In the world of investing, there are various strategies and approaches that investors employ to try and maximise their returns. One strategy that often faces a lot of fear, uncertainty, and doubt (FUD) is momentum investing. Many people believe that momentum investing is synonymous with short-term swing trading, high churn, and constant rotation of stocks. However, in this article, we will try to dispel these misconceptions and shed light on the true nature of momentum investing.

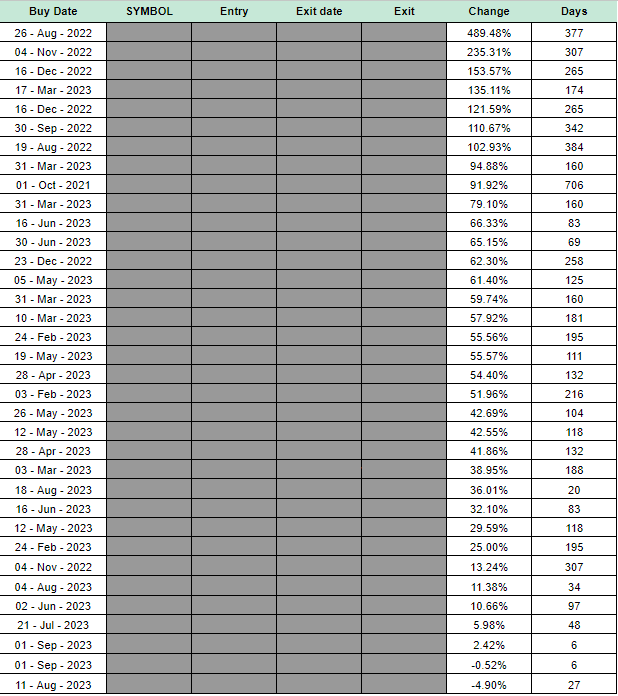

To illustrate the effectiveness of momentum investing, let us look at our highly popular 35 stock rotational momentum strategy that has been running for over a couple of years. The gains and holding periods for each stock are laid out in a sheet. While the specific stocks and prices are hidden, the data presented provides a clear picture of the success of the strategy.

Looking at the data in the sheet, it becomes evident that momentum investing can yield impressive returns. Stocks that have been held for very long periods have experienced substantial gains, some even surpassing triple-digit percentages. This evidence debunks the myth that momentum investing is solely a short-term, high-churn approach.

Average Holding Period across all 35 stocks as on 07 Sep 2023

On average, stocks in the presented strategy have been held for approximately 175 days, which is around six months. This holding period cannot be considered short-term trading or investing, but rather a medium-term investment approach. Additionally, some stocks held for an extended duration may even qualify for long-term tax benefits, providing investors with additional advantages.

It is crucial not to confuse momentum investing with value investing or long-term investing. While value investing focuses on finding undervalued stocks and holding them for the long haul, momentum investing thrives on taking advantage of the market’s natural movements. By following the market’s momentum and avoiding emotional decision-making, investors can let their investments grow without unnecessary intervention.

One common misconception about momentum investing is its high level of churn, suggesting a constant buying and selling of stocks. However, the presented strategy demonstrates that this is not the case. With only two stocks showing negative returns, the majority of the stocks in the strategy are in the green, with many achieving impressive gains.

The end goal : Peaceful Investing !

Momentum investing provides a peaceful, non-discretionary investing method that allows the market to operate as it should. By removing emotions and personal biases from the decision-making process, investors can benefit from the market’s natural momentum and capitalise on the trends.

Moreover, there are additional benefits to momentum investing beyond the potential returns. Investors can take advantage of tax breaks on losses incurred from quickly exiting underperforming stocks, while enjoying the potential for long-term gains on the stocks that continue to perform well. This win-win situation provides investors with both financial advantages and a sense of security in their investment strategy.

So, the next time you come across the concept of momentum investing, remember to break free from the FUD and consider giving it a chance. Embrace the power of non-discretionary investing and let the market work for you. With the right strategy and mindset, momentum investing can be a valuable addition to your investment portfolio.

Mi 35 – the rockstar Smallcap Strategy

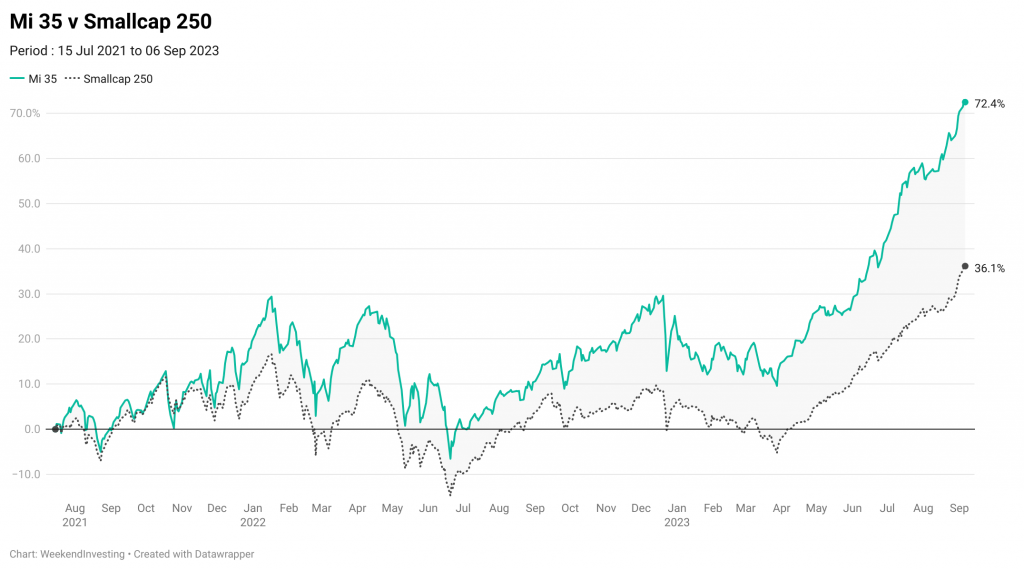

This strategy has been simply brilliant clocking 72% since going live on 15 Jul 2021 in comparison to 36% recorded by the Smallcap 250 index in the same period.

Download the WeekendInvesting App

If you have any questions for us. please write to us on support@weekendinvesting.com. You can also get on a 1-1 meeting with us should you need more clarity about the strategies or processes.