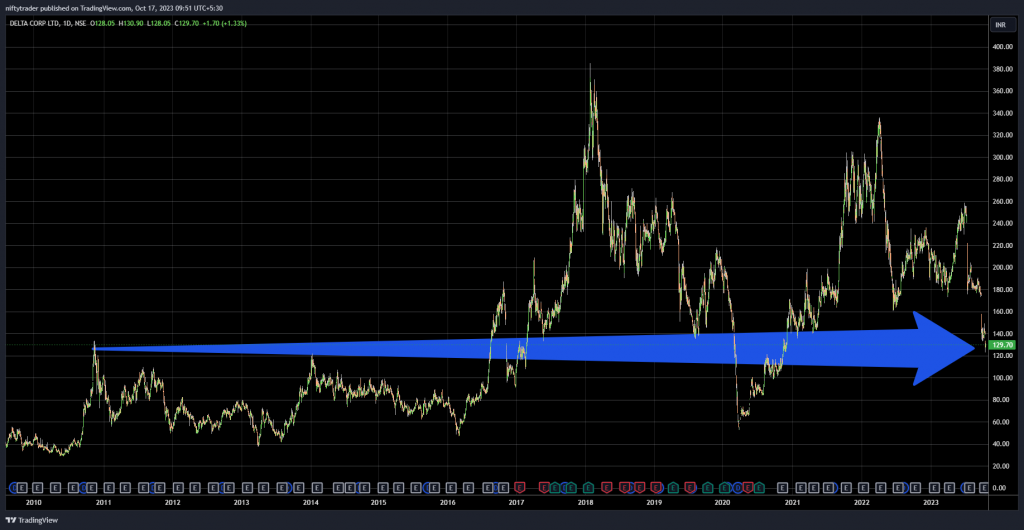

The stock has experienced a tumultuous ride in the markets. Despite being a well-known brand, the company’s shares have failed to generate significant returns for investors over the past twelve years. At the time of writing, the stock price stands at Rs 129, which means investors have essentially made no money during this period.

Timing the Markets vs. Long-Term Investing

While some investors may have managed to profit from short-term rallies by timing their trades, this isn’t a feasible strategy for the majority. Investors who adopt a buy and hold approach often find themselves stuck with overvalued stocks, unable to capitalise on short-term market movements. Many Delta Corp investors have found themselves in this situation, with some holding shares at levels above 300.

The problem of dealing with uncertainties

One of the primary reasons buy and hold hasn’t worked well for Delta Corp is the uncertainty surrounding the company’s future. In the market, circumstances can change rapidly. There might be a regime change, alterations in taxation policies, or legal disputes, all of which can directly impact a company’s valuation. Delta Corp’s revaluation presents a classic case where investors are left unsure when the stock will bounce back, leading to significant losses.

When investing in individual stocks, uncertainty remains a significant risk to consider. Company-specific factors, such as managerial decisions, industry dynamics, and unforeseen events, can drastically affect the stock’s performance. Even if investors believe they have in-depth knowledge about a company, its management, and the industry it operates in, there are always variables beyond their control. The inherent uncertainty in individual stock picking makes it a risky proposition to concentrate too heavily on any one stock.

The BBC Principle: A Simpler Approach

There is a much simpler approach to mitigate the risks associated with buy and hold investing – the Bhaav Bhagwan che (BBC) principle. This principle suggests that investors focus on following the price movement of a stock to determine when to buy or sell.

According to the BBC principle, if the stock’s price is rising, it is a good time to buy, while falling prices indicate the need to sell. Following this approach doesn’t guarantee profits on every trade, as losses are inevitable. However, by aligning investments with stocks that are performing well, investors can have a proper rule based approach which has demonstrated solid capabilities of outperforming benchmarks on a regular basis.

Looking Beyond Individual Stocks

Considering the complexity and uncertainty associated with individual companies, it’s vital for investors to adopt a diversified portfolio strategy. Relying on just one or a few stocks puts investors at high risk because adverse events impacting a particular company can result in substantial losses.

By treating stocks as vehicles to help reach financial goals rather than attaching undue emotional attachment, investors can maintain a more objective view of their investments. Adopting this mindset allows investors to focus on achieving consistent double-digit returns, regardless of the specific stock’s name.

At WeekendInvesting, we follow Bhaav Bhagwaan Che to core by removing noise and focusing only on price to make decisions. Here’s a free course to help you understand our investing philosophy better

If you have any questions, please write to support@weekendinvesting.com