How Stock Market Turnover is Changing in India

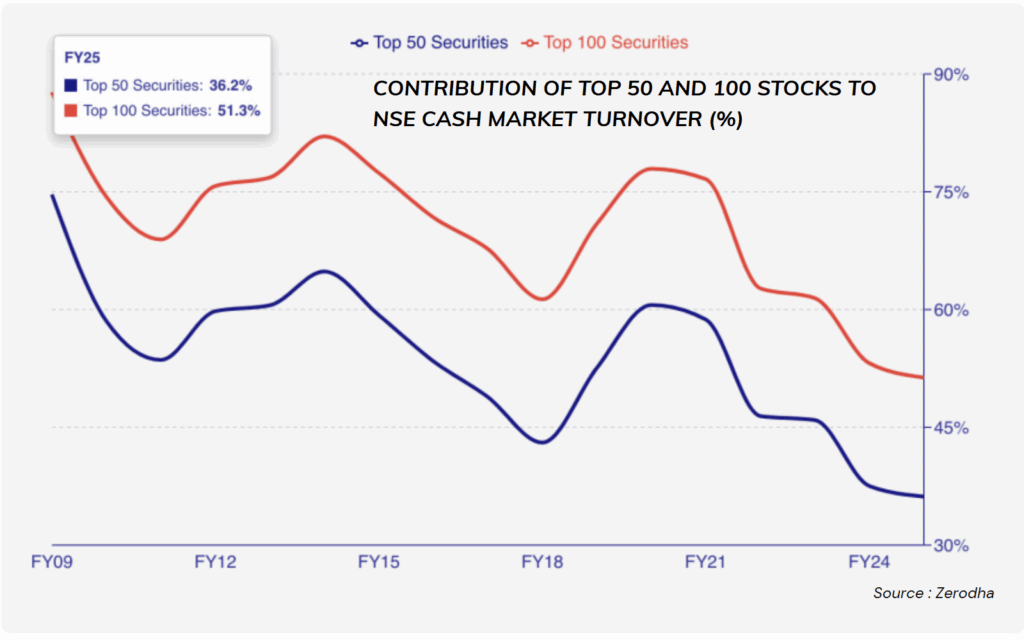

In recent years, the Indian stock market has experienced significant changes. One of the most notable trends is the decreasing contribution of the top 50 and top 100 stocks to the National Stock Exchange (NSE) cash market turnover. About 15 years ago, these top stocks accounted for nearly 70% to 90% of the daily turnover. Today, that number has dropped to approximately 35% to 50%.

Contribution of Top 50 and 100 Stocks to NSE Cash Market Turnover (%)

The Stock Market is Becoming Broader

This shift indicates that the stock market is becoming more diverse. In simple terms, investors are no longer focusing solely on a few large companies. Increasingly, traders and investors are participating in mid-cap and small-cap stocks as well. This is a positive sign for a developing market.

More Stocks are Sharing the Volume

Previously, market volume was largely concentrated on the top companies, but now trading volume is distributed across a wider array of stocks. This change demonstrates that the Indian market is becoming more balanced and less reliant on just a few major players. More companies are gaining attention and being actively traded.

Less Dependence on Foreign Institutional Investors (FIIs)

There was a time when Foreign Institutional Investors (FIIs) had a significant impact on the Indian stock market. If they sold their holdings, the market would often experience a sharp decline. However, now, even after six months of FII selling, the Indian stock market has remained resilient. This shows that domestic investors are stepping in to stabilize the market.

Signs of a Maturing Market

All these changes indicate one important trend: the Indian stock market is maturing. Trading volumes are no longer dominated by large-cap stocks. Investors are showing interest in a broader range of companies, which helps reduce risks and strengthen the market for everyone.

Is your portfolio still focused on just the top stocks? Or are you tapping into the broader market trend? Let us know in the comments!

Thank you so much for taking the time to read. We truly appreciate your support and hope you found it helpful. If you did, please consider sharing it with your friends. Looking forward to seeing you in the next one!

WeekendInvesting launches – The Momentum Podcast

In this episode of the Momentum Podcast by Weekend Investing, we sit down with Sudheer , a software engineer from Infosys who shares his honest and inspiring investing journey—from early losses in derivatives and scams to his turnaround using Weekend Investing’s smallcases.

💡 Hear how Sudheer allocates ₹30,000/month, balances risk with gold, navigates market dips confidently, and the crucial mindset shift he learned through momentum investing.

👉 Don’t miss Sudheer’s powerful advice for new investors and the importance of discipline and long-term thinking.

Fill in the form below to be part of this exciting series : https://forms.gle/HDbEk9xrTjVecW2c9