A Strong Rally in BSE

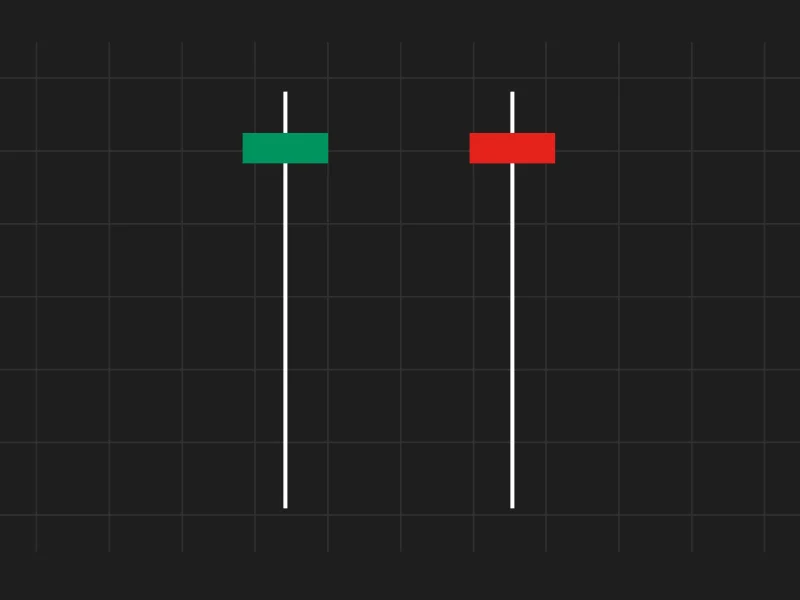

BSE has been experiencing a significant uptrend lately. In just one year, its share price has surged from around ₹2,000 to nearly ₹7,200.

This sharp increase has captured the attention of many investors. Once considered a quieter exchange compared to its larger rival, BSE is now leading the charts with strong momentum and impressive returns.

NSE’s Slow and Steady Rise

On the other hand, NSE is not yet publicly listed. However, its value in the unlisted market has also increased—by approximately 30% to 50% during the same period. While these gains are noteworthy, they are much lower compared to what BSE has achieved in the listed market. This is surprising because NSE is the larger exchange, with a significantly higher market share and stronger financials.

Listed vs. Unlisted Stocks

Many investors believe that unlisted stocks tend to perform better because they are harder to access and often represent growing businesses. However, in this instance, it is the listed stock—BSE—that has outperformed. The key reason is that market trends are crucial. Currently, BSE is demonstrating clear strength. Investors focused on trend-following are naturally drawn to BSE over NSE, solely because of its stronger momentum.

Why Trends Matter

Even though NSE is a much larger exchange with more business and higher financial metrics, BSE is currently outperforming in terms of stock performance. This highlights an important lesson: being large does not always equate to better returns. Trends often determine which stock will perform well in the short to medium term. Therefore, if NSE were listed today and exhibited slow growth, many trend-following strategies would likely still favor BSE.

Looking Ahead

As we look to the future, it will be fascinating to see what happens when NSE finally gets listed. The competition between the two exchanges could become even more exciting. For now, BSE is clearly in the lead, demonstrating that sometimes, underdogs can deliver the strongest returns.

What do you think about BSE’s strong run and NSE’s slower pace? Share your views in the comments, and if you found this blog useful, do SHARE it with your network!

WeekendInvesting launches – The Momentum Podcast

This episode of The Momentum Podcast unpacks 15 years of investing experience!

We cover:

✅ Early investing mistakes and learnings

✅ Navigating market fluctuations (including the 2020 crash)

✅ The transition from direct stock picking to managed funds

✅ The role of momentum investing in long-term strategy

✅ Key takeaways for building a resilient investment portfolio.

Whether you’re new to investing or looking to refine your approach, this episode is packed with practical advice!